Intermediate Accounting

9th Edition

ISBN: 9781259722660

Author: J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 19, Problem 19.21E

EPS; convertible

• LO19–7, LO19–9

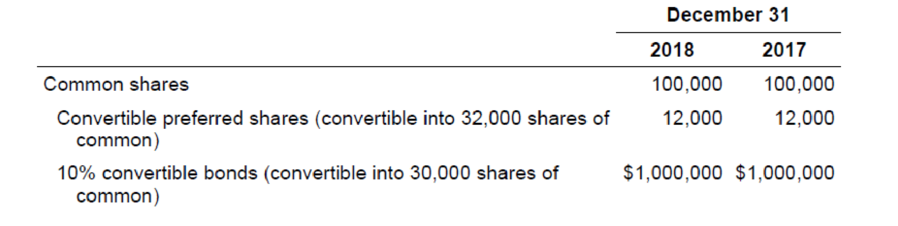

Compute Stanley’s basic and diluted earnings per share for the year ended December 31, 2018. Information from the financial statements of Ames Fabricators, Inc., included the following:

Ames’s net income for the year ended December 31, 2018, is $500,000. The income tax rate is 40%. Ames paid dividends of $5 per share on its preferred stock during 2018.

Required:

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Compute the materials variances on these financial accounting question

Solve this general accounting question

Financial Accounting

Chapter 19 Solutions

Intermediate Accounting

Ch. 19 - Prob. 19.1QCh. 19 - Prob. 19.2QCh. 19 - The Tax Code differentiates between qualified...Ch. 19 - Stock option (and other share-based) plans often...Ch. 19 - What is a simple capital structure? How is EPS...Ch. 19 - Prob. 19.6QCh. 19 - Blake Distributors had 100,000 common shares...Ch. 19 - Why are preferred dividends deducted from net...Ch. 19 - Prob. 19.9QCh. 19 - The treasury stock method is used to incorporate...

Ch. 19 - The potentially dilutive effect of convertible...Ch. 19 - How is the potentially dilutive effect of...Ch. 19 - Prob. 19.13QCh. 19 - If stock options and restricted stock are...Ch. 19 - Wiseman Electronics has an agreement with certain...Ch. 19 - Prob. 19.16QCh. 19 - When the income statement includes discontinued...Ch. 19 - Prob. 19.18QCh. 19 - Prob. 19.19QCh. 19 - (Based on Appendix B) LTV Corporation grants SARs...Ch. 19 - Prob. 19.1BECh. 19 - Prob. 19.2BECh. 19 - Stock options LO192 Under its executive stock...Ch. 19 - Prob. 19.4BECh. 19 - Prob. 19.5BECh. 19 - Prob. 19.6BECh. 19 - Prob. 19.7BECh. 19 - Prob. 19.8BECh. 19 - Prob. 19.9BECh. 19 - Performance-based options LO192 Refer to the...Ch. 19 - Prob. 19.11BECh. 19 - Prob. 19.12BECh. 19 - EPS; nonconvertible preferred shares LO197 At...Ch. 19 - Prob. 19.14BECh. 19 - Prob. 19.15BECh. 19 - Prob. 19.16BECh. 19 - Prob. 19.1ECh. 19 - Prob. 19.2ECh. 19 - Prob. 19.3ECh. 19 - Prob. 19.4ECh. 19 - Prob. 19.5ECh. 19 - Prob. 19.6ECh. 19 - Prob. 19.7ECh. 19 - Prob. 19.8ECh. 19 - Prob. 19.9ECh. 19 - Prob. 19.10ECh. 19 - Prob. 19.11ECh. 19 - EPS; shares issued; stock dividend LO195, LO196...Ch. 19 - Prob. 19.13ECh. 19 - EPS; stock dividend; nonconvertible preferred...Ch. 19 - EPS; net loss; nonconvertible preferred stock;...Ch. 19 - EPS; stock dividend; nonconvertible preferred...Ch. 19 - Prob. 19.17ECh. 19 - EPS; stock dividend; nonconvertible preferred...Ch. 19 - EPS; stock dividend; nonconvertible preferred...Ch. 19 - EPS; shares issued; stock options LO196 through...Ch. 19 - EPS; convertible preferred stock; convertible...Ch. 19 - Prob. 19.22ECh. 19 - Prob. 19.23ECh. 19 - Prob. 19.24ECh. 19 - Prob. 19.25ECh. 19 - EPS; concepts; terminology LO195 through LO1913...Ch. 19 - FASB codification research LO192 The FASB...Ch. 19 - Prob. 19.28ECh. 19 - Prob. 19.29ECh. 19 - Prob. 19.30ECh. 19 - Restricted stock units; cash settlement Appendix...Ch. 19 - Stock options; forfeiture; exercise LO192 On...Ch. 19 - Stock options; graded vesting LO192 January 1,...Ch. 19 - Stock options; graded vesting; measurement using a...Ch. 19 - Stock options; graded vesting; IFRS LO192, LO1914...Ch. 19 - Prob. 19.5PCh. 19 - Prob. 19.6PCh. 19 - Prob. 19.7PCh. 19 - Prob. 19.8PCh. 19 - EPS from statement of retained earnings LO194...Ch. 19 - EPS from statement of shareholders equity LO194...Ch. 19 - EPS; non convertible preferred stock; treasury...Ch. 19 - EPS; non convertible preferred stock; treasury...Ch. 19 - EPS; non convertible preferred stock; treasury...Ch. 19 - EPS; convertible preferred stock; convertible...Ch. 19 - EPS; antidilution LO194 through LO1910, LO1913...Ch. 19 - EPS; convertible bonds; treasury shares LO194...Ch. 19 - Prob. 19.17PCh. 19 - Prob. 19.18PCh. 19 - EPS; options; restricted stock; additional...Ch. 19 - Prob. 19.1BYPCh. 19 - Communication Case 192 Stock options; basic...Ch. 19 - Prob. 19.3BYPCh. 19 - Real World Case 195 Share-based plans; Walmart ...Ch. 19 - Prob. 19.6BYPCh. 19 - Prob. 19.7BYPCh. 19 - Analysis Case 198 EPS concepts LO194 through...Ch. 19 - Prob. 19.9BYPCh. 19 - Prob. 19.10BYPCh. 19 - Communication Case 1911 Dilution LO199 I thought...Ch. 19 - Real World Case 1912 Reporting EPS; discontinued...Ch. 19 - Analysis Case 1913 Analyzing financial statements;...Ch. 19 - Analysis Case 1915 Kelloggs EPS; PE ratio;...Ch. 19 - Prob. 19.16BYPCh. 19 - Prob. 1CCTCCh. 19 - Air FranceKLM Case IFRS LO199 Air FranceKLM (AF),...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cullumber Company uses a job-order cost system in each of its three manufacturing departments. Manufacturing overhead is applied to jobs on the basis of direct labour cost in Department D, direct labour hours in Department E, and machine hours in Department K. In establishing the predetermined overhead rates for 2022, the following estimates were made for the year. Department D E K Manufacturing overhead $1,280,000 $1,500,000 $840,000 Direct labour costs $1,600,000 $1,312,500 $472,500 Direct labour hours 105,000 125,000 42,000 Machine hours 420,000 525,000 120,000 The following information pertains to January 2022 for each manufacturing department. Department D E K Direct materials used Direct labour costs $147,000 $132,300 $81,900 $126,000 $115,500 $39,375 Manufacturing overhead incurred $103,950 $128,600 $73,950 Direct labour hours 8,400 11,550 3,675 Machine hours 35,700 47,250 10,380 Your answer is partially correct. Calculate the predetermined overhead rate for each department.…arrow_forwardGeneral Accounting Questionarrow_forwardWhat is the cost of the unsold merchandise on these financial accounting question?arrow_forward

- What are the proceeds to Brighton on these financial accounting question?arrow_forwardBigco Corporation is one of the nation's leading distributors of food and related products to restaurants, universities, hotels, and other customers. A simplified version of its recent income statement contained the following items (in millions). Cost of sales es Interest expense Income taxes Net earnings Sales Earnings before income taxes Selling, general, and administration expense Other revenues Total expenses (excluding income taxes) Total revenues $ 11,601 249 39 1,378 16,330 1,627 3,493 430 15,133 16,760 Prepare an income statement for the year ended June 30, current year. (Hint: First order the items as they would appear on the income statement and then confirm the values of the subtotals and totals.) Note: Enter your answers in millions rather than in dollars (for example, 5,000 million should be entered as 5,000 rather than 5,000,000). Revenues: Total revenues Expenses: BIGCO CORPORATION Income Statement (in millions) $ 0arrow_forwardNeed help with this general accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial instruments products; Author: fi-compass;https://www.youtube.com/watch?v=gvxozM3TUIg;License: Standard Youtube License