Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 27, Problem 4PA

Pareto chart and cost of quality report for a service company

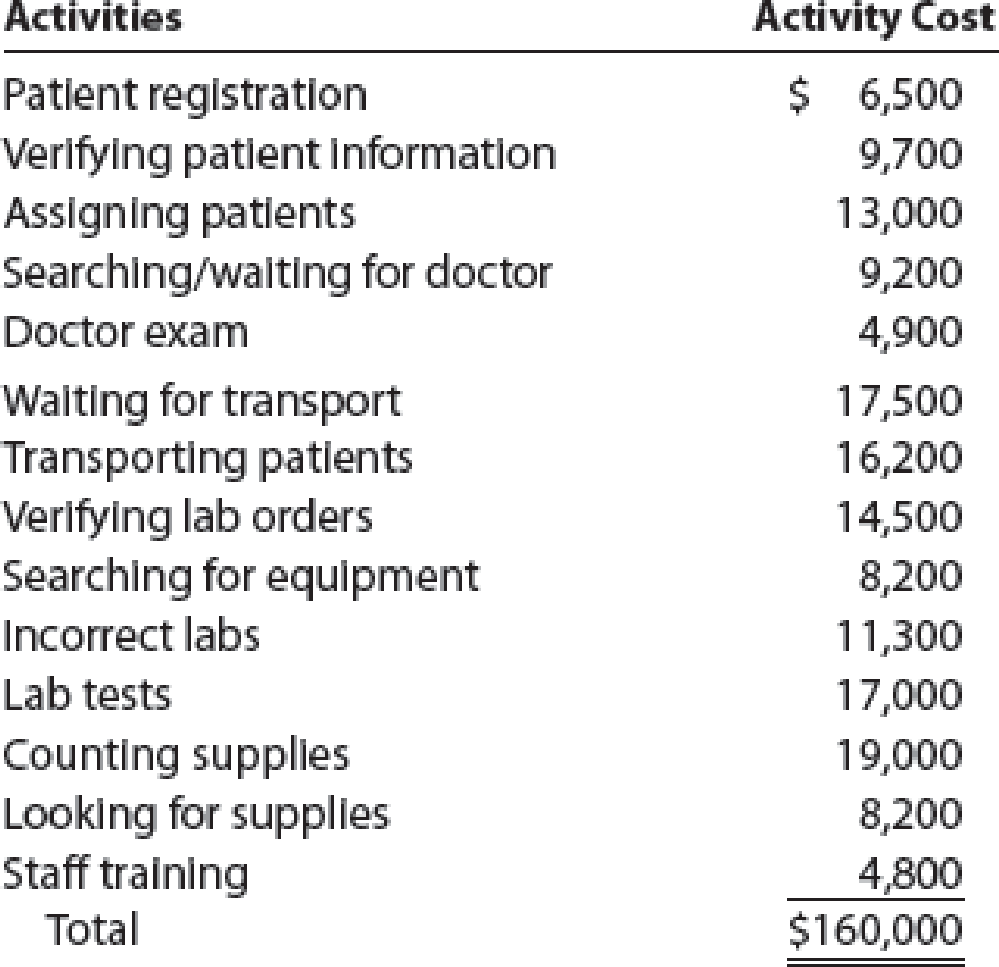

The administrator of Liberty Hospital has been asked to perform an activity analysis of the emergency room (ER). The ER activities include cost of quality and other patient care activities. The lab tests and transportation are hospital services external to the ER for determining external failure costs. The result of the activity analysis is summarized as follows:

Instructions

- 1. Prepare a Pareto chart of the ER activities.

- 2. Classify the activities into prevention, appraisal, internal failure, external failure, and other patient care activities. Classify the activities into value-added and non-value-added activities.

- 3. Use the activity cost information to determine the percentages of total ER costs that are prevention, appraisal, internal failure, external failure, and other patient care activities.

- 4. Determine the percentages of the total ER costs that are value-added and non-value-added.

- 5. Interpret the information.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

The completed Payroll Register for the February and March biweekly pay periods is provided, assuming benefits went into effect as anticipated.

Required:

Using the payroll registers, complete the General Journal entries as follows:

February 10 Journalize the employee pay.

February 10 Journalize the employer payroll tax for the February 10 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base.

February 14 Issue the employee pay.

February 24 Journalize the employee pay.

February 24 Journalize the employer payroll tax for the February 24 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employee will exceed the FUTA or SUTA wage base.

February 28 Issue the employee pay.

February 28 Issue payment for the payroll liabilities.

March 10 Journalize the employee pay.

March 10 Journalize the employer payroll tax for the March 10 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base.…

Please given step by step explanation general accounting question

Don't use ai solution please given answer general accounting

Chapter 27 Solutions

Financial And Managerial Accounting

Ch. 27 - What is the benefit of the lean philosophy?Ch. 27 - What are some examples of non-value-added lead...Ch. 27 - Why is a product-oriented layout preferred by lean...Ch. 27 - How is setup time related to lead time?Ch. 27 - Why do lean manufacturers favor pull or make to...Ch. 27 - Why would a lean manufacturer strive to produce...Ch. 27 - How is supply chain management different from...Ch. 27 - Why does lean accounting result in fewer...Ch. 27 - Why do lean manufacturers use a raw and in process...Ch. 27 - Why is the direct labor cost category eliminated...

Ch. 27 - Prob. 11DQCh. 27 - What is the benefit of identifying non-value-added...Ch. 27 - In what ways can the cost of a process be...Ch. 27 - Lead time Blues Inc. manufactures jeans in the...Ch. 27 - Prob. 2BECh. 27 - Lean accounting The annual budgeted conversion...Ch. 27 - Cost of quality report A quality control activity...Ch. 27 - Process activity analysis Roen Company incurred an...Ch. 27 - Lean principles The chief executive officer (CEO)...Ch. 27 - Prob. 2ECh. 27 - Lean principles Rag Swag Inc. manufactures various...Ch. 27 - Lead time analysis Furry Friends Inc. manufactures...Ch. 27 - Reduce setup time Vernon Inc. has analyzed the...Ch. 27 - Compute lead time Jackson Fabricators Inc....Ch. 27 - Calculate lead time Williams Optical Inc. is...Ch. 27 - Suppy chain management The following is an excerpt...Ch. 27 - Employee involvement Quickie Designs Inc. uses...Ch. 27 - Lean principles for a restaurant The management of...Ch. 27 - Accounting issues in a lean environment Eon...Ch. 27 - Lean accounting Westgate Inc. uses a lean...Ch. 27 - Lean accounting Modern Lighting Inc. manufactures...Ch. 27 - Lean accounting Vintage Audio Inc. manufactures...Ch. 27 - Pareto chart Meagher Solutions Inc. manufactures...Ch. 27 - Cost of quality report A. Using the information in...Ch. 27 - Pareto chart for a service company Three Rivers...Ch. 27 - Cost of quality and value-added/non-value-added...Ch. 27 - Process activity analysis The Brite Beverage...Ch. 27 - Process activity analysis for a service company...Ch. 27 - Prob. 21ECh. 27 - Lean principles Bright Night, Inc., manufactures...Ch. 27 - Lead time Sound Tek Inc. manufactures electronic...Ch. 27 - Lean accounting Dashboard Inc. manufactures and...Ch. 27 - Pareto chart and cost of quality report for a...Ch. 27 - Prob. 1PBCh. 27 - Lead time Master Chef Appliance Company...Ch. 27 - Lean accounting Com-Tel Inc. manufactures and...Ch. 27 - Pareto chart and cost of quality report for a...Ch. 27 - Make a Decision Lean Performance for...Ch. 27 - Prob. 2MADCh. 27 - Prob. 3MADCh. 27 - Prob. 4MADCh. 27 - Ethics in Action In August, Lannister Company...Ch. 27 - Communication Ethan Fromme, the chief financial...Ch. 27 - Leese Inc. has the following quality financial...Ch. 27 - When measuring the cost of quality, the cost of...Ch. 27 - In measuring the cost of quality, which one of the...Ch. 27 - External failure costs include all of the...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Answer? ? Financial accounting questionarrow_forwardNeither Joe nor Jessie is blind or over age 65, and they plan to file as married joint. Assume that the employer portion of the self-employment tax on Jessie's income is $831. Joe and Jessie have summarized the income and expenses they expect to report this year as follows: Income: Joe's salary $ 144,100 Jessie's craft sales 18,400 Interest from certificate of deposit 1,650 Interest from Treasury bond funds 716 Interest from municipal bond funds 920 Expenditures: Federal income tax withheld from Joe's wages $ 13,700 State income tax withheld from Joe's wages 6,400 Social Security tax withheld from Joe's wages 7,482 Real estate taxes on residence 6,200 Automobile licenses (based on weight) 310 State sales tax paid 1,150 Home mortgage interest 26,000 Interest on Masterdebt credit card 2,300 Medical expenses (unreimbursed) 1,690 Joe's employee expenses (unreimbursed) 2,400 Cost of…arrow_forwardNeed General Accounting Question solutionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

alue Chain Analysis EXPLAINED | B2U | Business To You; Author: Business To You;https://www.youtube.com/watch?v=SI5lYaZaUlg;License: Standard Youtube License