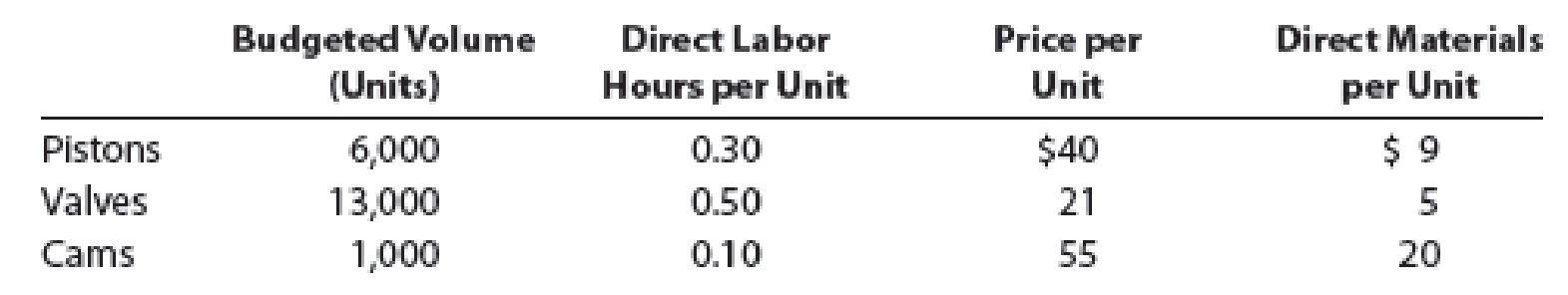

Isaac Engines Inc. produces three products—pistons, valves, and cams—for the heavy equipment industry. Isaac Engines has a very simple production process and product line and uses a single plantwide factory

The estimated direct labor rate is $20 per direct labor hour. Beginning and ending inventories are negligible and are, thus, assumed to be zero. The budgeted factory overhead for Isaac Engines is $235,200.

a. Determine the plantwide factory overhead rate.

b. Determine the factory overhead and direct labor cost per unit for each product.

c. Use the information provided to construct a budgeted gross profit report by product line for the year ended December 31, 20Y2. Include the gross profit as a percent of sales in the last line of your report, rounded to one decimal place.

d. What does the report in (c) indicate to you?

a.

Compute the plant-wide overhead rate using direct labor hours (DLH) as the allocation base.

Explanation of Solution

Single plant-wide factory overhead rate: The rate at which the factory or manufacturing overheads are allocated to products is referred to as single plant-wide factory overhead rate.

Formula to compute single plant-wide overhead rate:

Compute single plant-wide overhead rate using DLH as the allocation base.

Working note (1):

Compute the total number of direct labor hours (DLH) budgeted.

| Types of Products | Number of Budgeted Units | × | Number of DLH Per Unit | = | Total Number of Budgeted DLH |

| Pistons | 6,000 units | × | 0.30 DLH | = | 1,800 DLH |

| Valves | 13,000 units | × | 0.50 DLH | = | 6,500 DLH |

| Cams | 1,000 units | × | 0.10 DLH | = | 100 DLH |

| Total number of budgeted DLH | 8,400 DLH | ||||

Table (1)

b.

Calculate the factory overhead allocated per unit of each product, and direct labor cost per unit.

Explanation of Solution

Compute the factory overhead allocated per unit for each product.

| Types of Products | Single Plant-Wide Overhead Rate | × | Number of DLH Per Unit of Each Product | = | Factory Overhead Per Unit |

| Pistons | $28 per DLH | × | 0.30 DLH | = | $8.40 per unit |

| Valves | $28 per DLH | × | 0.50 DLH | = | $14.00 per unit |

| Cams | $28 per DLH | × | 0.10 DLH | = | $2.80 per unit |

Table (2)

Compute direct labor cost per unit for each product.

| Types of Products | Estimated Direct Labor Rate | × | Number of DLH Per Unit of Each Product | = | Direct Labor Cost Per Unit |

| Pistons | $20 per DLH | × | 0.30 DLH | = | $6 per unit |

| Valves | $20 per DLH | × | 0.50 DLH | = | $10 per unit |

| Cams | $20 per DLH | × | 0.10 DLH | = | $2 per unit |

Table (3)

c.

Prepare a budgeted gross profit report of Company I for the year ended December 31, 20Y2.

Explanation of Solution

Prepare a budgeted gross profit report of Company I, by product line, for the year ended December 31, 20Y2.

| Company I | |||

| Budgeted Gross Profit Report | |||

| December 31, 20Y2 | |||

| Pistons | Valves | Cams | |

| Revenues (2) | $240,000 | $273,000 | $55,000 |

| Direct materials cost (3) | (54,000) | (65,000) | (20,000) |

| Direct labor cost (4) | (36,000) | (130,000) | (2,000) |

| Factory overhead (5) | (50,400) | (182,000) | (2,800) |

| Gross profit | $99,600 | $(104,000) | $30,200 |

| Gross profit as a percent of sales (6) | 41.5% | (38.1)% | 54.9% |

Table (4)

Working note (2):

Compute the sales revenues for each product.

| Types of Products | Number of Budgeted Units | × | Price Per Unit | = | Sales Revenue |

| Pistons | 6,000 units | × | $40 | = | $240,000 |

| Valves | 13,000 units | × | 21 | = | 273,000 |

| Cams | 1,000 units | × | 55 | = | 55,000 |

Table (5)

Working note (3):

Compute the direct material cost for each product.

| Types of Products | Number of Budgeted Units | × | Cost Per Unit | = | Direct material Cost |

| Pistons | 6,000 units | × | $9.00 | = | $54,000 |

| Valves | 13,000 units | × | 5.00 | = | 65,000 |

| Cams | 1,000 units | × | 20.00 | = | 20,000 |

Table (6)

Working note (4):

Compute the direct labor cost for each product.

| Types of Products | Number of Budgeted Units | × | Cost Per Unit | = | Direct labor Cost |

| Pistons | 6,000 units | × | $6.00 | = | $36,000 |

| Valves | 13,000 units | × | 10.00 | = | 130,000 |

| Cams | 1,000 units | × | 2.00 | = | 2,000 |

Table (7)

Working note (5):

Compute the total factory overhead allocated for each product.

| Types of Products | Number of Budgeted Units | × | Factory Overhead Per Unit | = | Total Factory Overhead |

| Pistons | 6,000 units | × | $8.40 per unit | = | $50,400 |

| Valves | 13,000 units | × | 14.00 per unit | = | 182,000 |

| Cams | 1,000 units | × | 2.80 per unit | = | 2,800 |

Table (8)

Note: Refer to table (2) for value and computation of factory overhead per unit.

Working note (6):

Compute the gross profit as a percent of sales for each product.

| Types of Products |

Gross Profit (A) |

Sales Revenues (B) |

Gross Profit Percentage |

| Pistons | $99,600 | $240,000 | 41.5% |

| Valves | (104,000) | 273,000 | (38.1)% |

| Cams | 30,200 | 55,000 | 54.9% |

Table (9)

Note: Refer to Table (4) for value and computation of sales revenues.

d.

Discuss the interpretations from the gross profit report.

Explanation of Solution

Of the three products, cams are highly profitable, and pistons are also profitable as well. But valves are at loss. The sales price per unit should be increased or the cost price should be cut down to increase the profitability of valves.

Want to see more full solutions like this?

Chapter 18 Solutions

Financial And Managerial Accounting

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College