Concept explainers

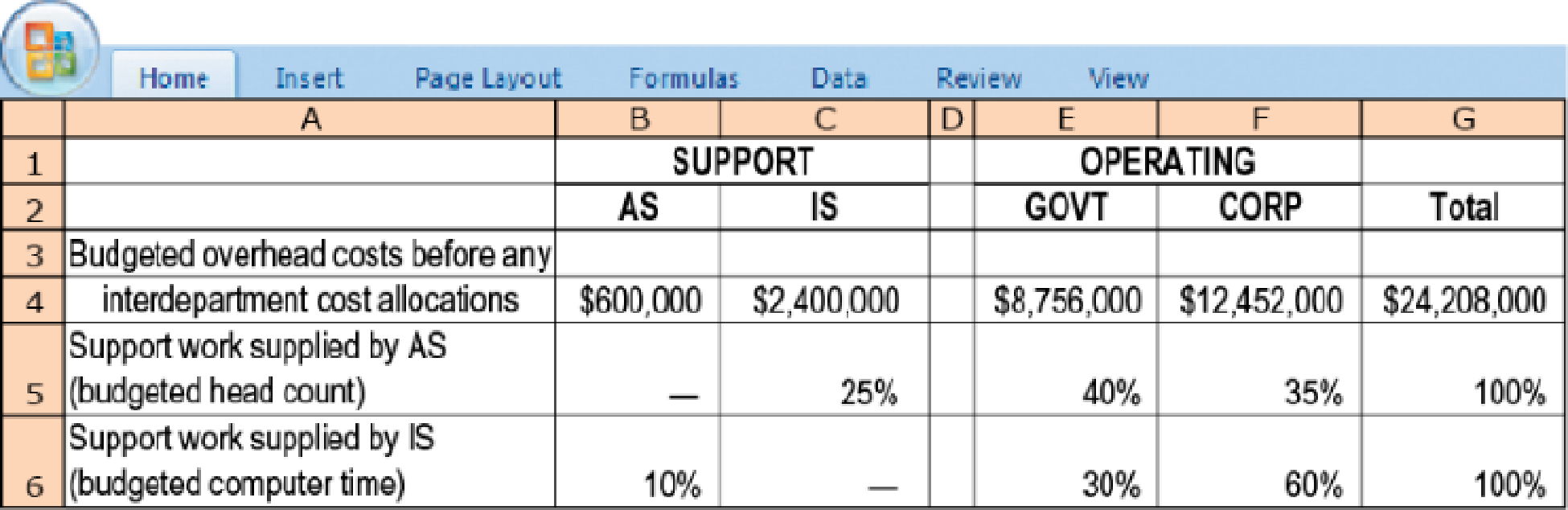

Support-department cost allocation; direct and step-down methods. Phoenix Partners provides management consulting services to government and corporate clients. Phoenix has two support departments—administrative services (AS) and information systems (IS)—and two operating departments—government consulting (GOVT) and corporate consulting (CORP). For the first quarter of 2017, Phoenix’s cost records indicate the following:

- 1. Allocate the two support departments’ costs to the two operating departments using the following methods:

Required

- a. Direct method

- b. Step-down method (allocate AS first)

- c. Step-down method (allocate IS first)

- 2. Compare and explain differences in the support-department costs allocated to each operating department.

- 3. What approaches might be used to decide the sequence in which to allocate support departments when using the step-down method?

Learn your wayIncludes step-by-step video

Chapter 15 Solutions

Horngren's Cost Accounting, Student Value Edition Plus MyLab Accounting with Pearson eText - Access Card Package (16th Edition)

Additional Business Textbook Solutions

Foundations Of Finance

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

Operations Management

Fundamentals of Management (10th Edition)

Horngren's Accounting (12th Edition)

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

- What is the present value of the tax shield on debt of this financial accounting question?arrow_forwardAnnapolis Company completes job #601 which has a standard of 520 labor hours at a standard rate of $18.70 per hour. The job was completed in 630 hours and the average actual labor rate was $18.80 per hour. What is the labor rate variance? (A negative number indicates a favorable variance and a positive number indicates an unfavorable variance.)arrow_forwardProvide calculation this question general financialarrow_forward

- Nonearrow_forwardBig Company has the following production data for January: units transferred out 30,000, and ending work in process 10,000 units that are 100% complete for materials and 45% complete for conversion costs. If unit materials cost is $3 and unit conversion cost is $5, determine the costs to be assigned to the units transferred out. a. $240,000 b. $80,000 c. $90,000 d. $150,000arrow_forwardGeneral accounting questionarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,