Concept explainers

Calculate lead time

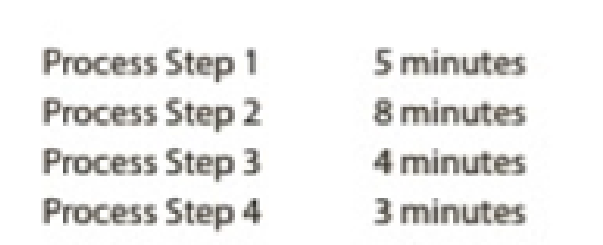

Williams Optical Inc. is considering a new lean product cell. The present manufacturing approach produces a product in four separate steps. The production batch sizes are 45 units. The process time for each step is as follows:

The time required to move each batch between steps is 5 minutes. In addition, the time to move raw materials to Process Step 1 is also 5 minutes, and the time to move completed units from Process Step 4 to finished goods inventory is 5 minutes.

The new lean layout will allow the company to reduce the batch sizes from 45 units to 3 units. The time required to move each batch between steps and the inventory locations will be reduced to 2 minutes. The processing time in each step will stay the same.

Determine the value-added, non-value-added, and total lead times, and the value-added ratio under the (A) present and (B) proposed production approaches. (Round percentages to one decimal place.)

Trending nowThis is a popular solution!

Chapter 27 Solutions

Financial And Managerial Accounting

- I need the correct answer to this financial accounting problem using the standard accounting approach.arrow_forwardhello dear tutor If submitted blurr comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forwardWhat are the implications of the matching principle in accounting?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College