Intermediate Accounting

9th Edition

ISBN: 9781259722660

Author: J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 16, Problem 16.9E

Determine taxable income

• LO16–1, LO16–2

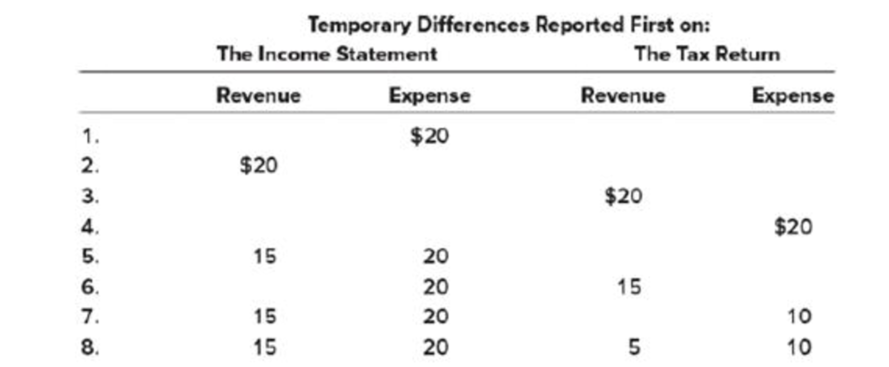

Eight independent situations are described below. Each involves future deductible amounts and/or future taxable amounts ($ in millions).

Required:

For each situation, determine taxable income, assuming pretax accounting income is $100 million.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

account

need help this questions account subject

account questions

Chapter 16 Solutions

Intermediate Accounting

Ch. 16 - Prob. 16.1QCh. 16 - A deferred tax liability (or asset) is described...Ch. 16 - Prob. 16.3QCh. 16 - Prob. 16.4QCh. 16 - Temporary differences result in future taxable or...Ch. 16 - Identify three examples of differences with no...Ch. 16 - The income tax rate for Hudson Refinery has been...Ch. 16 - Suppose a tax reform bill is enacted that causes...Ch. 16 - A net operating loss occurs when tax-deductible...Ch. 16 - Prob. 16.10Q

Ch. 16 - Additional disclosures are required pertaining to...Ch. 16 - Additional disclosures are required pertaining to...Ch. 16 - Prob. 16.13QCh. 16 - Prob. 16.14QCh. 16 - IFRS and U.S. GAAP follow similar approaches to...Ch. 16 - Temporary difference LO161 A company reports...Ch. 16 - Prob. 16.2BECh. 16 - Temporary difference LO162 A company reports...Ch. 16 - Prob. 16.4BECh. 16 - Temporary difference; income tax payable given ...Ch. 16 - Valuation allowance LO162, LO163 At the end of...Ch. 16 - Valuation allowance LO162, LO163 VeriFone Systems...Ch. 16 - Temporary and permanent differences; determine...Ch. 16 - Calculate taxable income LO161, LO164 Shannon...Ch. 16 - Multiple tax rates LO165 J-Matt, Inc., had pretax...Ch. 16 - Change in tax rate LO165 Superior Developers...Ch. 16 - Net operating loss carryforward LO167 During its...Ch. 16 - Net operating loss carryback LO167 AirParts...Ch. 16 - Tax uncertainty LO169 First Bank has some...Ch. 16 - Intraperiod tax allocation LO1610 Southeast...Ch. 16 - Temporary difference; taxable income given LO161...Ch. 16 - Prob. 16.2ECh. 16 - Prob. 16.3ECh. 16 - Prob. 16.4ECh. 16 - Prob. 16.5ECh. 16 - Prob. 16.6ECh. 16 - Identify future taxable amounts and future...Ch. 16 - Calculate income tax amounts under various...Ch. 16 - Determine taxable income LO161, LO162 Eight...Ch. 16 - Prob. 16.10ECh. 16 - Deferred tax asset; income tax payable given;...Ch. 16 - Prob. 16.12ECh. 16 - Prob. 16.13ECh. 16 - Multiple differences LO164, LO166 For the year...Ch. 16 - Multiple t ax rates LO162, LO165 Allmond...Ch. 16 - Prob. 16.16ECh. 16 - Deferred taxes; change in tax rates LO161, LO165...Ch. 16 - Multiple temporary differences; record income...Ch. 16 - Multiple temporary differences; record income...Ch. 16 - Net operating loss carryforward LO167 During...Ch. 16 - Net operating loss carryback LO167 Wynn Sheet...Ch. 16 - Net operating loss carryback and carryforward ...Ch. 16 - Identifying income tax deferrals LO161, LO162,...Ch. 16 - Multiple temporary differences; balance sheet...Ch. 16 - Multiple tax rates LO161, LO164, LO165 Case...Ch. 16 - Prob. 16.26ECh. 16 - Balance sheet classification LO168 As of December...Ch. 16 - Concepts; terminology LO161 through LO168 Listed...Ch. 16 - Tax credit; uncertainty regarding sustainability ...Ch. 16 - Intraperiod tax allocation LO1610 The following...Ch. 16 - FASB codification research LO165, LO168, LO1610...Ch. 16 - Prob. 16.1PCh. 16 - Prob. 16.2PCh. 16 - Prob. 16.3PCh. 16 - Prob. 16.4PCh. 16 - Change in tax rate; record taxes for four years ...Ch. 16 - Multiple differences; temporary difference yet to...Ch. 16 - Multiple differences; calculate taxable income;...Ch. 16 - Multiple differences; taxable income given; two...Ch. 16 - Determine deferred tax assets and liabilities ...Ch. 16 - Prob. 16.10PCh. 16 - Prob. 16.11PCh. 16 - Prob. 16.12PCh. 16 - Prob. 16.13PCh. 16 - Prob. 16.1BYPCh. 16 - Prob. 16.2BYPCh. 16 - Integrating Case 163 Tax effects of accounting...Ch. 16 - Communication Case 164 Deferred taxes; changing...Ch. 16 - Prob. 16.5BYPCh. 16 - Research Case 166 Researching the way tax...Ch. 16 - Analysis Case 167 Reporting deferred taxes; Ford...Ch. 16 - Prob. 16.8BYPCh. 16 - Judgment Case 169 Analyzing the effect of deferred...Ch. 16 - Prob. 16.12BYPCh. 16 - Target Case LO16-1, LO16-2, LO16-4, LO16-8,...Ch. 16 - Prob. 1CCIFRS

Additional Business Textbook Solutions

Find more solutions based on key concepts

Which of the following is a primary activity in the value chain?

purchasing

accounting

post-sales service

human...

Accounting Information Systems (14th Edition)

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

How is activity-based costing useful for pricing decisions?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Mary Williams, owner of Williams Products, is evaluating whether to introduce a new product line. After thinkin...

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (5th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- compared to the individual risks of constituting assets. Question 5 (6 marks) The common shares of Almond Beach Inc, have a beta of 0.75, offer a return of 9%, and have an historical standard deviation of return of 17%. Alternatively, the common shares of Palm Beach Inc. have a beta of 1.25, offer a return of 10%, and have an historical standard deviation of return of 13%. Both firms have a marginal tax rate of 37%. The risk-free rate of return is 3% and the expected rate of return on the market portfolio is 9½%. 1. Which company would a well-diversified investor prefer to invest in? Explain why and show all calculations. 2. Which company Would an investor who can invest in the shares of only one firm prefer to invest in? Explain why. RELEASED BY THE CI, MGMT2023, MARCH 2, 2025 5 Use the following template to organize and present your results: Theoretical CAPM Actual offered prediction for expected return (%) return (%) Standard deviation of return (%) Beta Almond Beach Inc. Palm Beach…arrow_forwardprovide correct answerarrow_forwardPlease solve. The screen print is kind of split. Please look carefully.arrow_forward

- Coronado Fire, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 2 1/2 pounds of multi- purpose dry chemical at 480 PSI. The commercial model is a low-volume (10,200 units), two-gallon cylinder that holds 10 pounds of multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion. Therefore, total annual direct labor hours are 96,300 or [1.5 hours x (54,000+10,200)]. Estimated annual manufacturing overhead is $1,566,090. Thus, the predetermined overhead rate is $16.26 or ($1,566,090 ÷ 96,300) per direct labor hour. The direct materials cost per unit is $18.50 for the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial models. The company's managers identified six activity cost pools and related…arrow_forwardCoronado Fire, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 2 1/2 pounds of multi- purpose dry chemical at 480 PSI. The commercial model is a low-volume (10,200 units), two-gallon cylinder that holds 10 pounds of multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion. Therefore, total annual direct labor hours are 96,300 or [1.5 hours x (54,000+ 10,200)]. Estimated annual manufacturing overhead is $1,566,090. Thus, the predetermined overhead rate is $16.26 or ($1,566,090 ÷ 96,300) per direct labor hour. The direct materials cost per unit is $18.50 for the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial models. The company's managers identified six activity cost pools and related…arrow_forwardThe completed Payroll Register for the February and March biweekly pay periods is provided, assuming benefits went into effect as anticipated. Required: Using the payroll registers, complete the General Journal entries as follows: February 10 Journalize the employee pay. February 10 Journalize the employer payroll tax for the February 10 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base. February 14 Issue the employee pay. February 24 Journalize the employee pay. February 24 Journalize the employer payroll tax for the February 24 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employee will exceed the FUTA or SUTA wage base. February 28 Issue the employee pay. February 28 Issue payment for the payroll liabilities. March 10 Journalize the employee pay. March 10 Journalize the employer payroll tax for the March 10 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Chapter 19 Accounting for Income Taxes Part 1; Author: Vicki Stewart;https://www.youtube.com/watch?v=FMjwcdZhLoE;License: Standard Youtube License