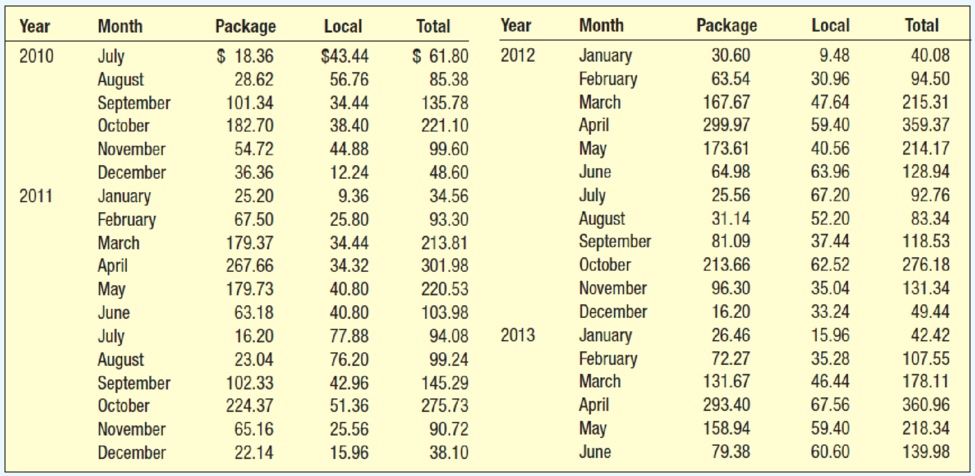

Blueberry Farms Golf and Fish Club of Hilton Head, South Carolina, wants to find monthly seasonal indexes for package play, nonpackage play, and total play. The package play refers to golfers who visit the area as part of a golf package. Typically, the greens fees, cart fees, lodging, maid service, and meals are included as part of a golfing package. The course earns a certain percentage of this total. The nonpackage play includes play by local residents and visitors to the area who wish to play golf. The following data, beginning with July 2010 and ending with June 2013, report the package and nonpackage play by month, as well as the total amount, in thousands of dollars.

Using statistical software:

Using statistical software:

- a. Develop a seasonal index for each month for the package sales. What do you note about the various months?

- b. Develop a seasonal index for each month for the nonpackage sales. What do you note about the various months?

- c. Develop a seasonal index for each month for the total sales. What do you note about the various months?

- d. Compare the indexes for package sales, nonpackage sales, and total sales. Are the busiest months the same?

a.

Provide a seasonal index for each month for the package sales.

Write a note about the seasonal index for package sales of various months.

Answer to Problem 31CE

The seasonal indexes for each month for the package sales are given below:

| Period | Month | Seasonal Index |

| 1 | July | 0.19792 |

| 2 | August | 0.25663 |

| 3 | September | 0.8784 |

| 4 | October | 2.10481 |

| 5 | November | 0.77747 |

| 6 | December | 0.18388 |

| 7 | January | 0.26874 |

| 8 | February | 0.63189 |

| 9 | March | 1.67943 |

| 10 | April | 2.73547 |

| 11 | May | 1.67903 |

| 12 | June | 0.60633 |

The two months, October and April signify more than twice the average.

Explanation of Solution

Twelve months moving average:

Centered moving average:

Specific seasonal index:

Some preliminary calculations are given below:

| Year | Quarter | Package |

Four-quarter moving average |

Centered Moving average | Specific seasonal |

| 2010 | July | 18.36 | |||

| August | 28.62 | ||||

| September | 101.34 | ||||

| October | 182.7 | ||||

| November | 54.72 | ||||

| December | 36.36 | ||||

| 2011 | January | 25.2 | 100.305 | 0.25123 | |

| February | 67.5 | 100.395 | 99.9825 | 0.67512 | |

| March | 179.37 | 100.215 | 99.79125 | 1.79745 | |

| April | 267.66 | 99.75 | 101.5688 | 2.63526 | |

| May | 179.73 | 99.8325 | 103.74 | 1.73250 | |

| June | 63.18 | 103.305 | 103.5825 | 0.60995 | |

| July | 16.2 | 104.175 | 103.215 | 0.15695 | |

| August | 23.04 | 102.99 | 103.275 | 0.22309 | |

| September | 102.33 | 103.44 | 102.6225 | 0.99715 | |

| October | 224.37 | 103.11 | 103.4813 | 2.16822 | |

| November | 65.16 | 102.135 | 104.5725 | 0.62311 | |

| December | 22.14 | 104.8275 | 104.3925 | 0.21209 | |

| 2012 | January | 30.6 | 104.3175 | 104.8575 | 0.29183 |

| February | 63.54 | 104.4675 | 105.585 | 0.60179 | |

| March | 167.67 | 105.2475 | 105.0375 | 1.59629 | |

| April | 299.97 | 105.9225 | 103.7063 | 2.89249 | |

| May | 173.61 | 104.1525 | 104.5575 | 1.66042 | |

| June | 64.98 | 103.26 | 105.6075 | 0.61529 | |

| July | 25.56 | 105.855 | 105.1875 | 0.24299 | |

| August | 31.14 | 105.36 | 105.3788 | 0.29551 | |

| September | 81.09 | 105.015 | 104.2425 | 0.77789 | |

| October | 213.66 | 105.7425 | 102.4688 | 2.08512 | |

| November | 96.3 | 102.7425 | 101.5838 | 0.94799 | |

| December | 16.2 | 102.195 | 101.5725 | 0.15949 | |

| 2013 | January | 26.46 | 100.9725 | ||

| February | 72.27 | 102.1725 | |||

| March | 131.67 | 109.1373 | |||

| April | 293.4 | 116.937 | |||

| May | 158.94 | 120.92 | |||

| June | 79.38 | 109.3275 |

The monthly indexes are as follows:

| 2010 | 2011 | 2012 | 2013 | Means | |

| Jan | - | 0.25123 | 0.29183 | - | 0.27153 |

| Feb | - | 0.67512 | 0.60179 | - | 0.63845 |

| Mar | - | 1.79745 | 1.59629 | - | 1.69687 |

| April | - | 2.63526 | 2.89249 | - | 2.76388 |

| May | - | 1.7325 | 1.66042 | - | 1.69647 |

| June | - | 0.60995 | 0.61529 | - | 0.61262 |

| July | - | 0.15695 | 0.24299 | - | 0.19997 |

| August | - | 0.22309 | 0.29551 | - | 0.25929 |

| Sep | - | 0.99715 | 0.7778 | - | 0.88752 |

| Oct | - | 2.16822 | 2.0851 | - | 2.12667 |

| Nov | - | 0.6231 | 0.9479 | - | 0.78555 |

| Dec | - | 0.21208 | 0.1594 | - | 0.18579 |

| Total | 12.1246233 |

Seasonal index:

Here,

Therefore, the following is obtained:

The seasonal indexes are as follows:

| 2010 | 2011 | 2012 | 2013 | Means | Seasonal Index | |

| Jan | - | 0.25123 | 0.29183 | - | 0.27153 | 0.268738257 |

| Feb | - | 0.67512 | 0.60179 | - | 0.63845 | 0.631891717 |

| Mar | - | 1.79745 | 1.59629 | - | 1.69687 | 1.679428286 |

| April | - | 2.63526 | 2.89249 | - | 2.76388 | 2.735469498 |

| May | - | 1.7325 | 1.66042 | - | 1.69647 | 1.679028041 |

| June | - | 0.60995 | 0.61529 | - | 0.61262 | 0.606326037 |

| July | - | 0.15695 | 0.24299 | - | 0.19997 | 0.19791885 |

| August | - | 0.22309 | 0.29551 | - | 0.25929 | 0.256634371 |

| Sep | - | 0.99715 | 0.7778 | - | 0.88752 | 0.87840128 |

| Oct | - | 2.16822 | 2.0851 | - | 2.12667 | 2.104812143 |

| Nov | - | 0.6231 | 0.9479 | - | 0.78555 | 0.777473047 |

| Dec | - | 0.21208 | 0.1594 | - | 0.18579 | 0.183878466 |

The seasonal index for October is 2.10481 and the seasonal index for April is 2.73547. That is, the months October and April represent more than twice the average when compared to other months.

b.

Create a seasonal index for each month for the non-package sales.

Write a note on seasonal index for the non-package sales for various months.

Answer to Problem 31CE

The seasonal index for each month for the non-package sales are as follows:

| Period | Month | Seasonal Index |

| 1 | July | 1.73270 |

| 2 | August | 1.53389 |

| 3 | September | 0.94145 |

| 4 | October | 1.29183 |

| 5 | November | 0.66928 |

| 6 | December | 0.52991 |

| 7 | January | 0.23673 |

| 8 | February | 0.69732 |

| 9 | March | 1.00695 |

| 10 | April | 1.13226 |

| 11 | May | 0.98282 |

| 12 | June | 1.24486 |

The two months, December and January have the low index values.

Explanation of Solution

The specific seasonal indices are as follows:

| Year | Quarter | Local ($) |

Four-quarter moving average |

Centered Moving average | Specific seasonal |

| 2010 | July | 43.44 | |||

| August | 56.76 | ||||

| September | 34.44 | ||||

| October | 38.4 | ||||

| November | 44.88 | ||||

| December | 12.24 | ||||

| 2011 | January | 9.36 | 36.075 | 0.259459 | |

| February | 25.8 | 34.64 | 38.32 | 0.673278 | |

| March | 34.44 | 37.51 | 39.485 | 0.87223 | |

| April | 34.32 | 39.13 | 40.38 | 0.849926 | |

| May | 40.8 | 39.84 | 40.115 | 1.017076 | |

| June | 40.8 | 40.92 | 39.465 | 1.033827 | |

| July | 77.88 | 39.31 | 39.625 | 1.965426 | |

| August | 76.2 | 39.62 | 39.845 | 1.912411 | |

| September | 42.96 | 39.63 | 40.61 | 1.057868 | |

| October | 51.36 | 40.06 | 42.205 | 1.216917 | |

| November | 25.56 | 41.16 | 43.24 | 0.591119 | |

| December | 15.96 | 43.25 | 44.195 | 0.361127 | |

| 2012 | January | 9.48 | 43.23 | 44.715 | 0.212009 |

| February | 30.96 | 45.16 | 43.27 | 0.715507 | |

| March | 47.64 | 44.27 | 42.04 | 1.133206 | |

| April | 59.4 | 42.27 | 42.275 | 1.405086 | |

| May | 40.56 | 41.81 | 43.135 | 0.940304 | |

| June | 63.96 | 42.74 | 44.25 | 1.445424 | |

| July | 67.2 | 43.53 | 45.24 | 1.485411 | |

| August | 52.2 | 44.97 | 45.69 | 1.142482 | |

| September | 37.44 | 45.51 | 45.82 | 0.81711 | |

| October | 62.52 | 45.87 | 46.11 | 1.355888 | |

| November | 35.04 | 45.77 | 47.235 | 0.741823 | |

| December | 33.24 | 46.45 | 47.88 | 0.694236 | |

| 2013 | January | 15.96 | 48.02 | ||

| February | 35.28 | 47.74 | |||

| March | 46.44 | 45.97091 | |||

| April | 67.56 | 45.348 | |||

| May | 59.4 | 46.22667 | |||

| June | 60.6 | 44.19 |

The monthly indexes are as follows:

| 2010 | 2011 | 2012 | 2013 | Means | |

| Jan | - | 0.25123 | 0.29183 | - | 0.235734 |

| Feb | - | 0.67512 | 0.60179 | - | 0.694392 |

| Mar | - | 1.79745 | 1.59629 | - | 1.002718 |

| April | - | 2.63526 | 2.89249 | - | 1.127506 |

| May | - | 1.7325 | 1.66042 | - | 0.97869 |

| June | - | 0.60995 | 0.61529 | - | 1.239626 |

| July | - | 0.15695 | 0.24299 | - | 1.725419 |

| August | - | 0.22309 | 0.29551 | - | 1.527446 |

| Sep | - | 0.99715 | 0.7778 | - | 0.937489 |

| Oct | - | 2.16822 | 2.0851 | - | 1.286403 |

| Nov | - | 0.6231 | 0.9479 | - | 0.666471 |

| Dec | - | 0.21208 | 0.1594 | - | 0.527681 |

| Total | 11.94958 |

The

Therefore, the following is obtained:

The seasonal indexes are as follows:

| 2010 | 2011 | 2012 | 2013 | Means | Seasonal Index | |

| Jan | - | 0.25123 | 0.29183 | - | 0.235734 | 0.23673 |

| Feb | - | 0.67512 | 0.60179 | - | 0.694392 | 0.69732 |

| Mar | - | 1.79745 | 1.59629 | - | 1.002718 | 1.00695 |

| April | - | 2.63526 | 2.89249 | - | 1.127506 | 1.13226 |

| May | - | 1.7325 | 1.66042 | - | 0.97869 | 0.98282 |

| June | - | 0.60995 | 0.61529 | - | 1.239626 | 1.24486 |

| July | - | 0.15695 | 0.24299 | - | 1.725419 | 1.73270 |

| August | - | 0.22309 | 0.29551 | - | 1.527446 | 1.53389 |

| Sep | - | 0.99715 | 0.7778 | - | 0.937489 | 0.94145 |

| Oct | - | 2.16822 | 2.0851 | - | 1.286403 | 1.29183 |

| Nov | - | 0.6231 | 0.9479 | - | 0.666471 | 0.66928 |

| Dec | - | 0.21208 | 0.1594 | - | 0.527681 | 0.52991 |

The seasonal index for December is 0.52991 and the seasonal index for January is 0.23673. That is, the months December and January represent the less index values when compared to other months.

c.

Create a seasonal index for each month for the total sales.

Write a note on various months.

Answer to Problem 31CE

The seasonal indexes for each month for the total sales are as follows:

| Period | Month | Seasonal Index |

| 1 | July | 0.63371 |

| 2 | August | 0.61870 |

| 3 | September | 0.89655 |

| 4 | October | 1.86415 |

| 5 | November | 0.74353 |

| 6 | December | 0.29180 |

| 7 | January | 0.25908 |

| 8 | February | 0.65069 |

| 9 | March | 1.49028 |

| 10 | April | 2.28041 |

| 11 | May | 1.48235 |

| 12 | June | 0.78876 |

The two months December and January have the low index values.

The two months April and October have the high index values.

Explanation of Solution

The specific seasonal indices are as follows:

| Year | Quarter | Local ($) |

Four-quarter moving average |

Centered Moving average | Specific seasonal |

| 2010 | July | 61.8 | |||

| August | 85.38 | ||||

| September | 135.78 | ||||

| October | 221.1 | ||||

| November | 99.6 | ||||

| December | 48.6 | ||||

| 2011 | January | 34.56 | 136.38 | 0.270833 | |

| February | 93.3 | 135.035 | 138.3025 | 0.276527 | |

| March | 213.81 | 137.725 | 139.2763 | 0.161078 | |

| April | 301.98 | 138.88 | 141.9488 | 0.11365 | |

| May | 220.53 | 139.6725 | 143.855 | 0.185009 | |

| June | 103.98 | 144.225 | 143.0475 | 0.392383 | |

| July | 94.08 | 143.485 | 142.84 | 0.827806 | |

| August | 99.24 | 142.61 | 143.12 | 0.767836 | |

| September | 145.29 | 143.07 | 143.2325 | 0.295684 | |

| October | 275.73 | 143.17 | 145.6863 | 0.186269 | |

| November | 90.72 | 143.295 | 147.8125 | 0.281746 | |

| December | 38.1 | 148.0775 | 148.5875 | 0.418898 | |

| 2012 | January | 40.08 | 147.5475 | 149.5725 | 0.236527 |

| February | 94.5 | 149.6275 | 148.855 | 0.327619 | |

| March | 215.31 | 149.5175 | 147.0775 | 0.221262 | |

| April | 359.37 | 148.1925 | 145.9813 | 0.165289 | |

| May | 214.17 | 145.9625 | 147.6925 | 0.189382 | |

| June | 128.94 | 146 | 149.8575 | 0.496045 | |

| July | 92.76 | 149.385 | 150.4275 | 0.72445 | |

| August | 83.34 | 150.33 | 151.0688 | 0.62635 | |

| September | 118.53 | 150.525 | 150.0625 | 0.315869 | |

| October | 276.18 | 151.6125 | 148.5788 | 0.226374 | |

| November | 131.34 | 148.5125 | 148.8188 | 0.266788 | |

| December | 49.44 | 148.645 | 149.4525 | 0.67233 | |

| 2013 | January | 42.42 | 148.9925 | ||

| February | 107.55 | 149.9125 | |||

| March | 178.11 | 155.1082 | |||

| April | 360.96 | 162.285 | |||

| May | 218.34 | 167.1467 | |||

| June | 139.98 | 153.5175 |

The monthly indexes are given below:

| 2010 | 2011 | 2012 | 2013 | Means | |

| Jan | - | 0.25341 | 0.267964 | - | 0.260687 |

| Feb | - | 0.674608 | 0.634846 | - | 0.654727 |

| Mar | - | 1.53515 | 1.463922 | - | 1.499536 |

| April | - | 2.127388 | 2.461755 | - | 2.294571 |

| May | - | 1.533002 | 1.450107 | - | 1.491555 |

| June | - | 0.726891 | 0.860417 | - | 0.793654 |

| July | - | 0.658639 | 0.616643 | - | 0.637641 |

| August | - | 0.693404 | 0.551669 | - | 0.622537 |

| Sep | - | 1.014365 | 0.789871 | - | 0.902118 |

| Oct | - | 1.892629 | 1.858812 | - | 1.875721 |

| Nov | - | 0.613751 | 0.88255 | - | 0.74815 |

| Dec | - | 0.256415 | 0.330807 | - | 0.293611 |

| Total | 0.993829 |

The

Therefore, the following is obtained:

The seasonal indexes are given below:

| 2010 | 2011 | 2012 | 2013 | Means | Seasonal Index | |

| Jan | - | 0.25341 | 0.267964 | 0.260687 | 0.25908 | |

| Feb | - | 0.674608 | 0.634846 | 0.654727 | 0.65069 | |

| Mar | - | 1.53515 | 1.463922 | 1.499536 | 1.49028 | |

| April | - | 2.127388 | 2.461755 | 2.294571 | 2.28041 | |

| May | - | 1.533002 | 1.450107 | 1.491555 | 1.48235 | |

| June | - | 0.726891 | 0.860417 | 0.793654 | 0.78876 | |

| July | - | 0.658639 | 0.616643 | 0.637641 | 0.63371 | |

| August | - | 0.693404 | 0.551669 | 0.622537 | 0.61870 | |

| Sep | - | 1.014365 | 0.789871 | 0.902118 | 0.89655 | |

| Oct | - | 1.892629 | 1.858812 | 1.875721 | 1.86415 | |

| Nov | - | 0.613751 | 0.88255 | 0.74815 | 0.74353 | |

| Dec | - | 0.256415 | 0.330807 | 0.293611 | 0.29180 |

The seasonal index for January is 0.25908 and the seasonal index for December is 0.29180. That is, the months December and January represent the less index values when compared to other months. The seasonal index for April is 2.28041 and the seasonal index for October is 1.86415. That is, the months April and October represent the more index values when compared to other months.

d.

Compare the indexes for package sales, non-package sales, and total sales.

Explain whether the busiest months are all the same.

Explanation of Solution

The seasonal index for April in package play is large when compared to remaining months. Hence, the package play is the highest in April.

The seasonal index for July in non-package is large when compared to the remaining months. Hence, the non-package play is the highest play in July. From the given information, 70% of the total sales come from package play. Hence, the total play is very similar to package play.

Want to see more full solutions like this?

Chapter 18 Solutions

Statistical Techniques in Business and Economics

- A special interest group reports a tiny margin of error (plus or minus 0.04 percent) for its online survey based on 50,000 responses. Is the margin of error legitimate? (Assume that the group’s math is correct.)arrow_forwardSuppose that 73 percent of a sample of 1,000 U.S. college students drive a used car as opposed to a new car or no car at all. Find an 80 percent confidence interval for the percentage of all U.S. college students who drive a used car.What sample size would cut this margin of error in half?arrow_forwardYou want to compare the average number of tines on the antlers of male deer in two nearby metro parks. A sample of 30 deer from the first park shows an average of 5 tines with a population standard deviation of 3. A sample of 35 deer from the second park shows an average of 6 tines with a population standard deviation of 3.2. Find a 95 percent confidence interval for the difference in average number of tines for all male deer in the two metro parks (second park minus first park).Do the parks’ deer populations differ in average size of deer antlers?arrow_forward

- Suppose that you want to increase the confidence level of a particular confidence interval from 80 percent to 95 percent without changing the width of the confidence interval. Can you do it?arrow_forwardA random sample of 1,117 U.S. college students finds that 729 go home at least once each term. Find a 98 percent confidence interval for the proportion of all U.S. college students who go home at least once each term.arrow_forwardSuppose that you make two confidence intervals with the same data set — one with a 95 percent confidence level and the other with a 99.7 percent confidence level. Which interval is wider?Is a wide confidence interval a good thing?arrow_forward

- Is it true that a 95 percent confidence interval means you’re 95 percent confident that the sample statistic is in the interval?arrow_forwardTines can range from 2 to upwards of 50 or more on a male deer. You want to estimate the average number of tines on the antlers of male deer in a nearby metro park. A sample of 30 deer has an average of 5 tines, with a population standard deviation of 3. Find a 95 percent confidence interval for the average number of tines for all male deer in this metro park.Find a 98 percent confidence interval for the average number of tines for all male deer in this metro park.arrow_forwardBased on a sample of 100 participants, the average weight loss the first month under a new (competing) weight-loss plan is 11.4 pounds with a population standard deviation of 5.1 pounds. The average weight loss for the first month for 100 people on the old (standard) weight-loss plan is 12.8 pounds, with population standard deviation of 4.8 pounds. Find a 90 percent confidence interval for the difference in weight loss for the two plans( old minus new) Whats the margin of error for your calculated confidence interval?arrow_forward

- A 95 percent confidence interval for the average miles per gallon for all cars of a certain type is 32.1, plus or minus 1.8. The interval is based on a sample of 40 randomly selected cars. What units represent the margin of error?Suppose that you want to decrease the margin of error, but you want to keep 95 percent confidence. What should you do?arrow_forward3. (i) Below is the R code for performing a X2 test on a 2×3 matrix of categorical variables called TestMatrix: chisq.test(Test Matrix) (a) Assuming we have a significant result for this procedure, provide the R code (including any required packages) for an appropriate post hoc test. (b) If we were to apply this technique to a 2 × 2 case, how would we adapt the code in order to perform the correct test? (ii) What procedure can we use if we want to test for association when we have ordinal variables? What code do we use in R to do this? What package does this command belong to? (iii) The following code contains the initial steps for a scenario where we are looking to investigate the relationship between age and whether someone owns a car by using frequencies. There are two issues with the code - please state these. Row3<-c(75,15) Row4<-c(50,-10) MortgageMatrix<-matrix(c(Row1, Row4), byrow=T, nrow=2, MortgageMatrix dimnames=list(c("Yes", "No"), c("40 or older","<40")))…arrow_forwardDescribe the situation in which Fisher’s exact test would be used?(ii) When do we use Yates’ continuity correction (with respect to contingencytables)?[2 Marks] 2. Investigate, checking the relevant assumptions, whether there is an associationbetween age group and home ownership based on the sample dataset for atown below:Home Owner: Yes NoUnder 40 39 12140 and over 181 59Calculate and evaluate the effect size.arrow_forward

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill