Concept explainers

Statement of

• LO21–3, LO21–8

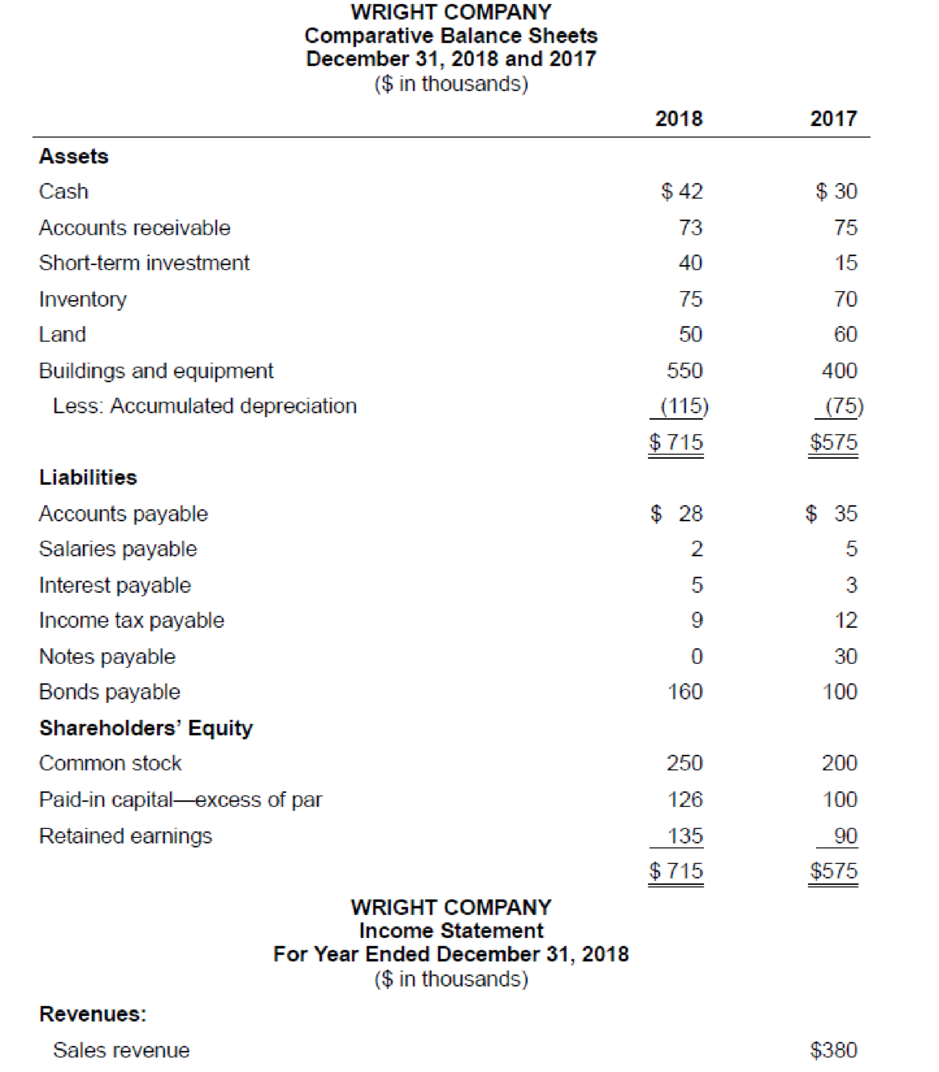

The comparative

Additional information from the accounting records:

a. Land that originally cost $10,000 was sold for $7,000.

b. The common stock of Microsoft Corporation was purchased for $25,000 as a short-term investment not classified as a cash equivalent.

c. New equipment was purchased for $150,000 cash.

d. A $30,000 note was paid at maturity on January 1.

e. On January 1, 2018, bonds were sold at their $60,000 face value.

f. Common stock ($50,000 par) was sold for $76,000.

g. Net income was $80,000 and cash dividends of $35,000 were paid to shareholders.

Required:

Prepare the statement of cash flows of Wright Company for the year ended December 31, 2018. Present cash flows from operating activities by the direct method. (You may omit the schedule to reconcile net income with cash flows from operating activities.)

Want to see the full answer?

Check out a sample textbook solution

Chapter 21 Solutions

INTERMEDIATE ACCOUNTING (LL) W/CONNECT

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning