Concept explainers

Accounting for manufacturing

This problem continues the Piedmont Computer Company situation from Chapter 16. Piedmont Computer Company uses a job order costing system in which each batch manufactured is a different job. Piedmont Computer Company assigns direct materials and direct labor to each job. The company assigns labor costs at $25 per hour. It allocates manufacturing overhead to jobs based on a predetermined overhead allocation rate, computed as a percentage of direct labor costs.

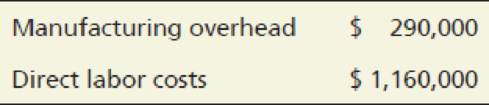

At the beginning of 2020, the controller prepared the following budget:

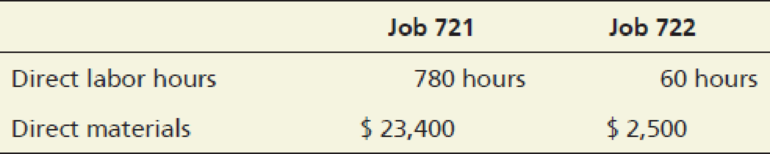

In November 2020, Piedmont Computer Company worked on several jobs. Records for two jobs appear here:

Requirements

- 1. Compute Piedmont Computer Company’s predetermined overhead allocation rate for 2020.

- 2. Compute the total cost of each job.

- 3. Why does Piedmont assign

costs to jobs ?

Want to see the full answer?

Check out a sample textbook solution

Chapter 17 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Additional Business Textbook Solutions

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

FUNDAMENTALS OF CORPORATE FINANCE

Financial Accounting, Student Value Edition (5th Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Don't use ai given answer accounting questionsarrow_forwardPlease provide correct solution this financial accounting questionarrow_forwardAllocate the two support departments’ costs to the two operating departments using the following methods: a. Direct method b. Step-down method (allocate HR first) c. Step-down method (allocate IS first) d. The Algebraic method.arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning