College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 27, Problem 5SEB

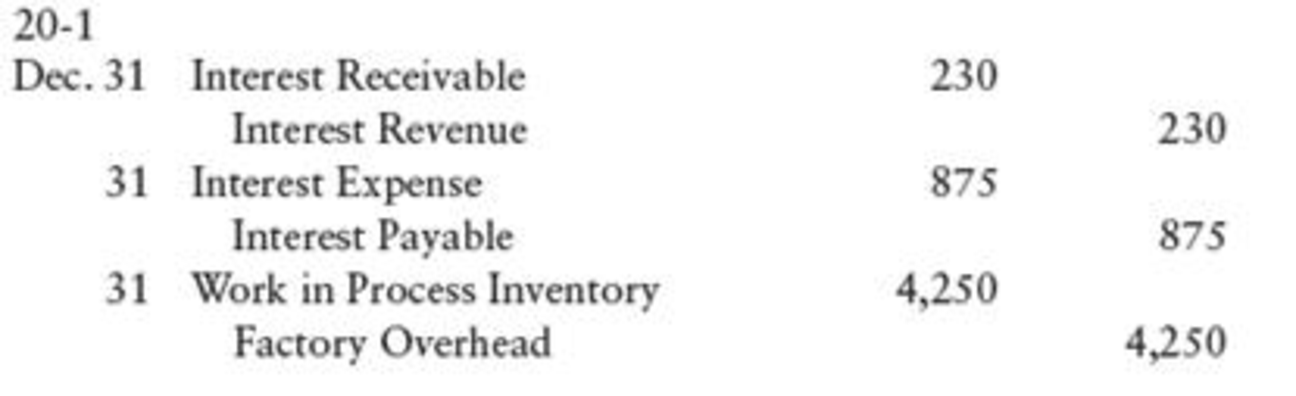

REVERSING ENTRIES Prepare reversing

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the firm's PE ratio for this financial accounting question?

Need help this question

Solve this financial accounting problem

Chapter 27 Solutions

College Accounting, Chapters 1-27

Ch. 27 - Under the perpetual inventory system, Cost of...Ch. 27 - Prob. 2TFCh. 27 - On the spreadsheet, the factory overhead account...Ch. 27 - Prob. 4TFCh. 27 - The adjustment for factory overhead applied to...Ch. 27 - LO2 The adjustment for the amount of factory...Ch. 27 - The adjustment for depreciation expense for the...Ch. 27 - At the end of the accounting period, a credit...Ch. 27 - Prob. 4MCCh. 27 - Prob. 5MC

Ch. 27 - LO2 Prepare adjusting entries at December 31 for J...Ch. 27 - Prob. 2CECh. 27 - Prob. 3CECh. 27 - Prob. 1RQCh. 27 - Prob. 2RQCh. 27 - Prob. 3RQCh. 27 - Prob. 4RQCh. 27 - Prob. 5RQCh. 27 - What are the distinctive features of ToyJoys...Ch. 27 - Prob. 7RQCh. 27 - Prob. 8RQCh. 27 - Prob. 9RQCh. 27 - ADJUSTING ENTRIES INCLUDING ADJUSTMENT FOR...Ch. 27 - Prob. 2SEACh. 27 - Prob. 3SEACh. 27 - CLOSING JOURNAL ENTRIES Prepare closing journal...Ch. 27 - REVERSING JOURNAL ENTRIES Prepare reversing...Ch. 27 - SPRE ADSHEET, ADJUSTING ENTRIES, AND FIN ANCIAL...Ch. 27 - FINANCIAL STATEMENTS The adjusted trial balance...Ch. 27 - ADJUSTING. CLOSING. AND REVERSING ENTRIES A...Ch. 27 - ADJUSTING ENTRIES INCLUDING ADJUSTMENT FOR...Ch. 27 - Prob. 2SEBCh. 27 - ADJUSTING JOURNAL ENTRIES FOR A MANUFACTURING...Ch. 27 - Prob. 4SEBCh. 27 - REVERSING ENTRIES Prepare reversing journal...Ch. 27 - SPREADSHEET, ADJUSTING ENTRIES, AND FINANCIAL...Ch. 27 - FINANCIAL STATEMENTS The adjusted trial balance...Ch. 27 - Prob. 8SPBCh. 27 - Prob. 1MYWCh. 27 - Reese Manufacturing Company manufactures and sells...Ch. 27 - Drafts of the condensed income statement and...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Solve this Accounting problemarrow_forwardNeed help with this accounting questionsarrow_forwardག 頁 頁 頁 1 1 1 A ག ་ Common Stock Wage Expense. Revenue Cash- Utility Expense Beginning Retained Earnings Rent Expense. Accounts Payable Equipment Dividends Accounts Receivable.x Notes Payable. ¤ 女 頁 Trial Balance Income Statement ¤ ¤ Statement of Retained Earnings -- Balance Sheet- -102,500 X -92,500- -------225,000 -22,500-x 15,000 1 27,500྾ ཙག -25,000-x -10,000- xx 200,000 -12,500- 47,500-1 -50,000-x 1 ¤ ¤ R R ¤ ¤arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY