Concept explainers

Payback methods, even and uneven

Sage estimates the cost of the new equipment at $159,000. The equipment has a useful life of 9 years. Sage expects cash fixed costs of $80,000 per year to operate the new machines, as well as cash variable costs in the amount of 5% of revenues. Sage evaluates investments using a cost of capital of 10%.

- 1. Calculate the payback period and the discounted payback period for this investment, assuming Sage expects to generate $140,000 in incremental revenues every year from the new machines.

Required

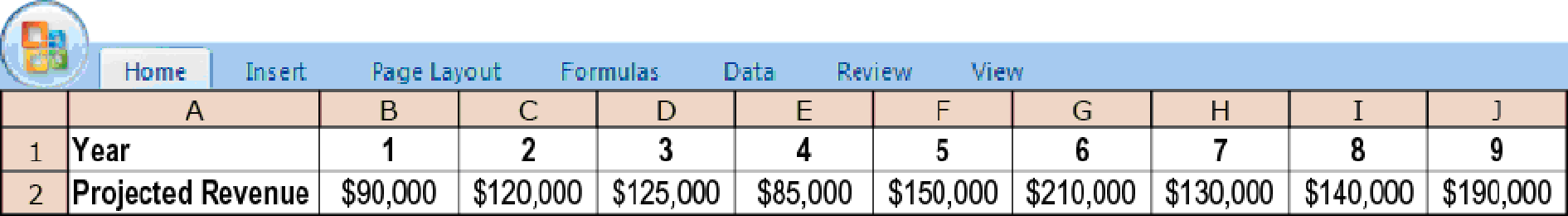

- 2. Assume instead that Sage expects the following uneven stream of incremental cash revenues from installing the new washing machines:

Based on this estimated revenue stream, what are the payback and discounted payback periods for the investment?

Trending nowThis is a popular solution!

Chapter 21 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning