Concept explainers

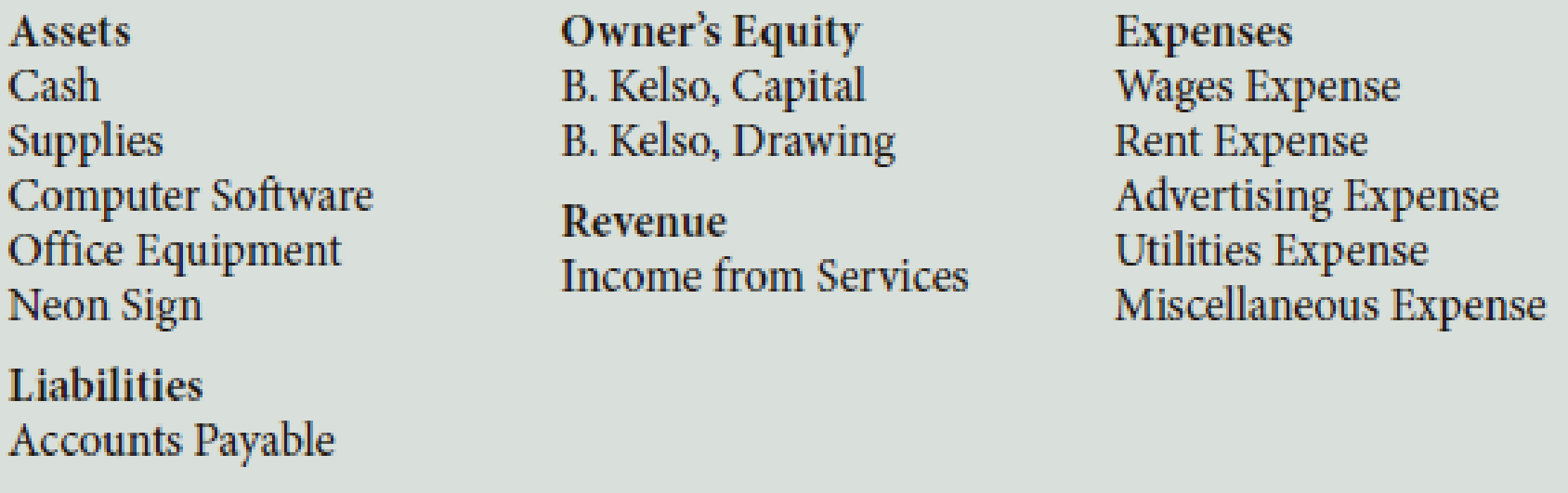

B. Kelso established Computer Wizards during November of this year. The accountant prepared the following chart of accounts:

The following transactions occurred during the month:

- a. Kelso deposited $45,000 in a bank account in the name of the business.

- b. Paid the rent for the current month, $1,800, Ck. No. 2001.

- c. Bought office desks and filing cabinets for cash, $790, Ck. No. 2002.

- d. Bought a computer and printer from Cyber Center for use in the business, $2,700, paying $1,700 in cash and placing the balance on account, Ck. No. 2003.

- e. Bought a neon sign on account from Signage Co., $1,350.

- f. Kelso invested her personal computer software with a fair market value of $600 in the business.

- g. Received a bill from Country News for newspaper advertising, $365.

- h. Sold services for cash, $1,245.

- i. Received and paid the electric bill, $345, Ck. No. 2004.

- j. Paid on account to Country News, a creditor, $285, Ck. No. 2005.

- k. Sold services for cash, $1,450.

- l. Paid wages to an employee, $925, Ck. No. 2006.

- m. Received and paid the bill for the city business license, $75, Ck. No. 2007.

- n. Kelso withdrew cash for personal use, $850, Ck. No. 2008.

- o. Kelso withdrew cash for personal use, $850, Ck. No. 2008.

Required

- 1. Record the owner’s name in the Capital and Drawing T accounts.

- 2. Correctly place the plus and minus signs for each T account and label the debit and credit sides of the accounts.

- 3. Record the transactions in T accounts. Write the letter of each entry to identify the transaction.

- 4. Foot the T accounts and show the balances.

- 5. Prepare a

trial balance , with a three-line heading, dated November 30, 20--.

Trending nowThis is a popular solution!

Chapter 2 Solutions

Bundle: College Accounting: A Career Approach, Loose-leaf Version, 13th + Quickbooks Online + Working Papers With Study Guide

Additional Business Textbook Solutions

Horngren's Accounting (12th Edition)

Intermediate Accounting (2nd Edition)

Economics of Money, Banking and Financial Markets, The, Business School Edition (5th Edition) (What's New in Economics)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Financial Accounting, Student Value Edition (5th Edition)

- REQUIRED Study the information given below and answer the following questions. Where discount factors are required use only the four decimals present value tables that appear after the formula sheet or in the module guide. Ignore taxes. 5.1 Calculate the Accounting Rate of Return on average investment of the second alternative (expressed to two decimal places). 5.2 Determine which of the two investment opportunities the company should choose by calculating the Net Present Value of each alternative. Your answer must include the calculation of the present values and NPV. 5.3 Calculate the Internal Rate of Return of the first alterative (expressed to two decimal places). Your answer must include two net present value calculations (using consecutive rates/percentages) and interpolation. INFORMATION The management of Bentall Incorporated is considering two investment opportunities: (5 marks) (9 marks) (6 marks) The first alternative involves the purchase of a new machine for R900 000 which…arrow_forwardREQUIRED Use the information provided below to answer the following questions: 4.1 Calculate the weighted average cost of capital (expressed to two decimal places). Your answer must include the calculations of the cost of equity, preference shares and the loan. 4.2 Calculate the cost of equity using the Capital Asset Pricing Model (expressed to two decimal places). (16 marks) (4 marks) INFORMATION Cadmore Limited intends raising finance for a proposed new project. The financial manager has provided the following information to determine the present cost of capital to the company: The capital structure consists of the following: ■3 million ordinary shares issued at R1.50 each but currently trading at R2 each. 1 200 000 12%, R2 preference shares with a market value of R2.50 per share. R1 000 000 18% Bank loan, due in March 2027. Additional information The company's beta coefficient is 1.3. The risk-free rate is 8%. The return on the market is 18%. The Gordon Growth Model is used to…arrow_forwardA dog training business began on December 1. The following transactions occurred during its first month. Use the drop-downs to select the accounts properly included on the income statement for the post-closing balancesarrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT