EBK HORNGREN'S COST ACCOUNTING

16th Edition

ISBN: 9780134475998

Author: Rajan

Publisher: YUZU

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 17, Problem 17.28E

Operation costing. The Carter Furniture Company needs to determine the cost of two work orders for December 2017. Work Order 1200A is for 250 painted, unassembled chests and Work Order 1250A is for 400 stained, assembled chests. The following information pertains to these two work orders:

Required

- 2. Using the information in requirement 1, calculate the budgeted cost of goods manufactured for the two December work orders.

- 3. Calculate the cost per unassembled chest and assembled chest for Work Order 1200A and Work Order 1250A, respectively.

17-28 Operation costing. The Carter Furniture Company needs to determine the cost of two work orders for December 2017. Work Order 1200A is for 250 painted, unassembled chests and Work Order 1250A is for 400 stained, assembled chests. The following information pertains to these two work orders:

| Work Order 1200A | Work Order 1250A | |

| Number of chests | 250 | 400 |

| Operations | ||

| 1. Cutting | Use | Use |

| 2. Painting | Use | Do not use |

| 3. Staining | Do not use | Use |

| 4. Assembling | Do not use | Use |

| 6. Packaging | Use | Use |

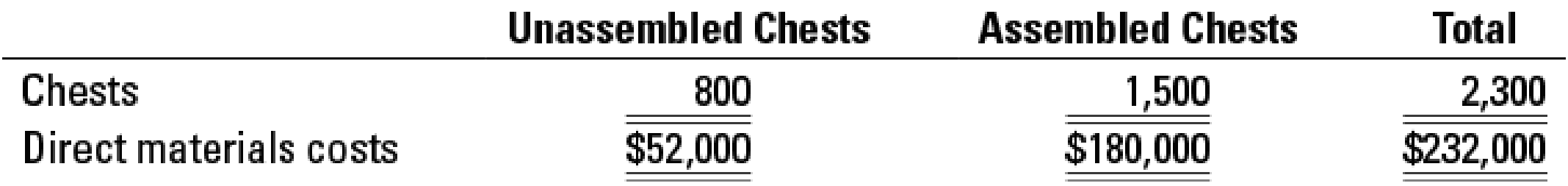

Selected budget information for December follows:

Budgeted conversion costs for each operation for December follow:

| Cutting | $41,400 |

| Painting | 6,400 |

| Staining | 24,000 |

| Assembling | 33,000 |

| Packaging | 11,500 |

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is its current yield of these financial accounting question?

Solve this questions

ans

Chapter 17 Solutions

EBK HORNGREN'S COST ACCOUNTING

Ch. 17 - Give three examples of industries that use...Ch. 17 - In process costing, why are costs often divided...Ch. 17 - Explain equivalent units. Why are equivalent-unit...Ch. 17 - What problems might arise in estimating the degree...Ch. 17 - Name the five steps in process costing when...Ch. 17 - Name the three inventory methods commonly...Ch. 17 - Describe the distinctive characteristic of...Ch. 17 - Describe the distinctive characteristic of FIFO...Ch. 17 - Prob. 17.9QCh. 17 - Identify a major advantage of the FIFO method for...

Ch. 17 - Identify the main difference between journal...Ch. 17 - The standard-costing method is particularly...Ch. 17 - Why should the accountant distinguish between...Ch. 17 - Transferred-in costs are those costs incurred in...Ch. 17 - Theres no reason for me to get excited about the...Ch. 17 - Assuming beginning work in process is zero, the...Ch. 17 - The following information concerns Westheimer...Ch. 17 - Sepulveda Corporation uses a process costing...Ch. 17 - Penn Manufacturing Corporation uses a...Ch. 17 - Kimberly Manufacturing uses a process-costing...Ch. 17 - Equivalent units, zero beginning inventory....Ch. 17 - Journal entries (continuation of 17-21). Refer to...Ch. 17 - Zero beginning inventory, materials introduced in...Ch. 17 - Weighted-average method, equivalent units. The...Ch. 17 - Weighted-average method, assigning costs...Ch. 17 - FIFO method, equivalent units. Refer to the...Ch. 17 - FIFO method, assigning costs (continuation of...Ch. 17 - Operation costing. The Carter Furniture Company...Ch. 17 - Weighted-average method, assigning costs....Ch. 17 - FIFO method, assigning costs. 1. Do Exercise 17-29...Ch. 17 - Transferred-in costs, weighted-average method....Ch. 17 - Transferred-in costs, FIFO method. Refer to the...Ch. 17 - Operation costing. Egyptian Spa produces two...Ch. 17 - Standard-costing with beginning and ending work in...Ch. 17 - Equivalent units, comprehensive. Louisville Sports...Ch. 17 - Weighted-average method. Hoffman Company...Ch. 17 - Journal entries (continuation of 17-36). Required...Ch. 17 - FIFO method (continuation of 17-36). 1. Do Problem...Ch. 17 - Transferred-in costs, weighted-average method...Ch. 17 - Transferred-in costs, FIFO method (continuation of...Ch. 17 - Weighted-average method. McKnight Handcraft is a...Ch. 17 - FIFO method (continuation of 17-41). 1. Complete...Ch. 17 - Transferred-in costs, weighted-average method....Ch. 17 - Transferred-in costs, FIFO method. Refer to the...Ch. 17 - Standard costing, journal entries. The Warner...Ch. 17 - Multiple processes or operations, costing. The...Ch. 17 - Benchmarking, ethics. Amanda McNall is the...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY