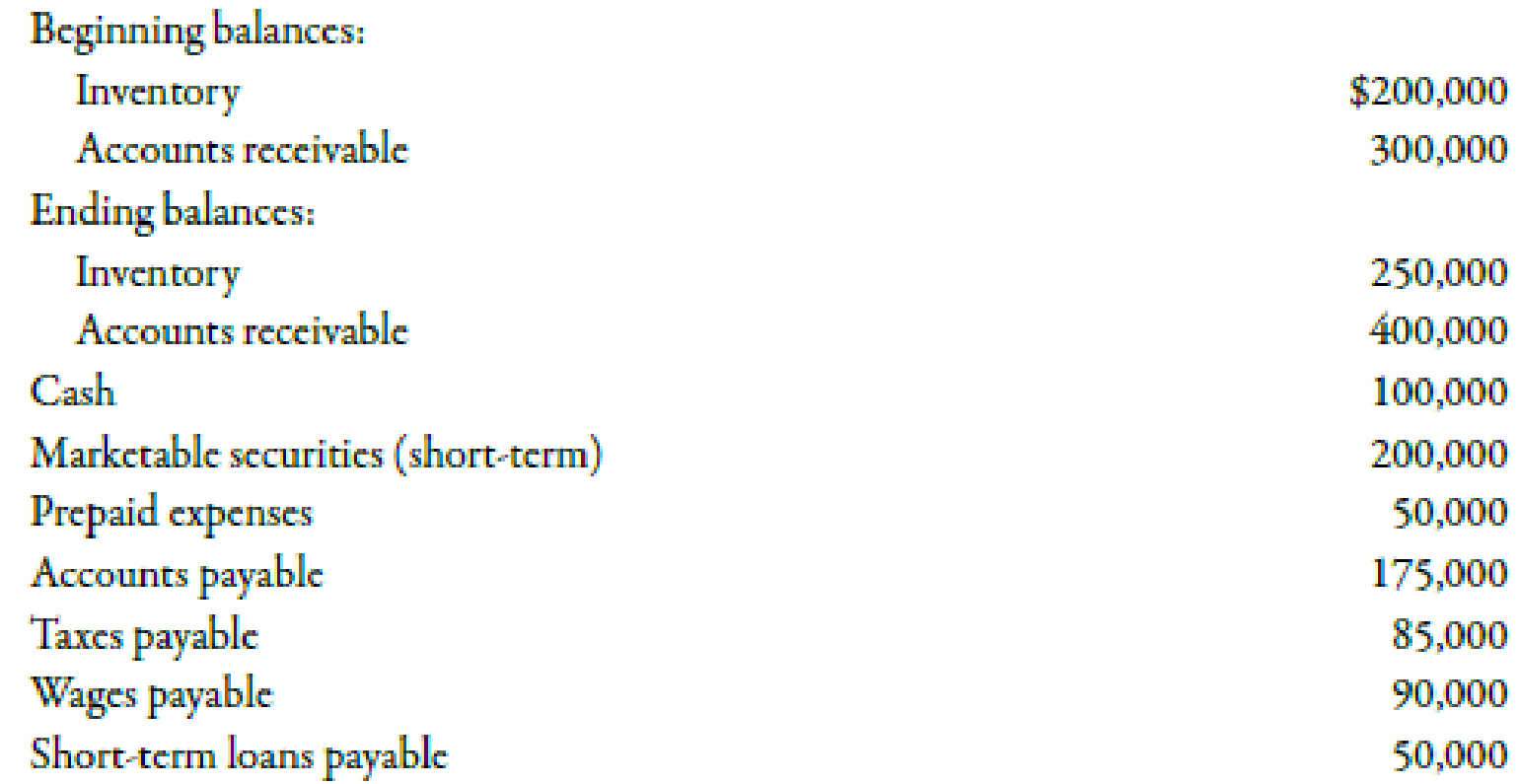

The following selected information is taken from the financial statements of Arnn Company for its most recent year of operations:

During the year, Arnn had net sales of $2.45 million. The cost of goods sold was $1.3 million.

Required:

Note: Round all answers to two decimal places.

- 1. Compute the

current ratio . - 2. Compute the quick or acid-test ratio.

- 3. Compute the

accounts receivable turnover ratio. - 4. Compute the accounts receivable turnover in days.

- 5. Compute the inventory turnover ratio.

- 6. Compute the inventory turnover in days.

1.

Calculate current ratio

Answer to Problem 56P

Current ratio is 2.5.

Explanation of Solution

Liquidity ratio

Liquidity ratios evaluate a firm’s ability to fulfil its present obligations. Some of the ratios calculated are current ratio, acid-test ratio and inventory turnover ratio.

Use the following formula to compute current ratio:

Substitute the values in the above formula:

Therefore, current ratiois 2.5.

Working notes

1. Calculation of current assets:

2. Calculation of current liabilities:

2.

Calculate quick ratio.

Answer to Problem 56P

Quick ratio is 1.75

Explanation of Solution

Use the following formula to compute quick ratio:

Substitute the values in the above formula:

Therefore, quick ratio is 1.75

Working notes

1. Calculation of quick assets:

3.

Calculate accounts receivable turnover ratio.

Answer to Problem 56P

Accounts receivable turnover ratio is 7 times.

Explanation of Solution

Use the following formula to compute accounts receivable turnover ratio:

Substitute the values in the above formula:

Therefore, accounts receivable turnover ratio is 7 times.

Working notes

1. Calculation of average accounts receivables:

4.

Calculate accounts receivable turnover in days.

Answer to Problem 56P

Accounts receivable turnover in days is 52.14 days.

Explanation of Solution

Use the following formula to compute accounts receivable turnover in days:

Substitute the values in the above formula:

Therefore, accounts receivable turnover in days is 52.14 days.

5.

Calculate inventory turnover ratio.

Answer to Problem 56P

Inventory turnover ratio is 5.78 times.

Explanation of Solution

Use the following formula to compute inventory turnover ratio:

Substitute the values in the above formula:

Therefore,

Working notes

1. Calculation of average inventory:

6.

Calculate inventory turnover in days.

Answer to Problem 56P

Inventory turnover in days is 63.15 days.

Explanation of Solution

Use the following formula to compute inventory turnover in days:

Substitute the values in the above formula:

Therefore, inventory turnover in days is 63.15 days.

Want to see more full solutions like this?

Chapter 15 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub