Variance interpretation

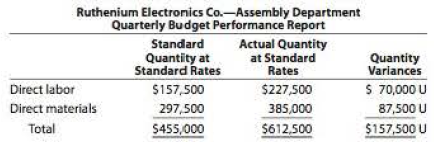

You have been asked to investigate some cost problems in the Assembly Department of Ruthenium Electronics Co., a consumer electronics company. To begin your investigation, you have obtained the following budget performance report for department for the last quarter:

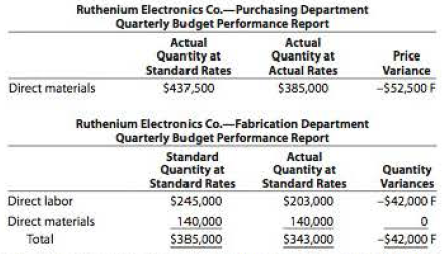

The following reports were also obtained:

You also interviewed the Assembly Department supervisor. Excerpts from the interview follow:

Q: What explains the poor performance in your department?

A: Listen, you've got to understand what it's been like in this department recently. Lately, it seems no matter how hard we try, we can't seem to make the standards. I'm not sure what is going on, but we've been having a lot of problems lately.

Q: What kind of problems?

A: Well, for instance, all this quarter we've been requisitioning purchased parts from the material storeroom, and the pans just didn't fit together very well I'm not sure what is going on. but during most of this quarter we've had to scrap and sort purchased pans—just to get our assemblies put together. Naturally, all this takes time and material. And that's not all.

Q: Go on.

A: All this quarter, the work that we've been receiving from the Fabrication Department has been shoddy. I mean, maybe around 20% of the stuff that comes in from Fabrication just can't be assembled. The fabrication is all wrong. As a result, we've had to scrap and rework a lot of the stuff. Naturally, this has just shot our quantity variances.

Interpret the variance reports in light of the comments by the Assembly Department supervisor.

Trending nowThis is a popular solution!

Chapter 22 Solutions

Financial & Managerial Accounting

- 4 POINTarrow_forwardThe story of FTX is another "open and shut" fraud case, this time taking place in the digital world. Completing this activity allows you to continue building your knowledge of how fraud is detected, how evidence is collected, how fraudsters are prosecuted, and how fraud affects those involved. Review the video, The Trial Against Same Bankman-Friend: How Did We Get Here? Read the following brief case overview: A federal grand jury in Manhattan returned an indictment charging Samuel Bankman-Fried, aka SBF, 30, of Stanford, California, with wire fraud, conspiracy to commit wire fraud, conspiracy to commit commodities fraud, conspiracy to commit securities fraud, conspiracy to commit money laundering, and conspiracy to defraud the Federal Election Commission and commit campaign finance violations. In March 2024, FTX co-founder and CEO Sam Bankman-Fried was convicted of 2 counts of wire fraud and five counts of conspiracy after his crypto empire collapsed, defrauding investors in his…arrow_forwardAns ?? Financial accounting questionarrow_forward

- Need answer accounting questionarrow_forwardDuring a specific period, Nexus Technologies reported a decrease in total assets of $14,500 and an increase in stockholders' equity of $9,800. By what amount and direction must total liabilities have changed during that same period?arrow_forwardPlease provide correct answerarrow_forward

- Answer this financial accounting questionarrow_forwardFTX was a leading cryptocurrency exchange that went bankrupt in November 2022 amid allegations that its owners had embezzled and misused customer funds. Sam Bankman-Fried, the CEO of the exchange, was sentenced to 25 years in prison and ordered to repay $11 billion. The catalyst was a Nov. 2 scoop by crypto news site CoinDesk revealing that the majority of assets held by Alameda Research, a quantitative trading firm and sister company also run by Bankman-Fried, consisted of FTT and other tokens invented and controlled by FTX and its insiders, rather than a fiat currency or cryptocurrency with market-driven and time-tested value. Scores of investors and customers pulled their funds out of FTX, forcing the exchange to become insolvent and declare bankruptcy. The revelations prompted concern across the cryptocurrency industry that FTX was overly leveraged with Alameda Research, relied on precarious financial accounting metrics, and faced associated financial management risks. Questions…arrow_forwardGiven correct answer general accountingarrow_forward

- can you please solve thisarrow_forwardneed helparrow_forwardRequired: 1. Compute a predetermined overhead rate for the plant as a whole based on machine hours. Round your answer to two decimal places. per machine hour 2. Compute predetermined overhead rates for each department using machine hours. (Note: Round to two decimal places, if necessary.) Department A Department B per machine hour per machine hour 3. Conceptual Connection: Job 73 used 20 machine hours from Department A and 50 machine hours from Department B. Job 74 used 50 machine hours from Department A and 20 machine hours from De Compute the overhead cost assigned to each job using the plantwide rate computed in Requirement 1. Repeat the computation using the departmental rates found in Requirement 2. Round final answers to cent, if necessary. Job 73 Job 74 Plantwide Departmental Which of the two approaches gives the fairer assignment? 4. Conceptual Connection: Repeat Requirement 3, assuming the expected overhead cost for Department B is $94,000 (not $69,000). Round overhead rates…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning