Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 27, Problem 4PB

Pareto chart and cost of quality report for a manufacturing company

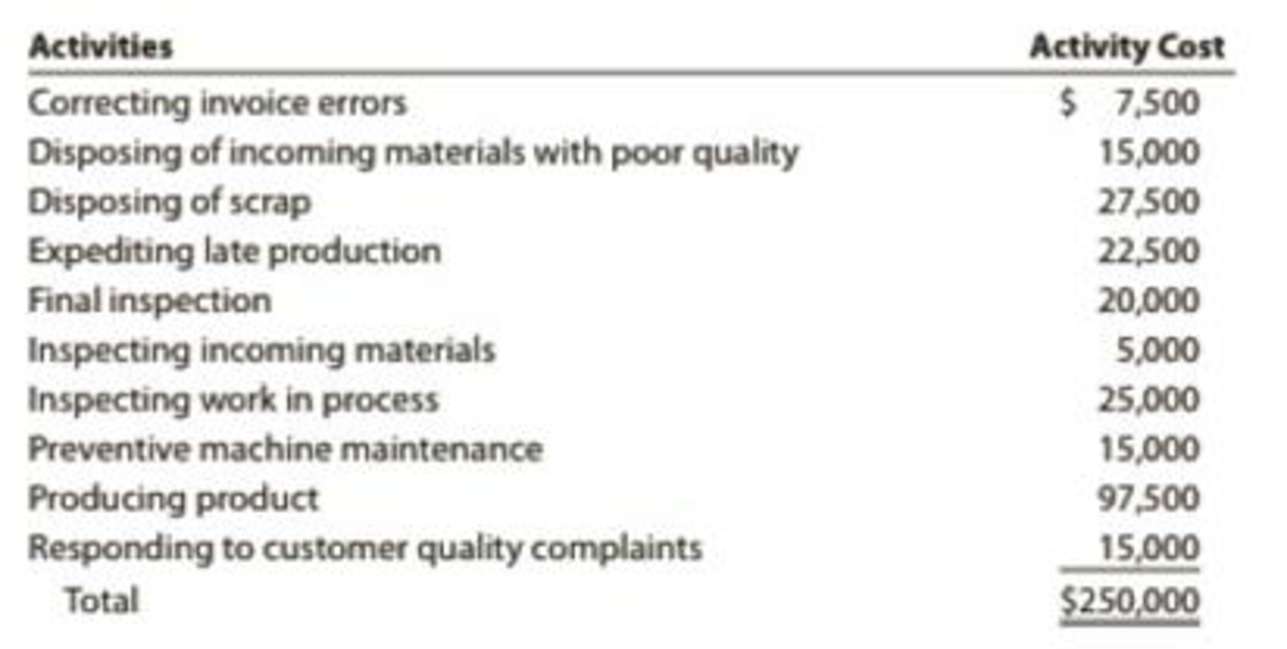

The president of Mission Inc. has been concerned about the growth in costs over the last several years. The president asked the controller to perform an activity analysis to gain a better insight into these costs. The activity analysis revealed the following:

The production process is complicated by quality problems, requiring the production manager to expedite production and dispose of scrap.

Instructions

- 1. Prepare a Pareto chart of the company activities.

- 2. Classify the activities into prevention, appraisal, internal failure, external failure, and not costs of quality (producing product). Classify the activities into value-added and non-value-added activities.

- 3. Use the activity cost information to determine the percentages of total costs that are prevention, appraisal, internal failure, external failure, and not costs of quality.

- 4. Determine the percentages of total costs that are value-added and non-value-added.

- 5. Interpret the information.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

What is the gross profit percentage for this period

The company's gross margin percentage is ?

Problem 19-13 (Algo)

Shoney Video Concepts produces a line of video streaming servers that are linked to personal computers for storing movies. These

devices have very fast access and large storage capacity.

Shoney is trying to determine a production plan for the next 12 months. The main criterion for this plan is that the employment level is

to be held constant over the period. Shoney is continuing in its R&D efforts to develop new applications and prefers not to cause any

adverse feelings with the local workforce. For the same reason, all employees should put in full workweeks, even if that is not the

lowest-cost alternative. The forecast for the next 12 months is

MONTH

FORECAST DEMAND

January

February

March

April

530

730

830

530

May

June

330

230

July

130

August

130

September

230

October

630

730

800

November

December

Manufacturing cost is $210 per server, equally divided between materials and labor. Inventory storage cost is $4 per unit per month

and is assigned based on the ending…

Chapter 27 Solutions

Financial And Managerial Accounting

Ch. 27 - What is the benefit of the lean philosophy?Ch. 27 - What are some examples of non-value-added lead...Ch. 27 - Why is a product-oriented layout preferred by lean...Ch. 27 - How is setup time related to lead time?Ch. 27 - Why do lean manufacturers favor pull or make to...Ch. 27 - Why would a lean manufacturer strive to produce...Ch. 27 - How is supply chain management different from...Ch. 27 - Why does lean accounting result in fewer...Ch. 27 - Why do lean manufacturers use a raw and in process...Ch. 27 - Why is the direct labor cost category eliminated...

Ch. 27 - Prob. 11DQCh. 27 - What is the benefit of identifying non-value-added...Ch. 27 - In what ways can the cost of a process be...Ch. 27 - Lead time Blues Inc. manufactures jeans in the...Ch. 27 - Prob. 2BECh. 27 - Lean accounting The annual budgeted conversion...Ch. 27 - Cost of quality report A quality control activity...Ch. 27 - Process activity analysis Roen Company incurred an...Ch. 27 - Lean principles The chief executive officer (CEO)...Ch. 27 - Prob. 2ECh. 27 - Lean principles Rag Swag Inc. manufactures various...Ch. 27 - Lead time analysis Furry Friends Inc. manufactures...Ch. 27 - Reduce setup time Vernon Inc. has analyzed the...Ch. 27 - Compute lead time Jackson Fabricators Inc....Ch. 27 - Calculate lead time Williams Optical Inc. is...Ch. 27 - Suppy chain management The following is an excerpt...Ch. 27 - Employee involvement Quickie Designs Inc. uses...Ch. 27 - Lean principles for a restaurant The management of...Ch. 27 - Accounting issues in a lean environment Eon...Ch. 27 - Lean accounting Westgate Inc. uses a lean...Ch. 27 - Lean accounting Modern Lighting Inc. manufactures...Ch. 27 - Lean accounting Vintage Audio Inc. manufactures...Ch. 27 - Pareto chart Meagher Solutions Inc. manufactures...Ch. 27 - Cost of quality report A. Using the information in...Ch. 27 - Pareto chart for a service company Three Rivers...Ch. 27 - Cost of quality and value-added/non-value-added...Ch. 27 - Process activity analysis The Brite Beverage...Ch. 27 - Process activity analysis for a service company...Ch. 27 - Prob. 21ECh. 27 - Lean principles Bright Night, Inc., manufactures...Ch. 27 - Lead time Sound Tek Inc. manufactures electronic...Ch. 27 - Lean accounting Dashboard Inc. manufactures and...Ch. 27 - Pareto chart and cost of quality report for a...Ch. 27 - Prob. 1PBCh. 27 - Lead time Master Chef Appliance Company...Ch. 27 - Lean accounting Com-Tel Inc. manufactures and...Ch. 27 - Pareto chart and cost of quality report for a...Ch. 27 - Make a Decision Lean Performance for...Ch. 27 - Prob. 2MADCh. 27 - Prob. 3MADCh. 27 - Prob. 4MADCh. 27 - Ethics in Action In August, Lannister Company...Ch. 27 - Communication Ethan Fromme, the chief financial...Ch. 27 - Leese Inc. has the following quality financial...Ch. 27 - When measuring the cost of quality, the cost of...Ch. 27 - In measuring the cost of quality, which one of the...Ch. 27 - External failure costs include all of the...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Compute 007s gross profit percentage and rate of inventory turnover for 2016arrow_forwardHeadland Company pays its office employee payroll weekly. Below is a partial list of employees and their payroll data for August. Because August is their vacation period, vacation pay is also listed. Earnings to Weekly Vacation Pay to Be Employee July 31 Pay Received in August Mark Hamill $5,180 $280 Karen Robbins 4,480 230 $460 Brent Kirk 3,680 190 380 Alec Guinness 8,380 330 Ken Sprouse 8,980 410 820 Assume that the federal income tax withheld is 10% of wages. Union dues withheld are 2% of wages. Vacations are taken the second and third weeks of August by Robbins, Kirk, and Sprouse. The state unemployment tax rate is 2.5% and the federal is 0.8%, both on a $7,000 maximum. The FICA rate is 7.65% on employee and employer on a maximum of $142,800 per employee. In addition, a 1.45% rate is charged both employer and employee for an employee's wages in excess of $142,800. Make the journal entries necessary for each of the four August payrolls. The entries for the payroll and for the…arrow_forwardThe direct materials variance is computed when the materials are purchasedarrow_forward

- Compute the assets turnover ratioarrow_forwardExercise 5-18 (Algo) Calculate receivables ratios (LO5-8) Below are amounts (in millions) from three companies' annual reports. WalCo TarMart Costbet Beginning Accounts Receivable $1,795 6,066 609 Ending Accounts Receivable $2,742 6,594 645 Net Sales $320,427 65,878 66,963 Required: 1. Calculate the receivables turnover ratio and the average collection period for WalCo, TarMart and CostGet 2. Which company appears most efficient in collecting cash from sales? Complete this question by entering your answers in the tabs below. Required 1 Required C Calculate the receivables turnover ratio and the average collection period for WalCo, TarMart and CostGet. (Enter your answers in millions rounded to 1 decimal place.) Receivables Turnover Ratio: WalCo S TarMart. S CostGet S Choose Numerator Choose Numerator "ValCo FarMart CostGet 320,427 $ 65.878 66,963 Choose Denominator Receivables turnover ratio 2,742.0 116.9 times 0 times 0 times Average Collection Period Choose Denominator Average…arrow_forwardWhat is the Whistleblower Protection Act of 1989 (amended in 2011)?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

alue Chain Analysis EXPLAINED | B2U | Business To You; Author: Business To You;https://www.youtube.com/watch?v=SI5lYaZaUlg;License: Standard Youtube License