Concept explainers

Statement of

• LO21–3, LO21–8

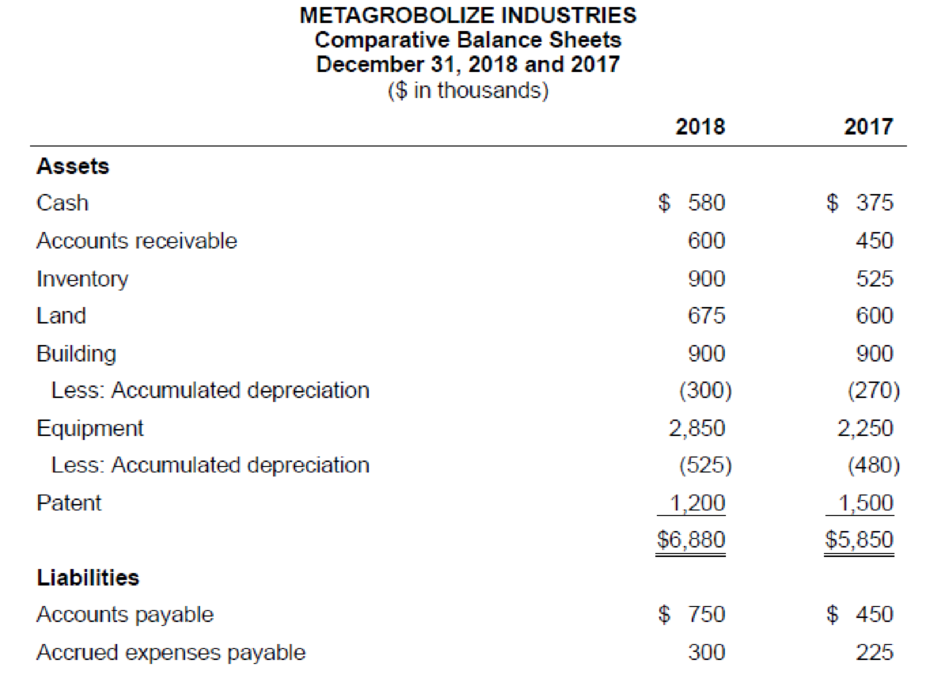

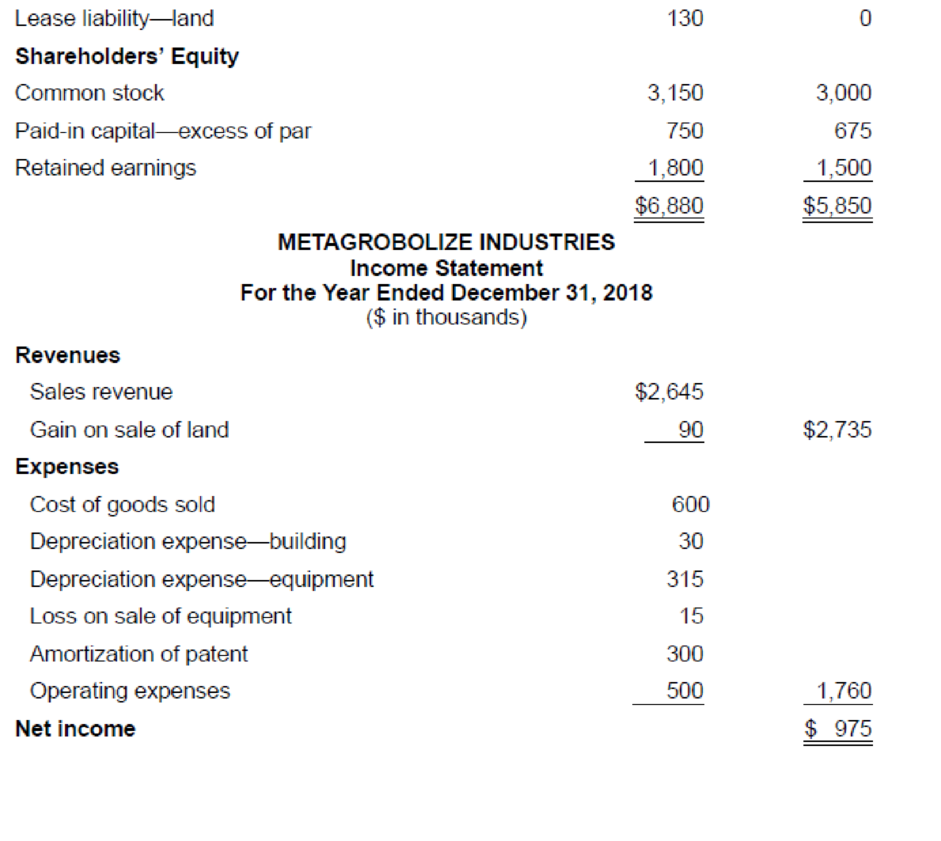

Comparative

Additional information from the accounting records:

a. Annual payments of $20,000 on the finance lease liability are paid each January 1, beginning in 2018.

b. During 2018, equipment with a cost of $300,000 (90%

c. The statement of shareholders’ equity reveals reductions of $225,000 and $450,000 for stock dividends and cash dividends, respectively.

Required:

Prepare the statement of cash flows of Metagrobolize for the year ended December 31, 2018. Present cash flows from operating activities by the direct method. (You may omit the schedule to reconcile net income to cash flows from operating activities.)

Want to see the full answer?

Check out a sample textbook solution

Chapter 21 Solutions

INTERMEDIATE ACCOUNTING (LL) W/CONNECT

- Can you solve this financial accounting problem using accurate calculation methods?arrow_forwardContinental Industries reported net sales of $5.80 million and beginning total assets of $2.20 million and ending total assets of $2.60 million. The average total asset amount is:arrow_forwardTo what extent should tax considerations influence the selection and application of accounting methods within an organization? Discuss the potential conflicts that may arise between the objective of maximizing financial reporting transparency and the desire to minimize tax liabilities through strategic accounting choices. Answer thisarrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning