Concept explainers

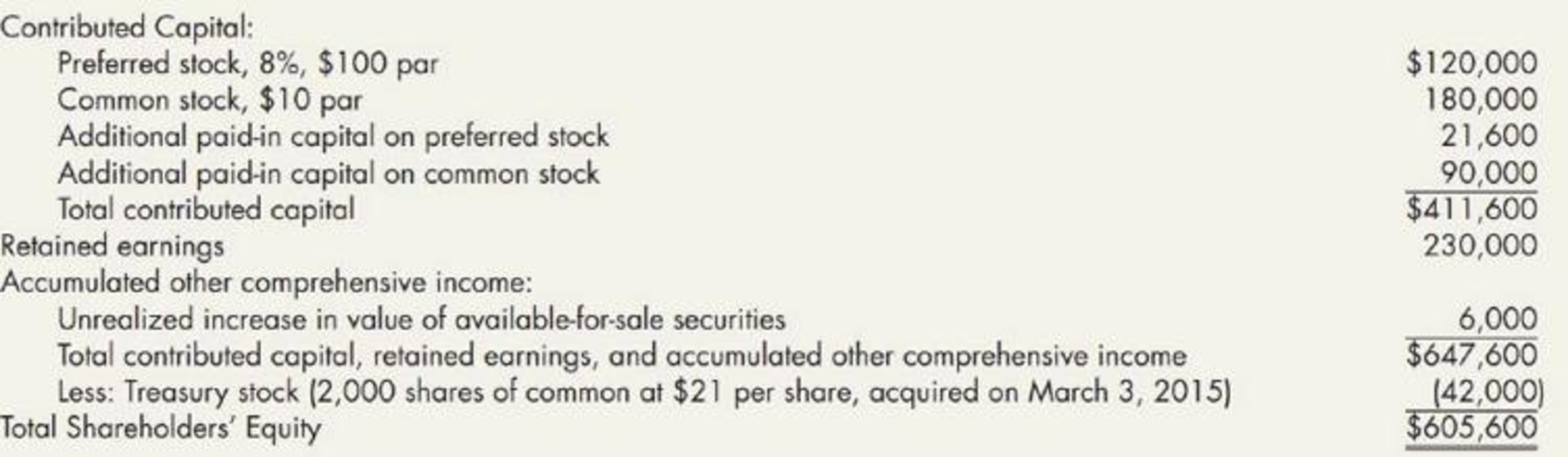

Gray Company lists the following shareholders’ equity items on its December 31, 2018,

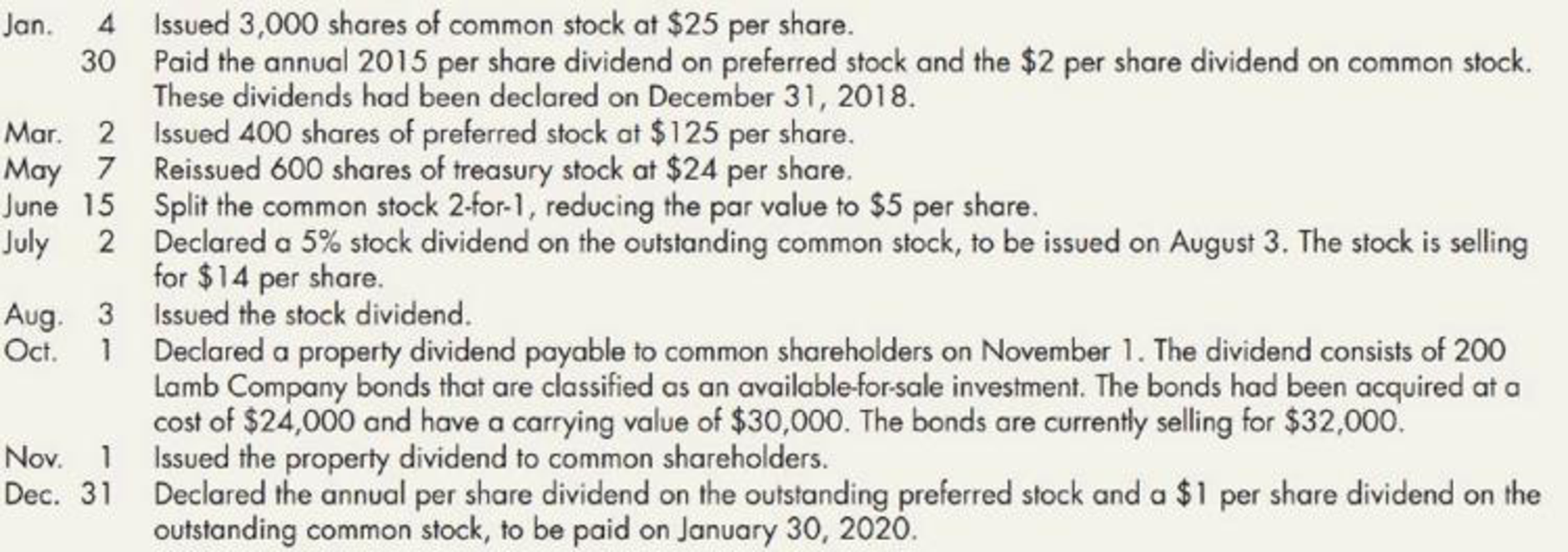

The following stock transactions occurred during 2019:

Required:

- 1. Prepare

journal entries to record the preceding transactions. - 2. Prepare the December 31, 2019, shareholders’ equity section (assume that 2019 net income was $225,000).

1.

Prepare necessary journal entry to record the given transactions.

Explanation of Solution

Stockholders’ Equity Section:

It is refers to the section of the balance sheet that shows the available balance stockholders’ equity as on reported date at the end of the financial year.

| Date | Account Titles and explanation | Debit ($) | Credit ($) |

| January 4, 2019 | Cash | 75,000 | |

| Common stock , at $10par | 10,000 | ||

|

Additional paid-in capital from stock dividend | 45,000 | ||

| ( To record the issuance of 1000 share of common stock at $40 per share) | |||

| January 30, 2019 | Dividend payable: Preferred | 9,600 | |

| Dividend payable: Common (1) | 32,000 | ||

| Cash | 41,600 | ||

| (To record declaration of preferred and common stock) | |||

| March 2, 2019 | Cash | 15,000 | |

| Preferred stock, $100 par | 1,500 | ||

|

Additional paid-in capital on preferred stock | 5,000 | ||

| ( To record issuance of preferred stock) | 11,500 | ||

| March 7, 2019 | Cash | 8,200 | |

| Treasury stock | 6,200 | ||

|

Additional paid-in capital on common stock | 2,000 | ||

| (To record the reissuance of treasury stock) | |||

| June 15, 2019 | No entry is required | ||

| June 15, 2019 | No entry is required | ||

|

July 2, 2019 | Retained earnings (2) | 27,440 | |

|

Common stock to be distributed | 9,800 | ||

|

Additional paid-in capital from stock dividend | 17,640 | ||

| (To record declaration of stock dividend) | |||

| August 3,2019 | Common stock to be distributed | 9,800 | |

| Common stock, $5 par | 9,800 | ||

| (To record the issuance of stock dividend) | |||

| October 1,2019 | Allowance for change in value of investment | 2,000 | |

| Unrealized increase in the value of available-for-sale of securities | 6,000 | ||

|

Gain on disposal of investment | 8,000 | ||

| (To record the declaration of property dividend) | |||

| Retained earnings | 32,000 | ||

| Property dividend payable | 32,000 | ||

| (To record the current value of the bond) | |||

| November 1,2019 | Property dividend payable | 32,000 | |

| Investment in Company L stock | 24,000 | ||

|

Allowance for change in value of investment | 8,000 | ||

| (To record the issuance of property dividend) | |||

| December 31, 2019 | Retained earnings | 53,960 | |

| Dividends payable: Preferred (3) | 12,800 | ||

| Dividends payable: Common (4) | 41,160 | ||

| (To record the declaration of annual per share dividend to the preferred and common stock) |

Table (1)

Note:

Note 1: On July 15 memorandum entry is made as the common stock split two for one and the par value is reduced from $10 to $5.

Note 2: On July 15 memorandum entry is made when treasury stock participates in the stock split. The treasury stock has 2,800 shares at a $6 par value per share costing $10.50 per share.

Working notes:

(1) Calculate the amount of dividend payable to the common stock:

(2) Calculate the amount of retained earnings:

| Particulars | Amount in $ |

| Shares issued | 42,000 |

| Less: Treasury shares (1,400 stock split for two for one) | 2,800 |

| Shares outstanding | 39,200 |

| Multiply: Stock dividend | 5% |

| Shares in stock dividend | 1,960 |

| Multiply: Current market price | $14 |

| Reduction in retained earnings | 27,440 |

Table (2)

(3) Calculate the amount of dividend payable to the preferred stock:

(4) Calculate the amount of dividend payable to the preferred stock:

2.

Prepare Company G’s statement of stockholder’s equity section for 2016.

Explanation of Solution

| Company G | |

| Shareholder's equity | |

| For the year ended December 31,2019 | |

| Particulars | Amount in $ |

| Contributed Capital: | |

| Preferred stock (8%, $100 par, 1,600 shares issued and outstanding) | 160,000 |

|

Common stock ($5 par, 43,960 shares issued of which 41,160 are outstanding and 2,800 shares are being held as treasury stock) | 219,800 |

| Additional paid-in capital on preferred stock | 31,600 |

| Additional paid-in capital on common stock | 93,000 |

| Additional paid-in capital from treasury stock | 1,800 |

| Additional paid-in capital from stock dividend | 17,640 |

| Total contributed capital | 523,840 |

|

Retained earnings (restricted in the amount of $29,400, the cost of the treasury shares) (5) | 341,600 |

| Total contributed capital, retained earnings, and donated capital | 865,440 |

| Less: Treasury stock (2,800 shares of common at $10.50 per share) | (29,400) |

| Total Shareholders’ Equity | 836,040 |

(Table 3)

(5) Calculate the amount of retained earnings:

Want to see more full solutions like this?

Chapter 16 Solutions

Intermediate Accounting: Reporting And Analysis

- Oriole Company sells product 2005WSC for $55 per unit and uses the LIFO method. The cost of one unit of 2005WSC is $52, and the replacement cost is $51. The estimated cost to dispose of a unit is $6, and the normal profit is 40% of selling price. At what amount per unit should product 2005WSC be reported, applying lower-of-cost-or-market?arrow_forwardNonearrow_forwardGeneral accountingarrow_forward

- Please correct answer with accounting questionarrow_forwardA company has decided to purchase equipment, needing to borrow $100,000 from its local bank to make the purchase. The bank gives the company two options: (a) 60-month installment note with 4% interest or (b) 120-month installment note with 8% interest. Lenders often charge a higher interest rate for longer-term loans to compensate for additional risk of lending for a longer time period. Record $100,000 cash received from the issuance of the 120-month installment note with 8% interest.Record $100,000 cash received from the issuance of the 120-month installment note with 8% interest. Select the options to display a 120-month installment note with 12% interest. How much of the principal amount is due after the 60th payment?arrow_forward!??arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning