Concept explainers

Reese Manufacturing Company manufactures and sells a limited line of products made to customer order. The company uses a perpetual inventory system and keeps its accounts on a calendar year basis. A 6-column spreadsheet is presented on page 1100.

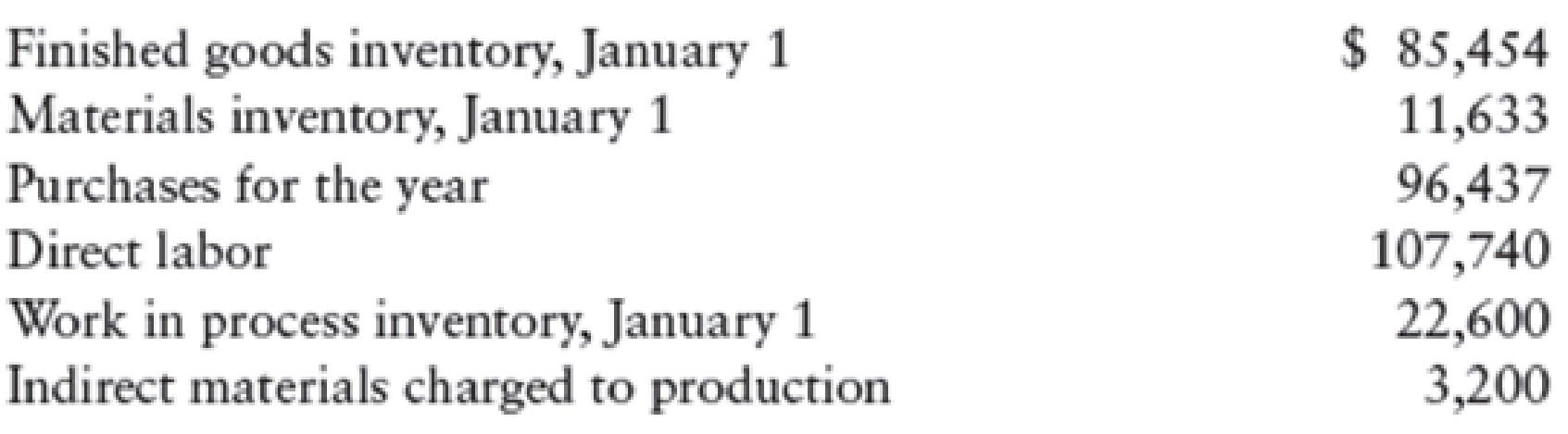

Additional information needed to prepare the income statement and schedule of cost of goods manufactured is as follows:

REQUIRED

- 1. Prepare an income statement and schedule of cost of goods manufactured for the year ended December 31,20--.

- 2. Prepare a statement of

retained earnings for the year ended December 31,20--. - 3. Prepare a

balance sheet as of December 31, 20--. - 4. Prepare the adjusting, closing, and reversing entries.

1.

Prepare an income statement and a schedule for cost of goods manufactured of Company R for the year ended December 31, 20--.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Cost of goods manufactured:

Cost of goods manufactured refers to the cost incurred for a making a product, that are available for sales at the end of the accounting period.

Prepare an income statement and a schedule for cost of goods manufactured of Company R for the year ended December 31, 20—as follows:

Income statement:

| Company R | ||

| Income Statement | ||

| For Year Ended December 31, 20-- | ||

| Particulars | Amount ($) | Amount ($) |

| Net sales | 537,137 | |

| Less: Sales return and allowances | 10,840 | 526,297 |

| Less: Cost of goods sold | ||

| Finished goods inventory, January 1 | 85,454 | |

| Add: Estimated returns inventory, January 1 | 70 | |

| Add: Cost of goods manufactured | 239,269 | |

| Cost of goods available for sale | 324,793 | |

| Less: Estimated returns inventory, December 31 | 640 | |

| Less: Finished goods inventory, December 31 | 42,675 | |

| Cost of goods sold | 281,478 | |

| Gross profit | 244,819 | |

| Less: Operating expenses: | ||

| Wages expense | 58,380 | |

| Advertising expense | 11,450 | |

| Office rent expense | 5,443 | |

| Office supplies expense | 800 | |

| Bad debt expense | 956 | |

| Insurance expense—office equipment | 98 | |

| Depreciation expense—office equipment | 923 | |

| Total operating expenses | 78,050 | |

| Operating income | 166,769 | |

| Less: Other expense: | ||

| Interest expense | 1,421 | |

| Income before income taxes | 165,348 | |

| Less: Income tax | 30,725 | |

| Net income | 134,623 | |

Table (1)

Schedule of cost of goods manufactured:

| Company R | |||

| Schedule of Cost of Goods Manufactured | |||

| For Year Ended December 31, 20-- | |||

| Particulars | Amount ($) | Amount ($) | Amount ($) |

| Work in process, January 1 | 22,600 | ||

| Direct materials | |||

| Materials inventory, January 1 | 11,633 | ||

| Add: Materials purchases | 96,437 | ||

| Materials available for use | 108,070 | ||

| Less: Materials inventory, December 31 | 22,353 | ||

| Cost of materials used | 85,717 | ||

| Less: Indirect materials charged to production | 3,200 | ||

| Cost of direct materials used | 82,517 | ||

| Direct labor | 107,740 | ||

| Factory overhead | 67,654 | ||

| Total manufacturing costs | 257,911 | ||

| Total work in process during the period | 280,511 | ||

| Less: Work in process, December 31 | 41,242 | ||

| Cost of goods manufactured | 239,269 | ||

Table (2)

2.

Prepare a statement of retained earnings of Company R for the year ended December 31, 20--.

Explanation of Solution

Statement of Retained Earnings:

This is a financial statement that determines the amount of earnings kept by the business as retained earnings at the end of the financial year. This statement shows the retained earnings held by the business at the beginning and at the end of the financial year, amount of net income earned during the year and the amount of dividend declared to the shareholder for the year.

Prepare a statement of retained earnings of Company R for the year ended December 31, 20—as follows:

| Company R | |

| Statement of Retained Earnings | |

| For Year Ended December 31, 20-- | |

| Particulars | Amount ($) |

| Retained earnings, January 1 | 195,341 |

| Add: Net income for the year | 134,623 |

| Subtotal | 329,964 |

| Less: Cash dividends | 36,000 |

| Retained earnings, December 31 | 293,964 |

Table (3)

3.

Prepare a balance sheet of Company R as of December, 20--.

Explanation of Solution

Balance sheet: Balance Sheet is one of the financial statements that summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Prepare a balance sheet of Company R as of December, 20—as follows:

| Company R | |||

| Balance Sheet | |||

| December 31, 20-- | |||

| Assets | Amount ($) | Amount ($) | Amount ($) |

| Current assets: | |||

| Cash | 44,783 | ||

| Accounts receivable | 78,096 | ||

| Less: Allowance for doubtful accounts | 6,030 | 72,066 | |

| Inventories: | |||

| Finished goods | 42,675 | ||

| Work in process | 41,242 | ||

| Materials | 22,353 | 106,270 | |

| Estimated returns inventory | 640 | ||

| Office supplies | 2,746 | ||

| Factory supplies | 489 | ||

| Prepaid insurance | 46 | ||

| Total current assets | 227,040 | ||

| Property, plant, and equipment: | |||

| Factory building | 186,674 | ||

| Less: Accumulated depreciation | 36,054 | 150,620 | |

| Factory equipment | 46,986 | ||

| Less: Accumulated depreciation | 3,839 | 43,147 | |

| Total property, plant, and equipment | 193,767 | ||

| Total assets | 420,807 | ||

| Liabilities | |||

| Current liabilities: | |||

| Notes payable | 12,470 | ||

| Accounts payable | 10,356 | ||

| Income tax payable | 14,725 | ||

| Customer refunds payable | 1,160 | ||

| Interest payable | 132 | ||

| Total liabilities | 38,843 | ||

| Stockholders’ Equity | |||

| Capital stock | 88,000 | ||

| Retained earnings | 293,964 | ||

| Total stockholders’ equity | 381,964 | ||

| Total liabilities and stockholders’ equity | 420,807 | ||

Table (4)

4.

Prepare the adjusting, closing, and reversing entries of Company R.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and stockholders’ equity) to maintain the records according to accrual basis principle.

Reversing entries: Reversing entries are made at the beginning of the accounting period when the accountant needs to cancel any entry made in the previous accounting period. It is done in order to eliminate any errors that might have occurred in the calculation of the revenue or expenses and henceforth increase the efficiency of the financial statements for an improved decision making.

Closing entries: The journal entries prepared to close the temporary accounts to Retained Earnings account are referred to as closing entries. The revenue, expense, and dividends accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Prepare the adjusting, closing, and reversing entries of Company R as follows:

Adjusting entries:

| Date | Account Title and Explanation | Post ref. | Debit ($) | Credit ($) | |

| December 31 | a. | Interest Expense | 132 | ||

| Interest Payable | 132 | ||||

| (To record the interest expense incurred at the end of the accounting year) | |||||

| December 31 | b. | Office Supplies Expense | 800 | ||

| Office Supplies | 800 | ||||

| (To record the office supplies expense incurred at the end of the accounting year) | |||||

| December 31 | c. | Factory Overhead | 1,389 | ||

| Factory Supplies | 1,389 | ||||

| (To record the factory overhead incurred at the end of the accounting year) | |||||

| December 31 | d. | Depreciation Expense-Office Equipment | 923 | ||

| Accumulated Depreciation-Office Equipment | 923 | ||||

| (To record the depreciation expense incurred at the end of the accounting year) | |||||

| December 31 | e. | Factory Overhead (Depreciation expense-Factory Equipment) | 12,553 | ||

| Accumulated Depreciation-Factory Equipment | 12,553 | ||||

| (To record the depreciation expense incurred at the end of the accounting year) | |||||

| December 31 | f. | Factory Overhead (Insurance Expense) | 1,356 | ||

| Insurance Expense-Office Equipment | 98 | ||||

| Prepaid Insurance | 1,454 | ||||

| (To record the factory overhead and insurance expense incurred) | |||||

| December 31 | g. | Bad Debt Expense | 956 | ||

| Allowance for Doubtful Accounts | 956 | ||||

| (To record the bad debt expense incurred at the end of the account) | |||||

| December 31 | h. | Sales return and allowances | 570 | ||

| Customer refunds payable | 570 | ||||

| (To record the sales return from the customer) | |||||

| December 31 | i. | Estimated returns inventory | 1,040 | ||

| Cost of goods sold | 1,040 | ||||

| (To record the expected return of cost of goods sold) | |||||

| December 31 | j. | Income Tax Expense | 14,725 | ||

| Income Tax Payable | 14,725 | ||||

| (To record the income tax expense incurred at the end of the account) | |||||

| December 31 | k. | Work in Process Inventory | 1,567 | ||

| Factory Overhead | 1,567 | ||||

| (To record the factory overhead transferred to the work in process inventory) | |||||

| December 31 | l. | Cost of Goods Sold | 641 | ||

| Factory Overhead | 641 | ||||

| (To record the factory overhead transferred to the cost of goods sold) |

Table (5)

Closing entries:

| Date | Account Title and Explanation | Post ref. | Debit ($) | Credit ($) |

| December 31 | Income Summary | 67,654 | ||

| Factory Overhead (Subsidiary ledger account) | 67,654 | |||

| (To close the subsidiary factory overheads account) | ||||

| December 31 | Factory Overhead | 67,654 | ||

| Income Summary | 67,654 | |||

| (To close the factory overhead account) | ||||

| December 31 | Sales | 537,137 | ||

| Income Summary | 537,137 | |||

| (To close the sales revenue account) | ||||

| December 31 | Income Summary | 402,514 | ||

| Sales return and allowances | 10,840 | |||

| Cost of Goods Sold | 281,478 | |||

| Wages Expense | 58,380 | |||

| Advertising Expense | 11,450 | |||

| Office Rent Expense | 5,443 | |||

| Office Supplies Expense | 800 | |||

| Bad Debt Expense | 956 | |||

| Insurance Expense-Office Equipment | 98 | |||

| Depreciation Expense-Office Equipment | 923 | |||

| Interest Expense | 1,421 | |||

| Income Tax Expense | 30,725 | |||

| (To close all expenses account) | ||||

| December 31 | Income Summary | 134,623 | ||

| Retained Earnings (1) | 134,623 | |||

| (To close the income summary account) | ||||

| December 31 | Retained Earnings | 36,000 | ||

| Cash dividends | 36,000 | |||

| (To close the cash dividends account) |

Table (6)

Closing entry for factory overhead:

In this closing entry, the factory overhead account is closed by transferring the amount of factory overhead to the income summary account in order to bring the factory overhead accounts balance to zero. Hence, debit the factory overhead account for $67,654, and credit the income summary account for $67,654.

Closing entry for revenue account:

In this closing entry, the sales revenue account is closed by transferring the amount of sales revenue to the income summary account in order to bring the revenue accounts balance to zero. Hence, debit the sales revenue account for $537,137, and credit the income summary account for $537,137.

Closing entry for expenses account:

In this closing entry, all expenses are closed by transferring the amount of all expenses to the income summary account in order to bring all the expense accounts balance to zero. Hence, debit the income summary account for $402,514, and credit all the expenses account for $402,514.

Closing entry for income summary account:

In this closing entry, the income summary account is closed by transferring the amount of net income to the retained earnings account in order to bring the income summary balance to zero. Hence, debit the income summary account for $134,623, and credit the retained earnings for $134,623.

Closing entry for dividends account:

The dividends are paid to the shareholders out of the retained earnings. Thus, retained earnings are debited since the earnings are decreased on payment of dividend. Dividends are a component of shareholders’ equity account. It is credited because dividends are transferred to retained earnings account.

Working note (1):

Calculate the value of retained earnings.

Reversing entries:

| Date | Account Title and Explanation | Post ref. | Debit ($) | Credit ($) |

| January 1 | Interest Payable | 132 | ||

| Interest Expense | 132 | |||

| (To record the reversing entry of interest expense) | ||||

| January 1 | Factory Overhead | 1,567 | ||

| Work in Process Inventory | 1,567 | |||

| (To record the reversing entry of factory overhead) |

Table (7)

- ■ Interest payable is a liability account and it decreases in the value of liabilities. Hence, debit the interest payable with $132.

- ■ Interest expense is component of shareholders’ equity, and it increases the value of shareholders equity. Hence, credit the interest expense with $132.

- ■ Factory overhead (expense) is a component of owner’s equity, and there is an increase in the value of expense. Hence, debit the factory overhead account with $1,567.

- ■ Work in process inventory is an asset account, and it decreases the value of asset. Hence, credit the work in process inventory account with $1,567.

Want to see more full solutions like this?

Chapter 27 Solutions

College Accounting, Chapters 1-27

- Please Make Perfect Answer For this Financial Accountingarrow_forwardThe purpose of the trial balance is to:A. Prepare for auditB. Ensure all transactions are postedC. Check that total debits equal total creditsD. Detect all errors correct solutarrow_forwardThe purpose of the trial balance is to:A. Prepare for auditB. Ensure all transactions are postedC. Check that total debits equal total creditsD. Detect all errors need helparrow_forward

- The purpose of the trial balance is to:A. Prepare for auditB. Ensure all transactions are postedC. Check that total debits equal total creditsD. Detect all errorsarrow_forwardGeneral Accounting Question solve without any problemarrow_forwardNeed Answer of this General Accounting Question Solution with Detailed Explanationarrow_forward

- General Accountingarrow_forwardNeed Help with this General Accounting Question Solutionarrow_forwardIf a company records an expense that was actually a capital expenditure, what will be the result?A. Assets overstatedB. Net income overstatedC. Expenses understatedD. Net income understated need helparrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub