Concept explainers

Weighted-average method, assigning costs. ZanyBrainy Corporation makes interlocking children’s blocks in a single processing department. Direct materials are added at the start of production. Conversion costs are added evenly throughout production. ZanyBrainy uses the weighted-average method of

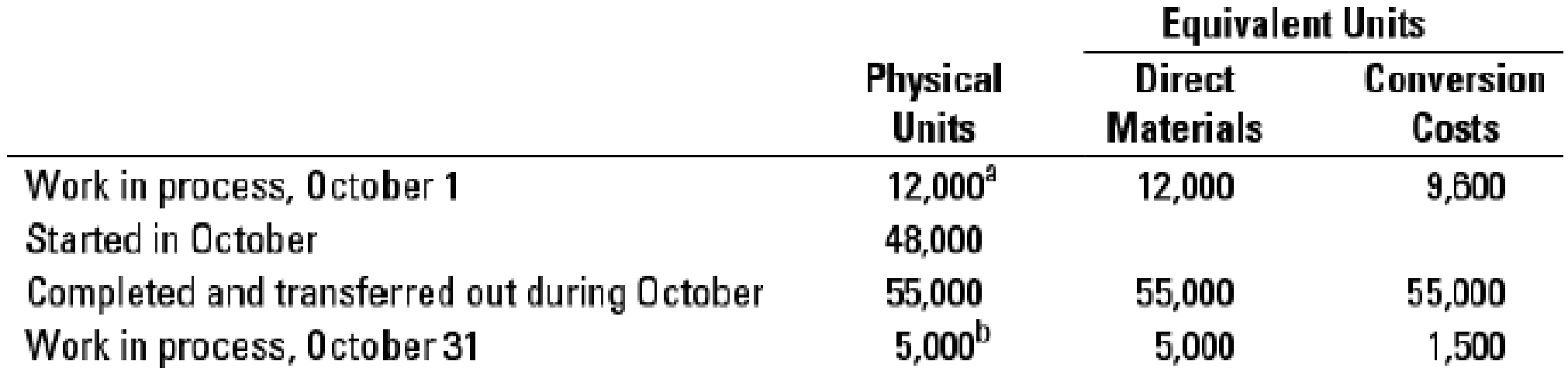

a Degree of completion: direct materials, 100%; conversion costs, 80%.

b Degree of completion: direct materials, 100%; conversion costs, 30%.

Total Costs for October 2017

| Work in process, beginning | ||

| Direct materials | $ 5,760 | |

| Conversion costs | 14,825 | $ 20,585 |

| Direct materials added during October | 25,440 | |

| Conversion costs added during October | 58,625 | |

| Total costs to account for | $104,650 |

- 1. Calculate the cost per equivalent unit for direct materials and conversion costs.

Required

- 2. Summarize the total costs to account for and assign them to units completed (and transferred out) and to units in ending work in process.

Learn your wayIncludes step-by-step video

Chapter 17 Solutions

EBK HORNGREN'S COST ACCOUNTING

Additional Business Textbook Solutions

Principles of Accounting Volume 1

Financial Accounting

Financial Accounting, Student Value Edition (4th Edition)

Horngren's Accounting (11th Edition)

Principles of Accounting Volume 2

Horngren's Financial & Managerial Accounting, The Financial Chapters (6th Edition)

- Kenkel, Ltd. uses backflush costing to account for its manufacturing costs. The trigger points are the purchase of materials, the completion of goods, and the sale of goods. Prepare journal entries to account for the following: a. Purchased raw materials, on account, 80,000. b. Requisitioned raw materials to production, 80,000. c. Distributed direct labor costs, 10,000. d. Factory overhead costs incurred, 60,000. (Use Various Credits for the account in the credit part of the entry.) e. Completed all of the production started. f. Sold the completed production for 225,000, on account.arrow_forwardPant Risers manufactures bands for self-dressing assistive devices for mobility-impaired individuals. Manufacturing is a one-step process where the bands are cut and sewn. This is the information related to this years production: Â Ending inventory was 100% complete as to materials and 70% complete as to conversion, and the total materials cost is $57,540 and the total conversion cost is $36,036. Using the weighted-average method, what are the unit costs if the company transferred out 17,000 units? What is the value of the inventory transferred out and the value of the ending WIP inventory?arrow_forwardThe Converting Department of Tender Soft Tissue Company uses the weighted average method and had 1,900 units in work in process that were 60% complete at the beginning of the period. During the period, 15,800 units were completed and transferred to the Packing Department. There were 1,200 units in process that were 30% complete at the end of the period. a. Determine the number of whole units to be accounted for and to be assigned costs for the period. b. Determine the number of equivalent units of production for the period. Assume that direct materials are placed in process during production.arrow_forward

- Davis Co. uses backflush costing to account for its manufacturing costs. The trigger points are the purchase of materials, the completion of goods, and the sale of goods. Prepare journal entries to account for the following: a. Purchased raw materials, on account, 70,000. b. Requisitioned raw materials to production, 70,000. c. Distributed direct labor costs, 15,000. d. Factory overhead costs incurred, 45,000. (Use Various Credits for the account in the credit part of the entry.) e. Completed all of the production started. f. Sold the completed production for 195,000, on account. (Hint: Use a single account for raw materials and work in process.)arrow_forwardThe following product costs are available for Kellee Company on the production of eyeglass frames: direct materials, $32,125; direct labor, $23.50; manufacturing overhead, applied at 225% of direct labor cost; selling expenses, $22,225; and administrative expenses, $31,125. The direct labor hours worked for the month are 3,200 hours. A. What are the prime costs? B. What are the conversion costs? C. What is the total product cost? D. What is the total period cost? E. If 6.425 equivalent units are produced, what is the equivalent material cost per unit? F. What is the equivalent conversion cost per unit?arrow_forwardHolmes Products, Inc., produces plastic cases used for video cameras. The product passes through three departments. For April, the following equivalent units schedule was prepared for the first department: Costs assigned to beginning work in process: direct materials, 90,000; conversion costs, 33,750. Manufacturing costs incurred during April: direct materials, 75,000; conversion costs, 220,000. Holmes uses the weighted average method. Required: 1. Compute the unit cost for April. 2. Determine the cost of ending work in process and the cost of goods transferred out.arrow_forward

- A company is using process costing with the first-in, first-out (FIFO) method, and all costs are added evenly throughout the manufacturing process. If there are 5,000 units in beginning work in process inventory (30% complete), 10,000 units in ending work in process inventory (60% complete), and 25,000 units started in process this period, how many equivalent units are there for this period? a. 22,500 units. b. 26,000 units. c. 24,500 units. d. 25,000 units.arrow_forwardK-Briggs Company uses the FIFO method to account for the costs of production. For Crushing, the first processing department, the following equivalent units schedule has been prepared: The cost per equivalent unit for the period was as follows: The cost of beginning work in process was direct materials, 40,000; conversion costs, 30,000. Required: 1. Determine the cost of ending work in process and the cost of goods transferred out. 2. Prepare a physical flow schedule.arrow_forwardPatterson Company produces wafers for integrated circuits. Data for the most recent year are provided: aCalculated using number of dies as the single unit-level driver. bCalculated by multiplying the consumption ratio of each product by the cost of each activity. Required: 1. Using the five most expensive activities, calculate the overhead cost assigned to each product. Assume that the costs of the other activities are assigned in proportion to the cost of the five activities. 2. Calculate the error relative to the fully specified ABC product cost and comment on the outcome. 3. What if activities 1, 2, 5, and 8 each had a cost of 650,000 and the remaining activities had a cost of 50,000? Calculate the cost assigned to Wafer A by a fully specified ABC system and then by an approximately relevant ABC approach. Comment on the implications for the approximately relevant approach.arrow_forward

- Chavez Concrete Inc. has two production departments. Blending had 1,000 units in process at the beginning of the period, two-fifths complete. During the period 7,800 units were received from Mixing, 8,200 units were transferred to the finished goods storeroom, and 600 units were in process at the end of the period, 1/3 complete. The cost of the beginning work in process was: The costs during the month were: 1. Using the data in E5-15, prepare a cost of production summary for the month ended January 31, 2016. 2. Prepare a journal entry to transfer the cost of the completed units from Blending to the finished goods storeroom.arrow_forwardClassic Clothing, Inc., is a manufacturer of winter clothes. It has a knitting department and a finishing department. This exercise focuses on the finishing department. Direct materials are added at the end of the process. Conversion costs are added evenly during the process. Classic uses the weighted-average method of process costing. The following information for June 2017 is available. Read the requirements2. Requirement 1. Calculate equivalent units of transferred-in costs, direct materials, and conversion costs. (Enter a "0" for any zero balances.) Equivalent Units Physical Units Transferred-In Direct Conversion (tons) Costs Materials Costs Work in process, beginning inventory (June 1) 100 Transferred in during June 165 To account for Completed and transferred out during June 200 Work in process, ending inventory (June 30) 65…arrow_forwardKETT Ltd uses process costing for its main product, Fitez. You are provided with the following data for its assembly division: Physical units (Fitez) Direct materials Conversion costs Beginning work in process (October) 100 $1,000 $400 Started in October 2020 1,100 Completed during October 2020 1,000 Ending work in process (October 2020) 200 Costs added during October 2020 $22,470 $12,000 Degree of completion of beginning work in process: direct material: 50%; conversion costs: 40% Degree of completion of ending work in process: direct material: 60%; conversion costs: 20% KETT uses the First In First Out (FIFO) method of process costing for this division. Q17: The total equivalent units for conversion costs are: 1,000 units 1,070 units 1,150 units 1,200 units 1.100 unitsarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning