Concept explainers

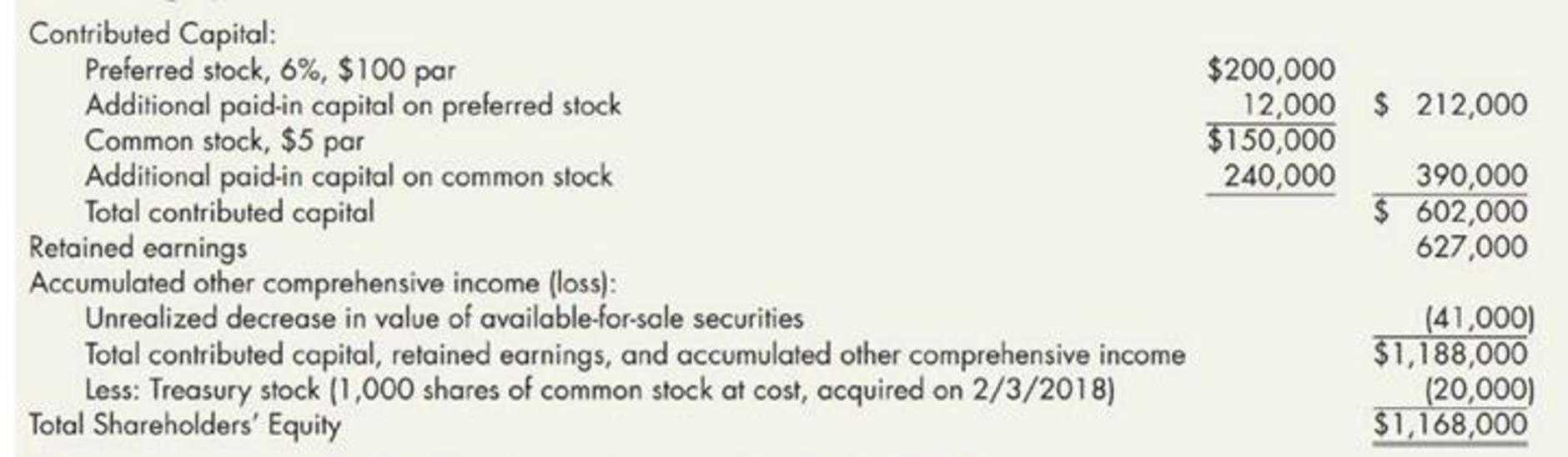

Included in the December 31, 2018, Jacobi Company

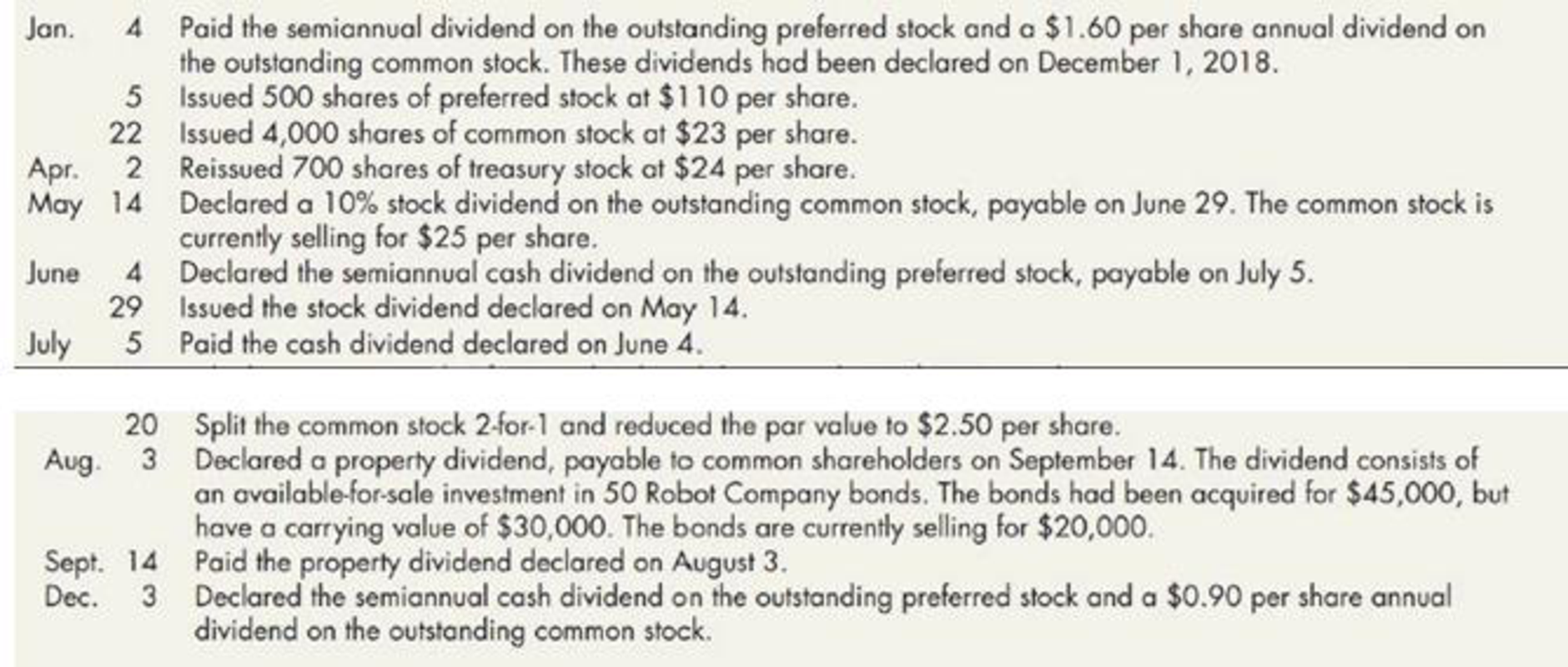

The company engaged in the following stock transactions during 2019:

Required:

- 1. Prepare

journal entries to record the preceding transactions. - 2. Prepare the December 31, 2019, shareholders’ equity section (assume that 2019 net income was $270,000).

1.

Prepare journal entry to record the given transactions.

Explanation of Solution

Stockholders’ Equity Section: It is refers to the section of the balance sheet that shows the available balance stockholders’ equity as on reported date at the end of the financial year.

Prepare journal entry to record the given transactions.

| Date | Account Titles and explanation | Debit ($) | Credit ($) |

| January 4, 2019 | Dividend payable: Preferred | 6,000 | |

| Dividend payable: Common (1) | 46,400 | ||

| Cash | 52,400 | ||

| (To record declaration of preferred and common stock) | |||

| January 5, 2019 | Cash | 55,000 | |

| Preferred stock, $100 par | 50,000 | ||

| Additional paid-in capital on preferred stock | 5,000 | ||

| ( To record issuance of preferred stock) | |||

| January 22, 2019 | Cash | 92,000 | |

| Common stock, $5 par | 20,000 | ||

|

Additional paid-in capital on common stock | 72,000 | ||

| ( To record issuance of common stock) | |||

| April 2, 2019 | Cash | 16,800 | |

| Treasury stock | 14,000 | ||

|

Additional paid-in capital on treasury stock | 2,800 | ||

| (To record the reissuance of treasury stock) | |||

|

May 14, 2019 | Retained earnings (2) | 84,250 | |

|

Common stock to be distributed | 16,850 | ||

| Additional paid-in capital from stock dividend | 67,400 | ||

| (To record declaration of stock dividend) | |||

| June 4, 2019 | Retained earnings | 7,500 | |

| Dividends payable: Preferred (3) | 7,500 | ||

| (To record the declaration of annual per share dividend to the preferred) | |||

| August 29, 2019 | Common stock to be distributed | 16,850 | |

| Common stock, $5 par | 16,850 | ||

| (To record the issuance of stock dividend) | |||

| July 5, 2019 | Dividends payable: Preferred stock | 7,500 | |

| Cash | 7,500 | ||

| (To record the amount of dividend paid on preferred stock) | |||

| July 20, 2019 | No entry is required | ||

| August 3 ,2019 | Loss on disposal of investment | 25,000 | |

|

Unrealized decrease in the value of available-for-sale of securities | 15,000 | ||

|

Allowance for change in value investment | 10,000 | ||

| (To record the declaration of property dividend) | |||

| Retained earnings | 20,000 | ||

| Property dividend payable | 20,000 | ||

| (To record the current value of the bond) | |||

| September 1,2019 | Property dividend payable | 20,000 | |

| Allowance for change in value of investment | 25,000 | ||

| Investment in Company A stock | 45,000 | ||

| (To record the issuance of property dividend) | |||

| December 3, 2019 | Retained earnings | 74,226 | |

| Dividends payable: Preferred (3) | 7,500 | ||

| Dividends payable: Common (4) | 66,726 | ||

| (To record the declaration of annual per share dividend to the preferred and common stock) |

Table (1)

Note:

Note 1: On July 20 memorandum entry is made as the common stock split two for one and the par value is reduced from $5 to $2.50.

Note 2: On July 20 memorandum entry is made when number of shares issued on common stock increases from 37,370

Working note (1): Calculate the amount of dividend payable to the common stock:

Working note (2): Calculate the amount of retained earnings:

| Particulars | Amount in $ |

| Shares issued | 34,000 |

| Less: Treasury shares | 300 |

| Shares outstanding | 33,700 |

| Multiply: Stock dividend | 10% |

| Shares in stock dividend | 3,370 |

| Multiply: Current market price | $25 |

| Reduction in retained earnings | 84,250 |

Table (2)

Working note (3): Calculate the amount of dividend payable to the preferred stock:

Working note (4): Calculate the amount of dividend payable to the common stock:

2.

Prepare Company J’s statement of stockholder’s equity section for 2019.

Explanation of Solution

Prepare Company J’s statement of stockholder’s equity section for 2019.

| Company J | |

| Shareholder's equity | |

| For the year ended December 31, 2019 | |

| Particulars | Amount in $ |

| Contributed Capital: | |

|

Preferred stock (6%, $100 par, 2,500 shares issued and outstanding) | 250,000 |

| Additional paid-in capital on preferred stock | 17,000 |

|

Common stock ($2.50 par, 74,740 shares issued of which 600 are in the corporate treasury) | 186,850 |

| Additional paid-in capital on common stock | 312,000 |

| Additional paid-in capital from treasury stock | 2,800 |

| Additional paid-in capital from stock dividend | 67,400 |

| Total contributed capital | 836,050 |

|

Retained earnings (restricted in the amount of $6,000, the cost of the treasury shares) (5) | 711,024 |

| Accumulated other comprehensive income (loss): | |

| Unrealized decrease in value of available-for-sale securities | (26,000) |

| Total contributed capital, retained earnings, and accumulated other comprehensive income | 1,521,074 |

| Less: Treasury stock (600 shares of common at $10 per share) | (6,000) |

| Total Shareholders’ Equity | 1,515,074 |

(Table 3)

(5) Calculate the amount of retained earnings:

Want to see more full solutions like this?

Chapter 16 Solutions

Intermediate Accounting: Reporting And Analysis

- What is the amount cost of goods available for sale ?arrow_forwardNeed help with this accounting questionsarrow_forwardParker Company has provided the following data for the most recent year: net operating income, $45,500; fixed expense, $92,000; sales, $193,000; and CM ratio, 70%. What is the company's total contribution margin? a. $121,000 b. $101,000 c. $142,500 d. $135,100arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning