Concept explainers

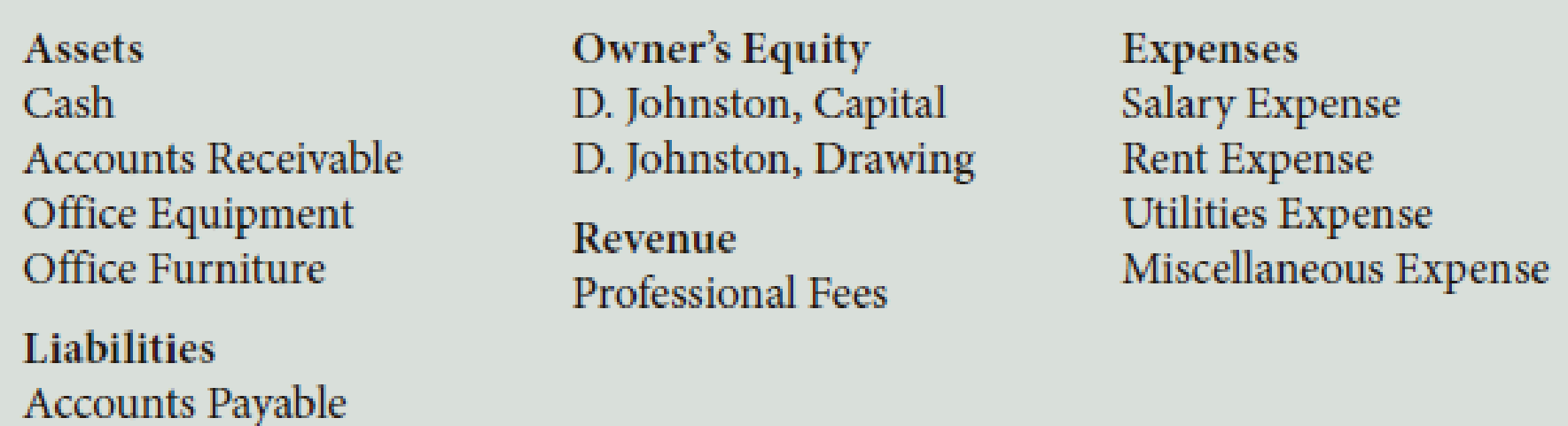

D. Johnston, a physical therapist, opened Johnston’s Clinic. His accountant provided the following chart of accounts:

The following transactions occurred during July of this year:

- a. Johnston deposited $35,000 in a bank account in the name of the business.

- b. Bought filing cabinets on account from Muller Office Supply, $560.

- c. Paid cash for chairs and carpeting for the waiting room, $835, Ck. No. 1000.

- d. Bought a photocopier from Rob’s Office Equipment, $650, paying $250 in cash and placing the balance on account, Ck. No. 1001.

- e. Received and paid the telephone bill, which included installation charges, $185, Ck. No. 1002.

- f. Sold professional services on account, $2,255.

- g. Received and paid the bill for the state physical therapy convention, $445, Ck. No. 1003.

- h. Received and paid the electric bill, $335, Ck. No. 1004.

- i. Received cash on account from credit customers, $1,940.

- j. Paid on account to Muller Office Supply, $250, Ck. No. 1005.

- k. Paid the office rent for the current month, $1,245, Ck. No. 1006.

- l. Sold professional services for cash, $1,950.

- m. Paid the salary of the receptionist, $960, Ck. No. 1007.

- n. Johnston withdrew cash for personal use, $1,200, Ck. No. 1008.

Required

- 1. Record the owner’s name in the Capital and Drawing T accounts.

- 2. Correctly place the plus and minus signs for each T account and label the debit and credit sides of the accounts.

- 3. Record the transactions in the T accounts. Write the letter of each entry to identify the transaction.

- 4. Foot the T accounts and show the balances.

- 5. Prepare a

trial balance as of July 31, 20--. - 6. Prepare an income statement for July 31, 20--.

- 7. Prepare a statement of owner’s equity for July 31, 20--.

- 8. Prepare a

balance sheet as of July 31, 20--.

Trending nowThis is a popular solution!

Chapter 2 Solutions

Bundle: College Accounting: A Career Approach, Loose-leaf Version, 13th + Quickbooks Online + Working Papers With Study Guide

Additional Business Textbook Solutions

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Horngren's Accounting (12th Edition)

Intermediate Accounting (2nd Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Economics of Money, Banking and Financial Markets, The, Business School Edition (5th Edition) (What's New in Economics)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College