Concept explainers

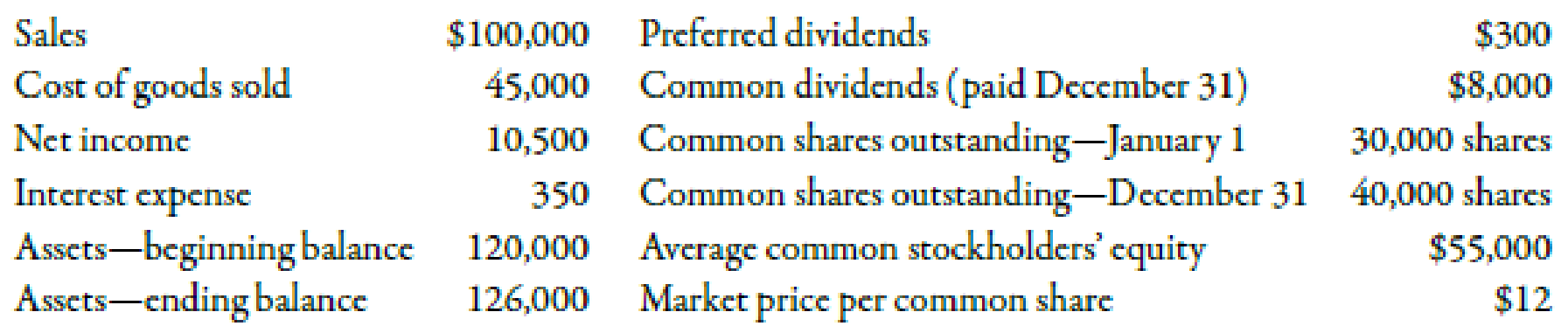

Albion Inc. provided the following information for its most recent year of operations. The tax rate is 40%.

Required:

- 1. Compute the following: (a) return on sales, (b) return on assets, (c) return on stockholders’ equity, (d) earnings per share, (e) price-earnings ratio, (f) dividend yield, and (g) dividend payout ratio.

- 2. CONCEPTUAL CONNECTION If you were considering purchasing stock in Albion, which of the above ratios would be of most interest to you? Explain.

1.

Calculate the return on sales, return on assets, return on stockholders’ equity, and earnings per share, price earnings ratio, and dividend yield and dividend payout ratio.

Explanation of Solution

Profitability Ratio:

These ratios evaluate a firm’s ability to earn profits. They help the stakeholders of the company to measure the degree to which funds invested by them are efficiently used. Some of the ratios calculated return on sales, total assets and stockholder’s equity.

(a)

Use the following formula to calculate the value of return on sales:

Substitute $10,500 for net income and $100,000 for sales in the above formula.

Therefore, the value of return on sales is 0.105 or 10.5%.

(b)

Use the following formula to calculate the value of return on assets:

Substitute $10,550 for net income, $350 for interest expense, 40% for tax rate and $123,000 for average total assets in the above formula.

Therefore, the value of return on assets is 0.087 or 8.7%.

(c)

Use the following formula to calculate the value of return on stockholder’s equity of this year:

Substitute $10,500 for net income, $300 for preference dividend and $55,000 for average common stockholder’s equity in the above formula.

Therefore, the value of return on stockholder’s equity is 0.185 or 18.5%.

(d)

Use the following formula to calculate the value of earnings per share:

Substitute $10,500 for net income, $300 for preference dividend and 35,000 for average common shares in the above formula.

Therefore, the value of earnings per share is $0.29 per share.

(e)

Use the following formula to calculate the price-earnings ratio:

Substitute $12.00 for market price per share and $0.29 (this value is calculated in part d) for earnings per share in the above formula.

Therefore, the value of price-earnings ratio is 41.38.

(f)

Use the following formula to calculate the value of dividend yield:

Substitute $0.20 for dividend per common shares, and $12.00 for market price per common share in the above formula.

Therefore, the value of dividend yield is 0.017 or 1.7%.

(g)

Use the following formula to calculate the value of dividend payout ratio:

Substitute $8,000 for common dividend, $10,500 for net income and $300 for preference dividend in the above formula.

Therefore, the value of dividend payout ratio is 0.7843.

Working Note:

1. Calculation of average total assets:

2. Calculation of average common stockholder’s equity:

3. Calculation of dividends common shares:

2.

Identify the ratio which would interest an investor while considering to purchase stock.

Explanation of Solution

The ratios computed are profitability ratios, and they are equally important for the investors. Therefore, it totally depends on the objectives of the investors which ratio is would be of more interest. For example: if an investor is thinking of having income after retirement by investing in stock of a company, then the investor would be interested in analyzing dividend payout ratio of the company.

Want to see more full solutions like this?

Chapter 15 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- Please give me answer general accounting questionarrow_forwardDo fast answer of this accounting questionsarrow_forwardSwifty Corporation purchased Windsor Company 3 years ago and at that time recorded goodwill of $380,000. The Windsor Division's net assets, including the goodwill, have a carrying amount of $760,000. The fair value of the division is estimated to be $1,010,000. Prepare Swifty' journal entry, if necessary, to record impairment of the goodwill. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Account Titles and Explanation eTextbook and Media Debit Creditarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning