Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 25BEB

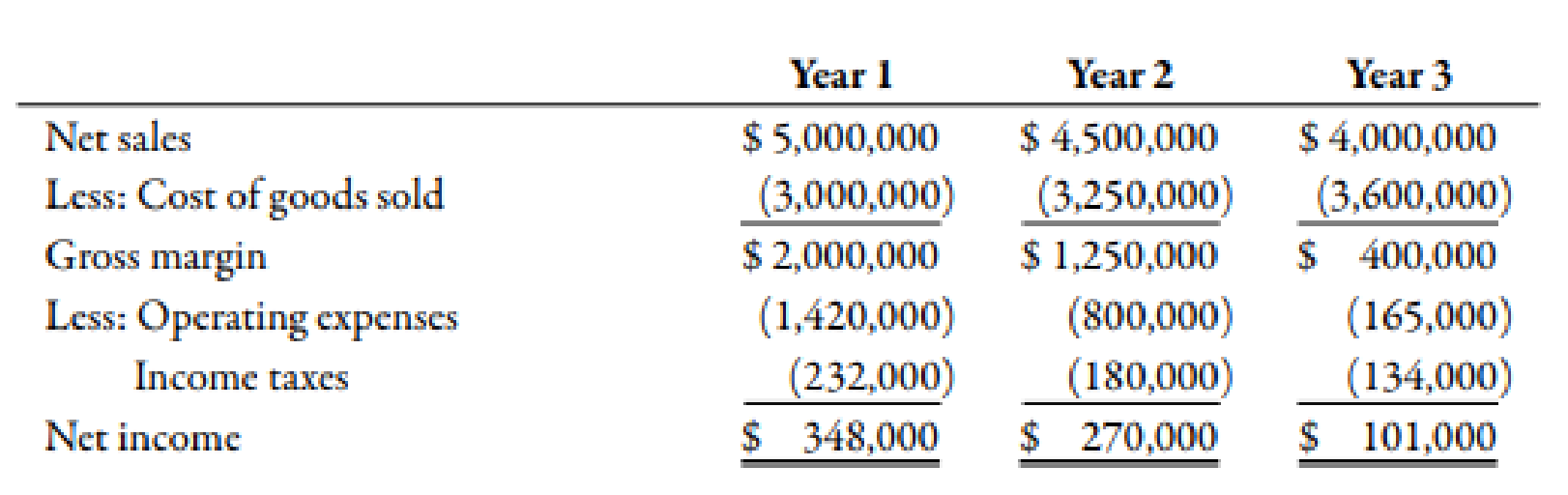

Jasmine Company provided the following income statements for its first 3 years of operation:

Refer to the information for Jasmine Company above.

Required:

Prepare common-size income statements by using net sales as the base. (Note: Round answers to the nearest whole percentage.)

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

What is the total after tax cash flow that will result from selling this asset on these financial accounting question?

Allowance for Doubtful Accounts has a debit balance of $2,900 at the end of the year, before adjustments. If an analysis of receivables indicates doubtful accounts of $36,000, what will be the amount of the appropriate adjusting entry? [Need The adjusting entry in Table format]

Calculate the gross profit ?

Chapter 15 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

Ch. 15 - Name the two major types of financial statement...Ch. 15 - Prob. 2DQCh. 15 - Explain how creditors, investors, and managers can...Ch. 15 - What are liquidity ratios? Leverage ratios?...Ch. 15 - Prob. 5DQCh. 15 - Prob. 6DQCh. 15 - Prob. 7DQCh. 15 - A high inventory turnover ratio provides evidence...Ch. 15 - A loan agreement between a bank and a customer...Ch. 15 - Prob. 10DQ

Ch. 15 - Explain why an investor would be interested in a...Ch. 15 - Prob. 12DQCh. 15 - Prob. 13DQCh. 15 - When a company participates in a stock buyback...Ch. 15 - Explain the significance of the inventory turnover...Ch. 15 - In a JIT manufacturing environment, the current...Ch. 15 - Prob. 1MCQCh. 15 - Prob. 2MCQCh. 15 - Fractions or percentages computed by dividing one...Ch. 15 - Prob. 4MCQCh. 15 - Pedee Companys inventory turnover in days is 80...Ch. 15 - Prob. 6MCQCh. 15 - Prob. 7MCQCh. 15 - Prob. 8MCQCh. 15 - A small pizza restaurant, founded and owned by the...Ch. 15 - Prob. 10MCQCh. 15 - Prob. 11BEACh. 15 - Scherer Company provided the following income...Ch. 15 - Chen Company has current assets equal to...Ch. 15 - Last year, Nikkola Company had net sales of...Ch. 15 - Last year, Nikkola Company had net sales of...Ch. 15 - Paxton Company provided the following income...Ch. 15 - Ernst Companys balance sheet shows total...Ch. 15 - Prob. 18BEACh. 15 - Prob. 19BEACh. 15 - The income statement, statement of retained...Ch. 15 - The income statement, statement of retained...Ch. 15 - The income statement, statement of retained...Ch. 15 - The income statement, statement of retained...Ch. 15 - Jasmine Company provided the following income...Ch. 15 - Jasmine Company provided the following income...Ch. 15 - LoLo Lemon Company has current assets equal to...Ch. 15 - Last year, Tobys Hats had net sales of 45,000,000...Ch. 15 - Last year, Tobys Hats had net sales of 45,000,000...Ch. 15 - Alessandra Makeup Manufactures provided the...Ch. 15 - Klynveld Companys balance sheet shows total...Ch. 15 - Prob. 31BEBCh. 15 - Prob. 32BEBCh. 15 - The income statement, statement of retained...Ch. 15 - The income statement, statement of retained...Ch. 15 - The income statement, statement of retained...Ch. 15 - The income statement, statement of retained...Ch. 15 - Sundahl Companys income statements for the past 2...Ch. 15 - Sundahl Companys income statements for the past 2...Ch. 15 - Cuneo Companys income statements for the last 3...Ch. 15 - Cuneo Companys income statements for the last 3...Ch. 15 - Prob. 41ECh. 15 - Upton Company has current assets equal to...Ch. 15 - Montalcino Company had net sales of 54,000,000....Ch. 15 - Whalen Company had net sales of 125,500,250,000....Ch. 15 - Prob. 45ECh. 15 - Prob. 46ECh. 15 - Bryce Company manufactures pet supplies. However,...Ch. 15 - Prob. 48ECh. 15 - Prob. 49ECh. 15 - Juroe Company provided the following income...Ch. 15 - Juroe Company provided the following income...Ch. 15 - Juroe Company provided the following income...Ch. 15 - Rebert Inc. showed the following balances for last...Ch. 15 - Rebert Inc. showed the following balances for last...Ch. 15 - Rebert Inc. showed the following balances for last...Ch. 15 - The following selected information is taken from...Ch. 15 - Grammatico Company has just completed its third...Ch. 15 - The following information has been gathered for...Ch. 15 - Mike Sanders is considering the purchase of Kepler...Ch. 15 - Prob. 60PCh. 15 - Mike Sanders is considering the purchase of Kepler...Ch. 15 - Mike Sanders is considering the purchase of Kepler...Ch. 15 - Mike Sanders is considering the purchase of Kepler...Ch. 15 - Albion Inc. provided the following information for...Ch. 15 - Prob. 65PCh. 15 - Prob. 66PCh. 15 - Prob. 67C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Need help with this accounting questionsarrow_forwardNeed correct answer general accounting questionarrow_forwardThe Marshall Company has a joint production process that produces two joint products and a by-product. The joint products are Ying and Yang, and the by-product is Bit. Marshall accounts for the costs of its products using the net realizable value method. The two joint products are processed beyond the split-off point, incurring separable processing costs. There is a $1,300 disposal cost for the by- product. A summary of a recent month's activity at Marshall is shown below: Units sold Units produced Separable processing costs-variable Separable processing costs-fixed Sales price Ying 65,000 65,000 $ 182,000 Yang 52,000 52,000 Bit 13,000 13,000 $ 55,000 $ $ 13,000 $ 6.00 $ 10,000 $ - $ 12.50 $ 1.50 Total joint costs for Marshall in the recent month are $188,200, of which $80,926 is a variable cost. Required: 1. Calculate the manufacturing cost per unit for each of the three products. Note: Round manufacturing cost per unit answers to 2 decimal places. 2. Calculate the total gross margin…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License