Concept explainers

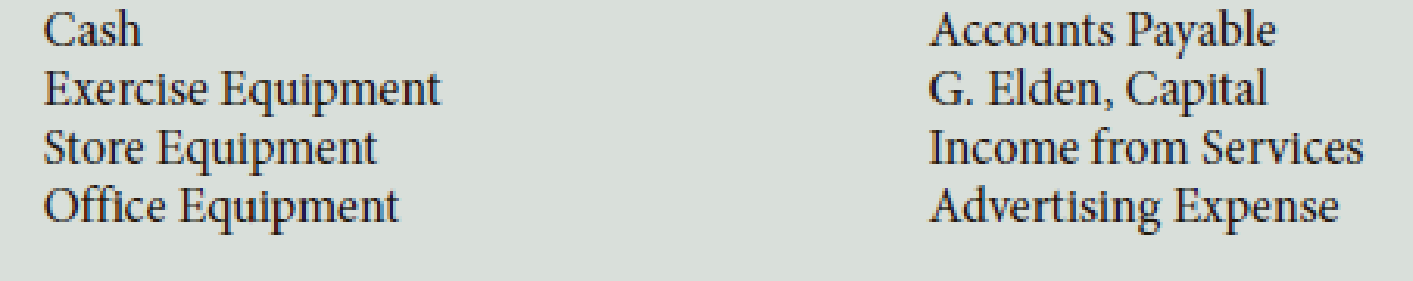

During December of this year, G. Elden established Ginny’s Gym. The following asset, liability, and owner’s equity accounts are included in the chart of accounts:

During December, the following transactions occurred:

- a. Elden deposited $35,000 in a bank account in the name of the business.

- b. Bought exercise equipment for cash, $8,150, Ck. No. 1001.

- c. Bought advertising on account from Hazel Company, $105.

- d. Bought a display rack on account from Cyber Core, $790.

- e. Bought office equipment on account from Office Aids, $185.

- f. Elden invested her exercise equipment with a fair market value of $1,200 in the business.

- g. Made a payment to Cyber Core, $200, Ck. No. 1002.

- h. Sold services for the month of December for cash, $800.

Required

- 1. Write the account classifications (Assets, Liabilities, Capital, Drawing, Revenue, Expense) in the fundamental

accounting equation , as well as the plus and minus signs and Debit and Credit. - 2. Write the account names on the T accounts under the classifications, place the plus and minus signs for each T account, and label the debit and credit sides of the T accounts

- 3. Record the amounts in the proper positions in the T accounts. Write the letter next to each entry to identify the transaction.

- 4. Foot and balance the accounts.

Trending nowThis is a popular solution!

Chapter 2 Solutions

Bundle: College Accounting: A Career Approach, Loose-leaf Version, 13th + Quickbooks Online + Working Papers With Study Guide

Additional Business Textbook Solutions

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Intermediate Accounting (2nd Edition)

Horngren's Accounting (12th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Business Essentials (12th Edition) (What's New in Intro to Business)

- Compute the variable and fixed cost elementsarrow_forwardThe formula AH * (SR-AR) is the: a. direct labor spending variance. b. direct labor volume variance. c. direct labor rate variance. d. direct labor efficiency variance.arrow_forwardStrait Company manufactures office furniture. During the most productive month of the year, 4,400 desks were manufactured at a total cost of $61,000. In the month of lowest production, the company made 2,335 desks at a cost of $43,000. Using the high-low method of cost estimation, total fixed costs are____. Options: a. $24,800 b. $29,400 c. $40,000 d. $22,632.arrow_forward

- On December 31, Strike Company decided to sell one of its batting cages. The initial cost of the equipment was $308,000 with accumulated depreciation of $199,000. Depreciation has been taken up to the end of the year. The company found a company that is willing to buy the equipment for $35,000. What is the amount of the gain or loss on this transaction? Answer this questionarrow_forwardAyayai Itzek manufactures and sells homemade wine, and he wants to develop a standard cost per gallon. The following are required for the production of a 50-gallon batch. - 2,910 ounces of grape concentrate at $0.08 per ounce. - 54 pounds of granulated sugar at $0.40 per pound. 60 lemons at $0.70 each. 250 yeast tablets at $0.29 each. - 200 nutrient tablets at $0.12 each. - 2,800 ounces of water at $0.005 per ounce. Ayayai estimates that 3% of the grape concentrate is wasted, 10% of the sugar is lost, and 25% of the lemons cannot be used. Compute the standard cost of the ingredients for one gallon of wine.arrow_forwardOn December 31, Strike Company decided to sell one of its batting cages. The initial cost of the equipment was $308,000 with accumulated depreciation of $199,000. Depreciation has been taken up to the end of the year. The company found a company that is willing to buy the equipment for $35,000. What is the amount of the gain or loss on this transaction?arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College