Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

6th Edition

ISBN: 9780134486857

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 17, Problem 5SE

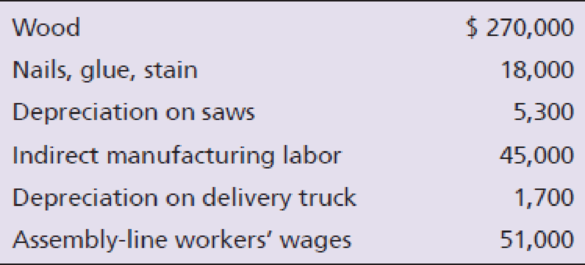

Oak Outdoor Furniture manufactures wood patio furniture. If the company reports the following costs for June 2018, what is the balance in the Manufacturing

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

general accounting

What is net income under absorption costing?

Hii expert please provide answer general accounting question

Chapter 17 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Ch. 17 - Would the following companies most likely use a...Ch. 17 - Would the following companies most likely use a...Ch. 17 - Would the following companies most likely use a...Ch. 17 - Would the following companies most likely use a...Ch. 17 - Would the following companies most likely use a...Ch. 17 - Prob. 6TICh. 17 - Record the following journal entries for Smith...Ch. 17 - Prob. 8TICh. 17 - Prob. 9TICh. 17 - Prob. 10TI

Ch. 17 - Prob. 11TICh. 17 - Prob. 12TICh. 17 - The following information pertains to Smith...Ch. 17 - Prob. 14TICh. 17 - Prob. 15TICh. 17 - Prob. 16TICh. 17 - Wesson Company is a consulting firm. The firm...Ch. 17 - Prob. 18TICh. 17 - Would an advertising agency use job order or...Ch. 17 - Prob. 2QCCh. 17 - When a manufacturing company uses indirect...Ch. 17 - When a manufacturing company uses direct labor, it...Ch. 17 - Gell Corporation manufactures computers. Assume...Ch. 17 - Gell Corporation manufactures computers. Assume...Ch. 17 - Gell Corporation manufactures computers. Assume...Ch. 17 - Gell Corporation manufactures computers. Assume...Ch. 17 - A manufacturing company completed work on a job....Ch. 17 - For which of the following reasons would David...Ch. 17 - Why do managers need to know the cost of their...Ch. 17 - What types of companies use job order costing...Ch. 17 - What types of companies use process costing...Ch. 17 - What is the purpose of a job cost record?Ch. 17 - Explain the difference between cost of goods...Ch. 17 - A job was started on May 15, completed on June 27,...Ch. 17 - Give the journal entry for raw materials purchased...Ch. 17 - What is the purpose of the raw materials...Ch. 17 - How does the use of direct and indirect materials...Ch. 17 - Prob. 10RQCh. 17 - Give five examples of manufacturing overhead...Ch. 17 - What is the predetermined overhead allocation...Ch. 17 - What is an allocation base? Give some examples.Ch. 17 - How is manufacturing overhead allocated to jobs?Ch. 17 - A completed job cost record shows the unit cost of...Ch. 17 - Prob. 16RQCh. 17 - Give the journal entry for the completion of a...Ch. 17 - Prob. 18RQCh. 17 - Explain the difference between underallocated...Ch. 17 - If a company incurred 5,250 in actual overhead...Ch. 17 - Prob. 21RQCh. 17 - Explain the terms accumulate, assign, allocate,...Ch. 17 - Prob. 23RQCh. 17 - Prob. 24RQCh. 17 - Would the following companies most likely use job...Ch. 17 - Prob. 2SECh. 17 - Analyze the following T-accounts to determine the...Ch. 17 - Prob. 4SECh. 17 - Oak Outdoor Furniture manufactures wood patio...Ch. 17 - Job 303 includes direct materials costs of 550 and...Ch. 17 - Calculating predetermined overhead allocation...Ch. 17 - Lincoln Company completed jobs that cost 38,000 to...Ch. 17 - Columbus Enterprises reports the following...Ch. 17 - The T-account showing the manufacturing overhead...Ch. 17 - Adjusting Manufacturing Overhead Justice Companys...Ch. 17 - Prob. 12SECh. 17 - Prob. 13SECh. 17 - Prob. 14SECh. 17 - Prob. 15ECh. 17 - Defining terminology Match the following terms to...Ch. 17 - Prob. 17ECh. 17 - Goldenrod Company makes artificial flowers and...Ch. 17 - Selected cost data for Classic Print Co. are as...Ch. 17 - Prob. 20ECh. 17 - Prob. 21ECh. 17 - Prob. 22ECh. 17 - Jordan Company has the following information for...Ch. 17 - Journalize the following transactions for Marges...Ch. 17 - Prob. 25ECh. 17 - Analyze the following T-accounts, and determine...Ch. 17 - Prob. 27ECh. 17 - Clement Manufacturing makes carrying cases for...Ch. 17 - Ki Technology Co. manufactures DVDs for computer...Ch. 17 - Superior Construction, Inc. is a home builder in...Ch. 17 - Accounting for manufacturing overhead Prestige...Ch. 17 - Mighty Stars produces stars for elementary...Ch. 17 - Bluebird Design, Inc. is a Web site design and...Ch. 17 - Sutherland Manufacturing makes carrying cases for...Ch. 17 - Ye Technology Co. manufactures DVDs for computer...Ch. 17 - Meadow Construction, Inc. is a home builder in...Ch. 17 - Accounting for manufacturing overhead Elegant...Ch. 17 - Hero Stars produces stars for elementary teachers...Ch. 17 - Skylark Design, Inc. is a Web site design and...Ch. 17 - Accounting for manufacturing overhead This problem...Ch. 17 - Granite Construction Incorporated is a major...Ch. 17 - Hiebert Chocolate, Ltd. is located in Memphis. The...Ch. 17 - Prob. 1FC

Additional Business Textbook Solutions

Find more solutions based on key concepts

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (5th Edition)

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

Real options and its types. Introduction: The net present value is the variation between present cash inflows v...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Explain how to derive a total expenditures (TE) curve.

Macroeconomics

The flowchart for the process at the local car wash. Introduction: Flowchart: A flowchart is a visualrepresenta...

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company must place an order for a product that will be sold in the upcoming holiday season by July 1, 2024 to receive a bulk discount. The demand for the product is forecasted to be 2,500, 4,500, 7,000, or 9,000 units. Leftover units can be sold to a clearance store for $50 per unit. The company purchases the product for $165 and sells it for $250. What is the profit if the company purchases 7,000 units but the actual demand turns out to be 4,500 units?arrow_forward??!!arrow_forwardAccounting questionarrow_forward

- Solve this Accounting problemarrow_forwardTutor please provide answerarrow_forwardThe Sakamoto Manufacturing company's Finishing Department started the month with 18,200 units in its beginning Work in Process (WIP) inventory. An additional 275,800 units were transferred in from the prior department during the month to begin processing in the Finishing Department. At the end of the month, there were 39,600 units in the ending Work in Process inventory of the Finishing Department. How many units were transferred to the next processing department during the month? Please helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY