Concept explainers

Superior Construction, Inc. is a home builder in Arizona. Superior uses a

- a. Purchased materials on account, $400,000.

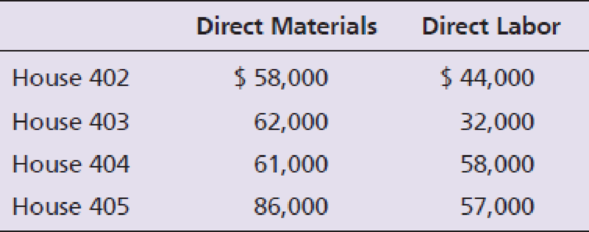

- b. Requisitioned direct materials and used direct labor in construction. Recorded the materials requisitioned.

- c. The company incurred total wages of $300,000. Use the data from Item b to assign the wages. Wages are not yet paid.

- d.

Depreciation of construction equipment, $6,700. - e. Other overhead costs incurred: Equipment rentals paid in cash, $30,000; Worker liability insurance expired, $7,000.

- f. Allocated overhead to jobs.

- g. Houses completed: 402, 404.

- h. House sold on account: 404 for $250,000.

Requirements

- 1. Calculate Superior’s predetermined overhead allocation rate for the year.

- 2. Prepare

journal entries to record the events in the general journal. - 3. Open T-accounts for Work-in-Process Inventory and Finished Goods Inventory.

Post the appropriate entries to these accounts, identifying each entry by letter. Determine the ending account balances, assuming that the beginning balances were zero. - 4. Add the costs of the unfinished houses, and show that this total amount equals the ending balance in the Work-in-Process Inventory account.

- 5. Add the costs of the completed house that has not yet been sold, and show that this equals the ending balance in Finished Goods Inventory.

- 6. Compute gross profit on the house that was sold. What costs must gross profit cover for Superior Construction?

Learn your wayIncludes step-by-step video

Chapter 17 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Additional Business Textbook Solutions

Managerial Accounting (5th Edition)

Operations Management

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

MARKETING:REAL PEOPLE,REAL CHOICES

Foundations of Financial Management

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub