Intermediate Accounting

9th Edition

ISBN: 9781259722660

Author: J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 16, Problem 16.30E

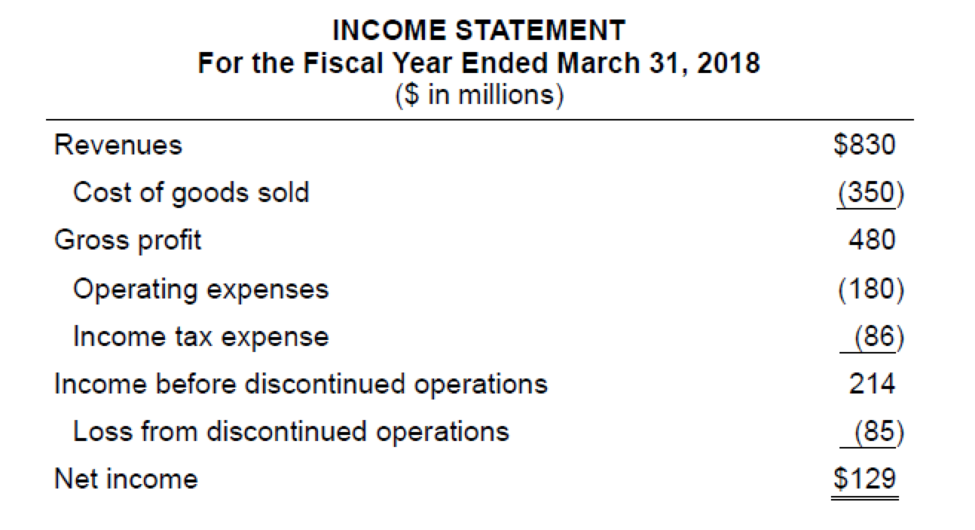

Intraperiod tax allocation

• LO16–10

The following income statement does not reflect intraperiod tax allocation.

Required:

Recast the income statement to reflect intraperiod tax allocation.

The company’s tax rate is 40%.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please help me solve this general accounting question using the right accounting principles.

I am searching for the correct answer to this general accounting problem with proper accounting rules.

I am searching for the correct answer to this financial accounting problem with proper accounting rules.

Chapter 16 Solutions

Intermediate Accounting

Ch. 16 - Prob. 16.1QCh. 16 - A deferred tax liability (or asset) is described...Ch. 16 - Prob. 16.3QCh. 16 - Prob. 16.4QCh. 16 - Temporary differences result in future taxable or...Ch. 16 - Identify three examples of differences with no...Ch. 16 - The income tax rate for Hudson Refinery has been...Ch. 16 - Suppose a tax reform bill is enacted that causes...Ch. 16 - A net operating loss occurs when tax-deductible...Ch. 16 - Prob. 16.10Q

Ch. 16 - Additional disclosures are required pertaining to...Ch. 16 - Additional disclosures are required pertaining to...Ch. 16 - Prob. 16.13QCh. 16 - Prob. 16.14QCh. 16 - IFRS and U.S. GAAP follow similar approaches to...Ch. 16 - Temporary difference LO161 A company reports...Ch. 16 - Prob. 16.2BECh. 16 - Temporary difference LO162 A company reports...Ch. 16 - Prob. 16.4BECh. 16 - Temporary difference; income tax payable given ...Ch. 16 - Valuation allowance LO162, LO163 At the end of...Ch. 16 - Valuation allowance LO162, LO163 VeriFone Systems...Ch. 16 - Temporary and permanent differences; determine...Ch. 16 - Calculate taxable income LO161, LO164 Shannon...Ch. 16 - Multiple tax rates LO165 J-Matt, Inc., had pretax...Ch. 16 - Change in tax rate LO165 Superior Developers...Ch. 16 - Net operating loss carryforward LO167 During its...Ch. 16 - Net operating loss carryback LO167 AirParts...Ch. 16 - Tax uncertainty LO169 First Bank has some...Ch. 16 - Intraperiod tax allocation LO1610 Southeast...Ch. 16 - Temporary difference; taxable income given LO161...Ch. 16 - Prob. 16.2ECh. 16 - Prob. 16.3ECh. 16 - Prob. 16.4ECh. 16 - Prob. 16.5ECh. 16 - Prob. 16.6ECh. 16 - Identify future taxable amounts and future...Ch. 16 - Calculate income tax amounts under various...Ch. 16 - Determine taxable income LO161, LO162 Eight...Ch. 16 - Prob. 16.10ECh. 16 - Deferred tax asset; income tax payable given;...Ch. 16 - Prob. 16.12ECh. 16 - Prob. 16.13ECh. 16 - Multiple differences LO164, LO166 For the year...Ch. 16 - Multiple t ax rates LO162, LO165 Allmond...Ch. 16 - Prob. 16.16ECh. 16 - Deferred taxes; change in tax rates LO161, LO165...Ch. 16 - Multiple temporary differences; record income...Ch. 16 - Multiple temporary differences; record income...Ch. 16 - Net operating loss carryforward LO167 During...Ch. 16 - Net operating loss carryback LO167 Wynn Sheet...Ch. 16 - Net operating loss carryback and carryforward ...Ch. 16 - Identifying income tax deferrals LO161, LO162,...Ch. 16 - Multiple temporary differences; balance sheet...Ch. 16 - Multiple tax rates LO161, LO164, LO165 Case...Ch. 16 - Prob. 16.26ECh. 16 - Balance sheet classification LO168 As of December...Ch. 16 - Concepts; terminology LO161 through LO168 Listed...Ch. 16 - Tax credit; uncertainty regarding sustainability ...Ch. 16 - Intraperiod tax allocation LO1610 The following...Ch. 16 - FASB codification research LO165, LO168, LO1610...Ch. 16 - Prob. 16.1PCh. 16 - Prob. 16.2PCh. 16 - Prob. 16.3PCh. 16 - Prob. 16.4PCh. 16 - Change in tax rate; record taxes for four years ...Ch. 16 - Multiple differences; temporary difference yet to...Ch. 16 - Multiple differences; calculate taxable income;...Ch. 16 - Multiple differences; taxable income given; two...Ch. 16 - Determine deferred tax assets and liabilities ...Ch. 16 - Prob. 16.10PCh. 16 - Prob. 16.11PCh. 16 - Prob. 16.12PCh. 16 - Prob. 16.13PCh. 16 - Prob. 16.1BYPCh. 16 - Prob. 16.2BYPCh. 16 - Integrating Case 163 Tax effects of accounting...Ch. 16 - Communication Case 164 Deferred taxes; changing...Ch. 16 - Prob. 16.5BYPCh. 16 - Research Case 166 Researching the way tax...Ch. 16 - Analysis Case 167 Reporting deferred taxes; Ford...Ch. 16 - Prob. 16.8BYPCh. 16 - Judgment Case 169 Analyzing the effect of deferred...Ch. 16 - Prob. 16.12BYPCh. 16 - Target Case LO16-1, LO16-2, LO16-4, LO16-8,...Ch. 16 - Prob. 1CCIFRS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you help me solve this general accounting question using valid accounting techniques?arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forward

- Please provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardI need guidance with this financial accounting problem using the right financial principles.arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Operating Loss Carryback and Carryforward; Author: SuperfastCPA;https://www.youtube.com/watch?v=XiYhgzSGDAk;License: Standard Youtube License