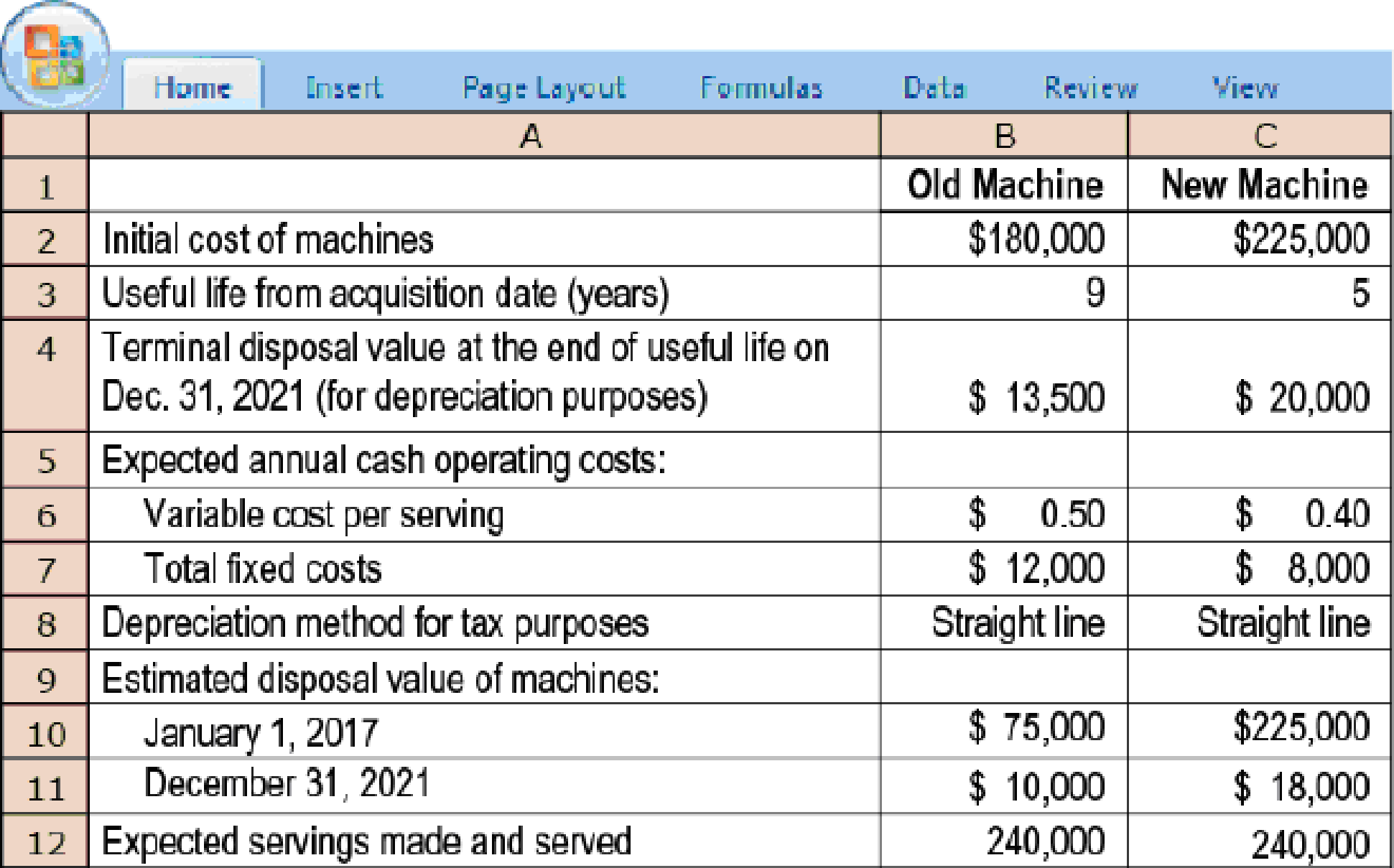

Replacement of a machine, income taxes, sensitivity. (CMA, adapted) The Kuhl Brothers own a frozen custard ice cream shop. The brothers currently are using a machine that has been in use for the last 4 years. On January 1, 2017, the Kuhl Brothers are considering buying a new machine to make their frozen custard. The Kuhl Brothers have two options: (1) continue using the old freezing machine or (2) sell the old machine and purchase a new freezing machine. The seller of the new machine is not interested in a trade-in of Kuhl’s old machine. The following information has been obtained:

The Kuhl Brothers are subject to a 25% income tax rate. Any gain or loss on the sale of machines is treated as an ordinary tax item and will affect the taxes paid by the Kuhl Brothers in the year in which it occurs. The Kuhl Brothers have an after-tax required

- 1. The Kuhl Brothers ask you whether they should buy the new machine. To help in your analysis, calculate the following:

Required

- a. One-time after-tax cash effect of disposing of the old machine on January 1, 2017

- b. Annual recurring after-tax cash operating savings from using the new machine (variable and fixed)

- c. Cash tax savings due to differences in annual

depreciation of the old machine and the new machine - d. Difference in after-tax cash flow from terminal disposal of new machine and old machine

- 2. Use your calculations in requirement 1 and the

net present value method to determine whether the Kuhl Brothers should continue to use the old machine or acquire the new machine. - 3. How much more or less would the recurring after-tax cash operating savings of the new machine need to be for the Kuhl Brothers to earn exactly the 8% after-tax required rate of return? Assume that all other data about the investment do not change.

Trending nowThis is a popular solution!

Chapter 21 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- What is the true option general Accounting questionarrow_forwardAlderon Ltd. has 1,200 defective units of a product that cost $3.50 per unit in direct costs and $7.10 per unit in indirect costs when produced last year. The units can be sold as scrap for $4.80 per unit or reworked at an additional cost of $3.10 per unit and sold at the full price of $13.50. The incremental net income (loss) from the choice of reworking the units would be____.arrow_forwardMangesh Analytics, Inc. sells earnings forecasts for European securities. Its credit terms are 2/15, net 40. Based on experience, 60 percent of all customers will take the discount. What is the average collection period? Need answerarrow_forward

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT