Concept explainers

Hiebert Chocolate, Ltd. is located in Memphis. The company prepares gift boxes of chocolates for private parties and corporate promotions. Each order contains a selection of chocolates determined by the customer, and the box is designed to the customer’s specifications. Accordingly, Hiebert uses a

One of Hiebert’s largest customers is the Goforth and Leos law firm. This organization sends chocolates to its clients each Christmas and also provides them to employees at the firm’s gatherings. The law firm’s managing partner, Bob Goforth, placed the client gift order in September for 500 boxes of cream-filled dark chocolates. But Goforth and Leos did not place its December staff-party order until the last week of November. This order was for an additional 100 boxes of chocolates identical to the ones to be distributed to clients.

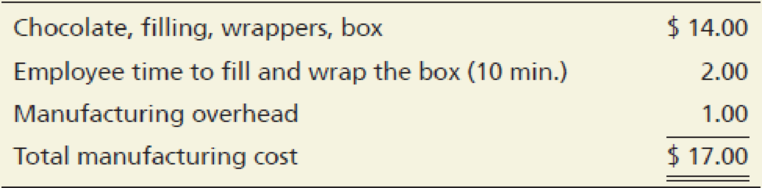

Hiebert budgeted the cost per box for the original 500-box order as follows:

Ben Hiebert, president of Hiebert Chocolate, Ltd., priced the order at $20 per box.

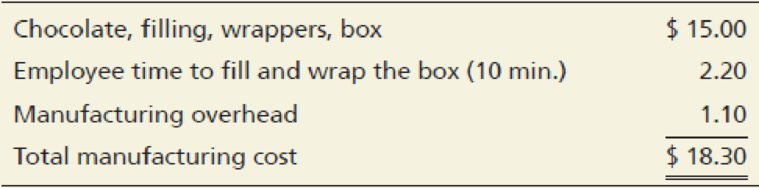

In the past few months, Hiebert has experienced cost increases for both dark chocolate and direct labor. All other costs have remained the same. Hiebert budgeted the cost per box for the second order as follows:

Requirements

- 1. Do you agree with the cost analysis for the second order? Explain your answer.

- 2. Should the two orders be accounted for as one job or two in Hiebert’s system?

- 3. What sales price per box should Ben Hiebert set for the second order? What are the advantages and disadvantages of this sales price?

Want to see the full answer?

Check out a sample textbook solution

Chapter 17 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

- Waiting for your solution general accounting questionarrow_forwardAnswer? ? Financial accounting questionarrow_forwardNeither Joe nor Jessie is blind or over age 65, and they plan to file as married joint. Assume that the employer portion of the self-employment tax on Jessie's income is $831. Joe and Jessie have summarized the income and expenses they expect to report this year as follows: Income: Joe's salary $ 144,100 Jessie's craft sales 18,400 Interest from certificate of deposit 1,650 Interest from Treasury bond funds 716 Interest from municipal bond funds 920 Expenditures: Federal income tax withheld from Joe's wages $ 13,700 State income tax withheld from Joe's wages 6,400 Social Security tax withheld from Joe's wages 7,482 Real estate taxes on residence 6,200 Automobile licenses (based on weight) 310 State sales tax paid 1,150 Home mortgage interest 26,000 Interest on Masterdebt credit card 2,300 Medical expenses (unreimbursed) 1,690 Joe's employee expenses (unreimbursed) 2,400 Cost of…arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning