INTERMEDIATE ACCOUNTING (LL) W/CONNECT

9th Edition

ISBN: 9781260679694

Author: SPICELAND

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 21, Problem 21.9P

• LO21–3, LO21–4

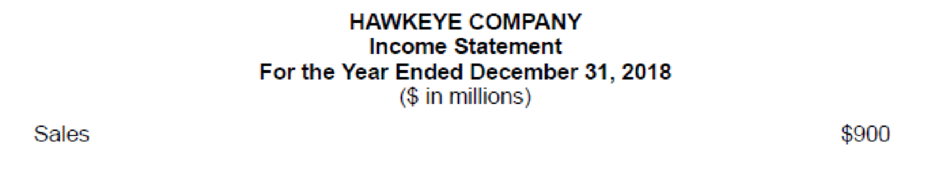

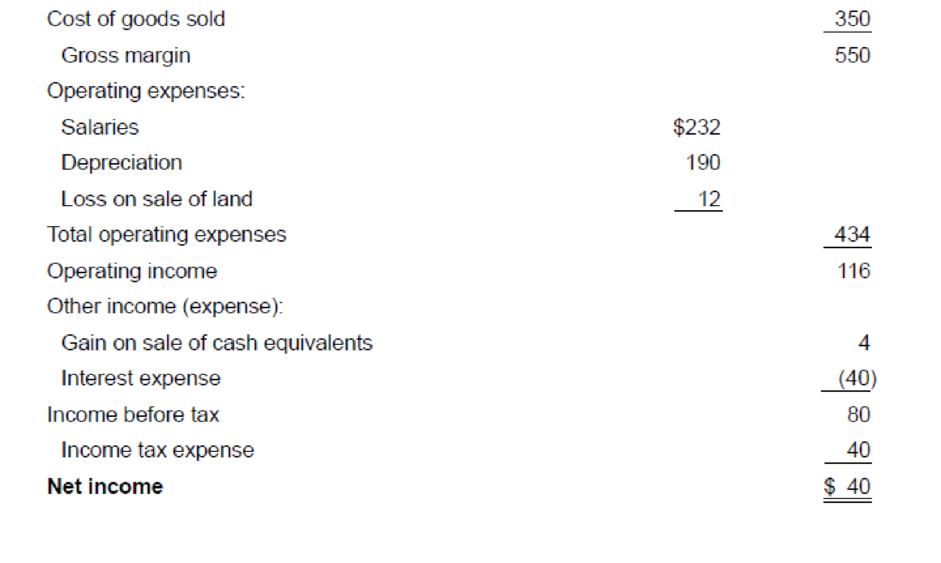

Portions of the financial statements for Hawkeye Company are provided below.

Required:

- 1. Prepare the cash flows from operating activities section of the statement of cash flows for Hawkeye Company using the direct method.

- 2. Prepare the cash flows from operating activities section of the statement of cash flows for Hawkeye Company using the indirect method.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Need answer general accounting question

Please explain the correct approach for solving this general accounting question.

I am trying to find the accurate solution to this general accounting problem with appropriate explanations.

Chapter 21 Solutions

INTERMEDIATE ACCOUNTING (LL) W/CONNECT

Ch. 21 - Effects of all cash flows affect the balances of...Ch. 21 - Prob. 21.2QCh. 21 - Prob. 21.3QCh. 21 - Prob. 21.4QCh. 21 - Prob. 21.5QCh. 21 - Prob. 21.6QCh. 21 - Prob. 21.7QCh. 21 - The sale of stock and the sale of bonds are...Ch. 21 - Does the statement of cash flows report only...Ch. 21 - Prob. 21.10Q

Ch. 21 - Perhaps the most noteworthy item reported on an...Ch. 21 - Prob. 21.12QCh. 21 - Given sales revenue of 200,000, how can it be...Ch. 21 - Prob. 21.14QCh. 21 - When determining the amount of cash paid for...Ch. 21 - Prob. 21.16QCh. 21 - When using the indirect method of determining net...Ch. 21 - Prob. 21.18QCh. 21 - Prob. 21.19QCh. 21 - Where can we find authoritative guidance for the...Ch. 21 - U.S. GAAP designates cash outflows for interest...Ch. 21 - Prob. 21.1BECh. 21 - Prob. 21.2BECh. 21 - Prob. 21.3BECh. 21 - Prob. 21.4BECh. 21 - Prob. 21.5BECh. 21 - Prob. 21.6BECh. 21 - Prob. 21.7BECh. 21 - Prob. 21.8BECh. 21 - Investing activities LO215 Carter Containers sold...Ch. 21 - Financing activities LO216 Refer to the situation...Ch. 21 - Prob. 21.11BECh. 21 - Prob. 21.12BECh. 21 - Classification of cash flows LO213 through LO216...Ch. 21 - Determine cash paid to suppliers of merchandise ...Ch. 21 - Determine cash received from customers LO213...Ch. 21 - Prob. 21.4ECh. 21 - Prob. 21.5ECh. 21 - Prob. 21.6ECh. 21 - Determine cash paid for bond interest LO213...Ch. 21 - Determine cash paid for bond interest LO213 For...Ch. 21 - Determine cash paid for income taxes LO213...Ch. 21 - Prob. 21.10ECh. 21 - Prob. 21.11ECh. 21 - Installment note; statement of cash flow effects ...Ch. 21 - Prob. 21.13ECh. 21 - Identifying cash flows from investing activities...Ch. 21 - Prob. 21.15ECh. 21 - Prob. 21.16ECh. 21 - Indirect method; reconciliation of net income to...Ch. 21 - Spreadsheet entries from statement of retained...Ch. 21 - Prob. 21.19ECh. 21 - Prob. 21.20ECh. 21 - Cash flow s from operating activities (direct...Ch. 21 - Indirect method; reconciliation of net income to...Ch. 21 - Prob. 21.23ECh. 21 - Cash flows from operating activities (indirect...Ch. 21 - Prob. 21.25ECh. 21 - Cash flow s from operating activities (indirect...Ch. 21 - Prob. 21.27ECh. 21 - Prob. 21.28ECh. 21 - Prob. 21.29ECh. 21 - Prob. 21.30ECh. 21 - Prob. 21.31ECh. 21 - Prob. 21.32ECh. 21 - Prob. 21.1PCh. 21 - Statement of cash flows; direct method LO213,...Ch. 21 - Prob. 21.3PCh. 21 - Statement of cash flows; direct method LO213,...Ch. 21 - Statement of cash flows; direct method LO213,...Ch. 21 - Cash flows from operating activities (direct...Ch. 21 - Prob. 21.7PCh. 21 - Cash flows from operating activities (direct...Ch. 21 - Cash flows from operating activities (direct...Ch. 21 - Prob. 21.10PCh. 21 - Prepare a statement of cash flows; direct method ...Ch. 21 - Prob. 21.12PCh. 21 - Prob. 21.13PCh. 21 - Statement of cash flows; indirect method; limited...Ch. 21 - Integrating problem; bonds; lease transactions;...Ch. 21 - Statement of cash flows; indirect method LO214,...Ch. 21 - Prob. 21.17PCh. 21 - Statement of cash flows; indirect method LO214,...Ch. 21 - Prob. 21.19PCh. 21 - Prob. 21.20PCh. 21 - Prob. 21.21PCh. 21 - Prob. 21.1BYPCh. 21 - Prob. 21.2BYPCh. 21 - Research Case 213 Information from cash flow...Ch. 21 - Analysis Case 215 Smudged ink; find missing...Ch. 21 - Real World Case 216 Analyze cash flow activities;...Ch. 21 - Prob. 21.7BYPCh. 21 - Prob. 21.8BYPCh. 21 - Research Case 219 FASB codification; locate and...Ch. 21 - IFRS Case 2110 Statement of cash flows...Ch. 21 - Prob. CCTC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License