Concept explainers

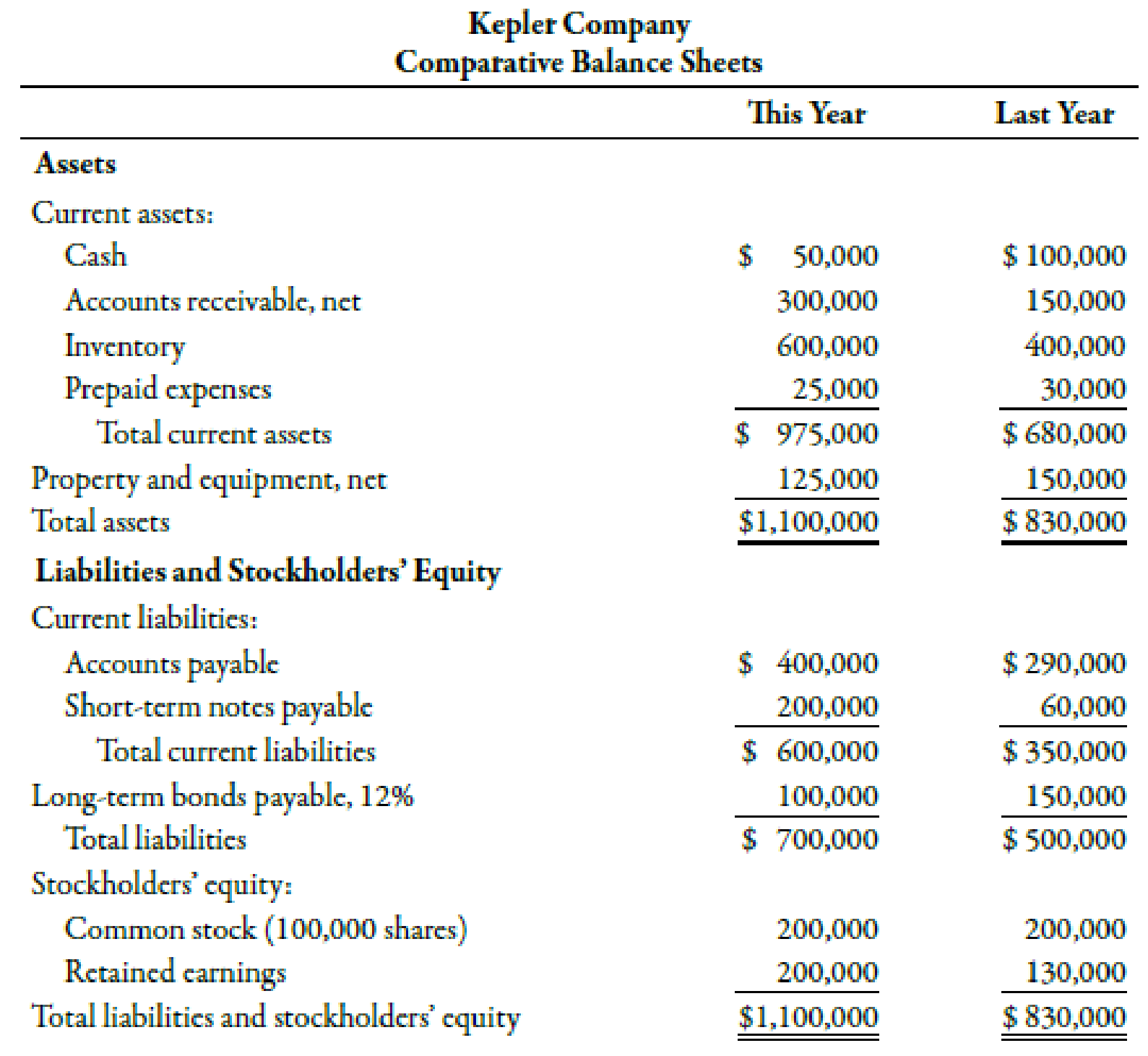

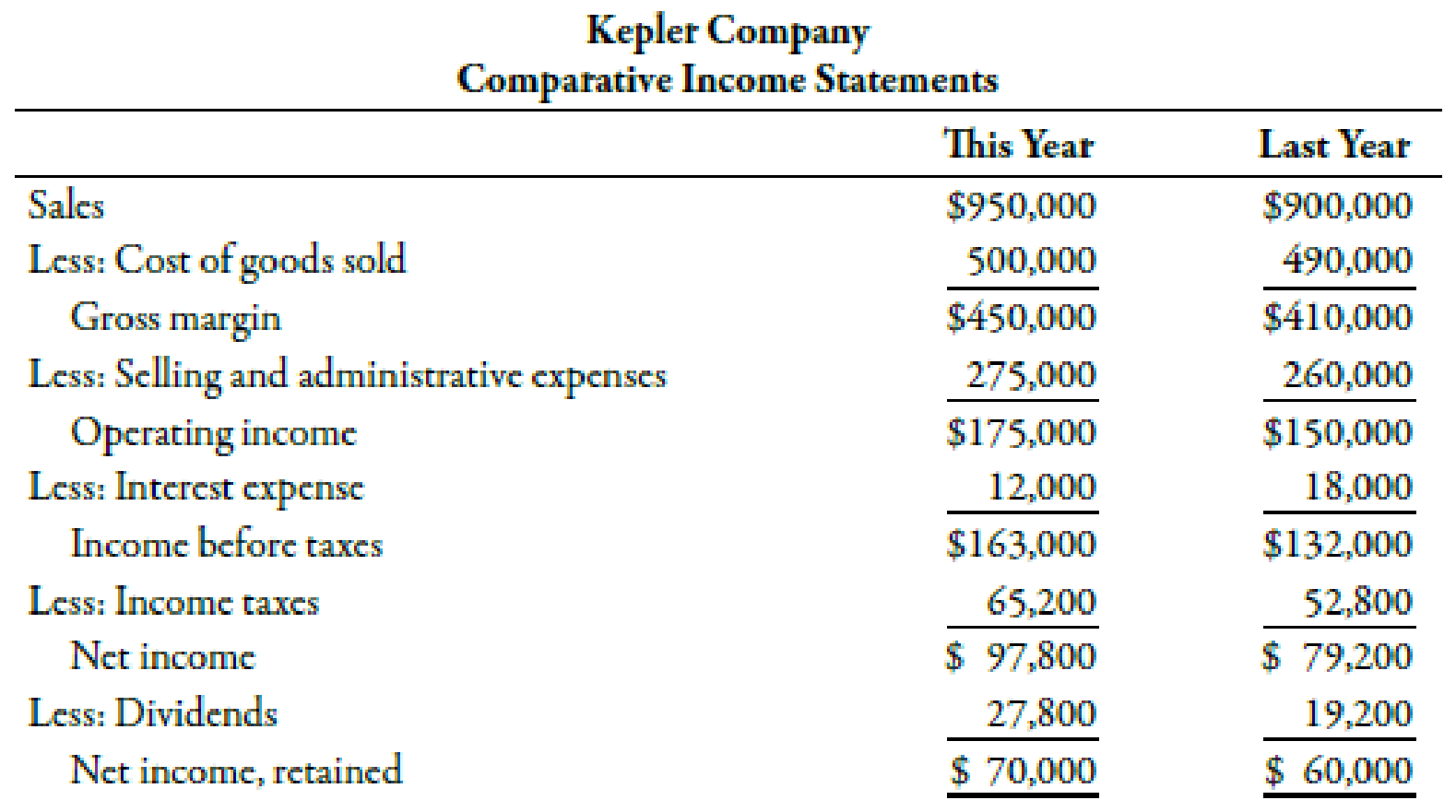

Mike Sanders is considering the purchase of Kepler Company, a firm specializing in the manufacture of office supplies. To be able to assess the financial capabilities of the company, Mike has been given the company’s financial statements for the 2 most recent years.

Required:

Note: Round all answers to two decimal places.

- 1. Compute the following for each year: (a) return on assets, (b) return on stockholders’ equity, (c) earnings per share, (d) price-earnings ratio, (e) dividend yield, and (f ) dividend payout ratio.

- 2. CONCEPTUAL CONNECTION Based on the analysis in Requirement 1, would you invest in the common stock of Kepler?

1.

Calculate the return on assets, return on stockholders’ equity, earnings per share, price earnings ratio, dividend yield and dividend payout ratio.

Explanation of Solution

Profitability Ratio:

These ratios evaluate a firm’s ability to earn profits. They help the stakeholders of the company to measure the degree to which funds invested by them are efficiently used. Some of the ratios calculated return on sales, total assets and stockholder’s equity.

(a)

Use the following formula to calculate the value of return on assets of this year:

Substitute $97,800 for net income, $12,000 for interest expense, 40% for tax rate and $965,000 for average total assets in the above formula.

Therefore, the value of return on assets is 0.11.

Use the following formula to calculate the value of return on assets of last year:

Substitute $97,880 for net income, $12,000 for interest expense, 40% for tax rate and $965,000 for average total assets in the above formula.

Therefore, the value of return on assets is 0.11.

(b)

Use the following formula to calculate the value of return on stockholder’s equity of this year:

Substitute $97,880 for net income, $0 for preference dividend and $365,000 for average common stockholder’s equity in the above formula.

Therefore, the value of return on stockholder’s equity is 0.27.

Use the following formula to calculate the value of return on stockholder’s equity of last year:

Substitute $79,220 for net income, $0 for preference dividend and $330,000 for average common stockholder’s equity in the above formula.

Therefore, the value of return on stockholder’s equity is 0.24.

(c)

Use the following formula to calculate the value of return on earnings per share of this year:

Substitute $97,800 for net income, $0 for preference dividend and 100,000 for average common shares in the above formula.

Therefore, the value of earnings per share is $0.98 per share.

Use the following formula to calculate the value of earnings per share of last year:

Substitute $79,200 for net income, $0 for preference dividend and 100,000 for average common shares in the above formula.

Therefore, the value of earnings per share is $0.79 per share.

(d)

Use the following formula to calculate the price-earnings ratio of this year:

Substitute $2.98 for market price per share and $0.98 for earnings per share in the above formula.

Therefore, the value of price-earnings ratio is 3.04.

Use the following formula to calculate the price-earnings ratio of last year:

Substitute $2.98 for market price per share and $0.79 for earnings per share in the above formula.

Therefore, the value of price-earnings ratio is 3.77.

(e)

Use the following formula to calculate the value of dividend yield of this year:

Substitute $0.278 for dividend per common shares, and $2.98 for market price per common share in the above formula.

Therefore, the value of dividend yield is 0.0933 or 9.33%.

Use the following formula to calculate the value of dividend yield of last year:

Substitute $0.192 for dividend per common shares, and $2.98 for market price per common share in the above formula.

Therefore, the value of dividend yield is 0.0644 or 6.44%.

(f)

Use the following formula to calculate the value of dividend payout ratio of this year:

Substitute $27,800 for common dividend, $97,800 for net income and $0 for preference dividend in the above formula.

Therefore, the value of dividend payout ratio is 0.28.

Use the following formula to calculate the value of dividend payout ratio of last year:

Substitute $19,200 for common dividend, $79,200 for net income and $0 for preference dividend in the above formula.

Therefore, the value of dividend payout ratio is 0.24.

Working Note:

1. Calculation of interest expense:

2. Calculation of average total assets of this year:

3. Calculation of average total assets of last year:

4. Calculation of average common stockholder’s equity of this year:

5. Calculation of average common stockholder’s equity of last year:

6. Calculation of earnings per share for this year:

7. Calculation of earnings per share for last year:

8. Calculation of dividends common shares of this year:

9. Calculation of dividends common shares of last year:

2.

Identify whether an individual should invest in Company KE on the basis of above calculations.

Explanation of Solution

The value of return on assets has remained more or less same but other ratios such as return on equity, earning per share, dividend yield and dividend payout ratio have increased. On the other hand, the price earnings ratio decreased considerably. Computation of profitability ratios have provided mixed results. An individual needs other information as well for making an investment decisions. Other information includes the comparison report of rate of return with the other companies and past data of dividend payout ratio to analyze the growth trend of the company.

Want to see more full solutions like this?

Chapter 15 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- Kindly help me with accounting questionsarrow_forwardA firm has an asset with a market value of $10,000 and a book value of $4,000. If its marginal tax rate is 25%, what will the net proceeds from selling the asset be? Financial accounting problemarrow_forwardEverwood Manufacturing uses a predetermined overhead rate based on direct labor hours to apply manufacturing overhead to jobs. The company estimated total overhead costs of $9,500,000 and total direct labor hours of 190,000 hours for the year. Requirements: 1. Compute the predetermined overhead rate. 2. If actual direct labor hours worked were 195,000 hours, calculate the total applied overhead. 3. If the actual overhead incurred was $9,800,000, determine whether the company has overapplied or underapplied overhead, and by how much.arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College