Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 18, Problem 17E

Evaluating selling and administrative cost allocations

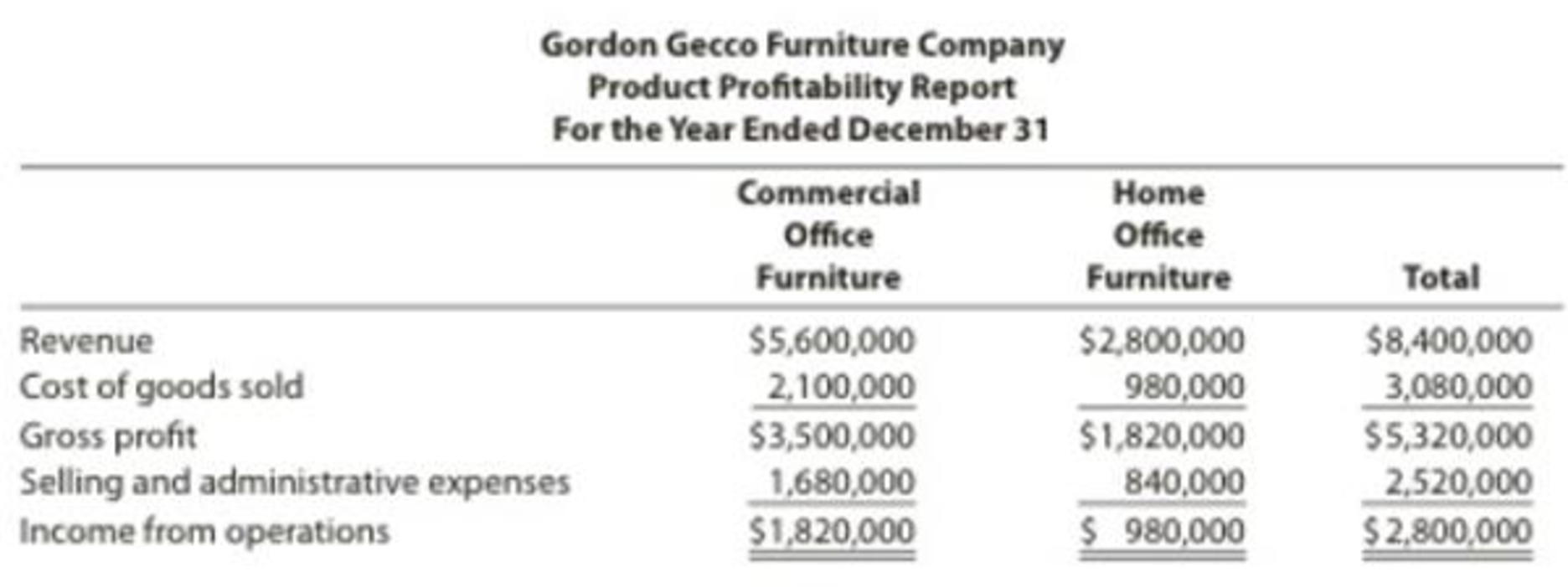

Gordon Gecco Furniture Company has two major product lines with the following characteristics:

Commercial office furniture: Few large orders, little advertising support, shipments in full truckloads, and low handling complexity

Home office furniture: Many small orders, large advertising support, shipments in partial truckloads, and high handling complexity

The company produced the following profitability report for management:

The selling and administrative expenses are allocated to the products on the basis of relative sales dollars.

Evaluate the accuracy of this report and recommend an alternative approach.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Write down as many descriptions describing rock and roll that you can.

From these descriptions can you come up with s denition of rock and roll?

What performers do you recognize?

What performers don’t you recognize?

What can you say about musical inuence on these current rock musicians?

Try to break these inuences into genres and relate them to the rock musicians. What does

Mick Jagger say about country artists?

What does pioneering mean?

What kind of ensembles w

Recently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: What impact would the write-down of inventory have had on Abercrombie's expenses, Gross margin, and Net income?

Recently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: What impact would the write-down of inventory have had on Abercrombie's assets, Liabilities, and Equity?

Chapter 18 Solutions

Financial And Managerial Accounting

Ch. 18 - Why would management be concerned about the...Ch. 18 - Why would a manufacturing company with multiple...Ch. 18 - How do the multiple production department and the...Ch. 18 - Under what two conditions would the multiple...Ch. 18 - How does activity-based costing differ from the...Ch. 18 - Shipping, selling, marketing, sales order...Ch. 18 - Prob. 7DQCh. 18 - Under what circumstances might the activity-based...Ch. 18 - When might activity-based costing be preferred...Ch. 18 - Prob. 10DQ

Ch. 18 - Single plantwide factory overhead rate The total...Ch. 18 - Multiple production department factory overhead...Ch. 18 - Activity-based costing: factory overhead costs The...Ch. 18 - Activity-based costing: selling and administrative...Ch. 18 - Activity-based costing for a service business...Ch. 18 - Kennedy Appliance Inc.s Machining Department...Ch. 18 - Bach Instruments Inc. makes three musical...Ch. 18 - Scrumptious Snacks Inc. manufactures three types...Ch. 18 - Isaac Engines Inc. produces three productspistons,...Ch. 18 - Handy Leather, Inc., produces three sizes of...Ch. 18 - Eclipse Motor Company manufactures two types of...Ch. 18 - The management of Nova Industries Inc....Ch. 18 - Comfort Foods Inc. uses activity-based costing to...Ch. 18 - Nozama.com Inc. sells consumer electronics over...Ch. 18 - Hercules Inc. manufactures elliptical exercise...Ch. 18 - Lonsdale Inc. manufactures entry and dining room...Ch. 18 - Activity cost pools, activity rates, and product...Ch. 18 - Handbrain Inc. is considering a change to...Ch. 18 - Prob. 14ECh. 18 - Activity-based costing and product cost distortion...Ch. 18 - Single plantwide rate and activity-based costing...Ch. 18 - Evaluating selling and administrative cost...Ch. 18 - Construct and interpret a product profitability...Ch. 18 - Metroid Electric manufactures power distribution...Ch. 18 - Activity-based costing for a service company...Ch. 18 - Bounce Back Insurance Company carries three major...Ch. 18 - Gwinnett County Chrome Company manufactures three...Ch. 18 - The management of Gwinnett County Chrome Company,...Ch. 18 - Activity-based and department rate product costing...Ch. 18 - Activity-based product costing Mello Manufacturing...Ch. 18 - Allocating selling and administrative expenses...Ch. 18 - Product costing and decision analysis for a...Ch. 18 - Single plantwide factory overhead rate Spotted Cow...Ch. 18 - Multiple production department factory overhead...Ch. 18 - Activity-based department rate product costing and...Ch. 18 - Activity-based product costing Sweet Sugar Company...Ch. 18 - Allocating selling and administrative expenses...Ch. 18 - Product costing and decision analysis for a...Ch. 18 - Life Force Fitness, Inc., assembles and sells...Ch. 18 - Activity-based product cost improvement Gourmet...Ch. 18 - Labor classification trade-off Skidmore...Ch. 18 - Production run size and activity improvement...Ch. 18 - Hospital activity-based costing analysis Lancaster...Ch. 18 - Ethics in Action The controller of Tri Con Global...Ch. 18 - Communication The controller of New Wave Sounds...Ch. 18 - Pelder Products Company manufactures two types of...Ch. 18 - The Chocolate Baker specializes in chocolate baked...Ch. 18 - Young Company is beginning operations and is...Ch. 18 - Cynthia Rogers, the cost accountant for Sanford...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Profitability index; Author: The Finance Storyteller;https://www.youtube.com/watch?v=Md5ocNqKHq8;License: Standard Youtube License