Concept explainers

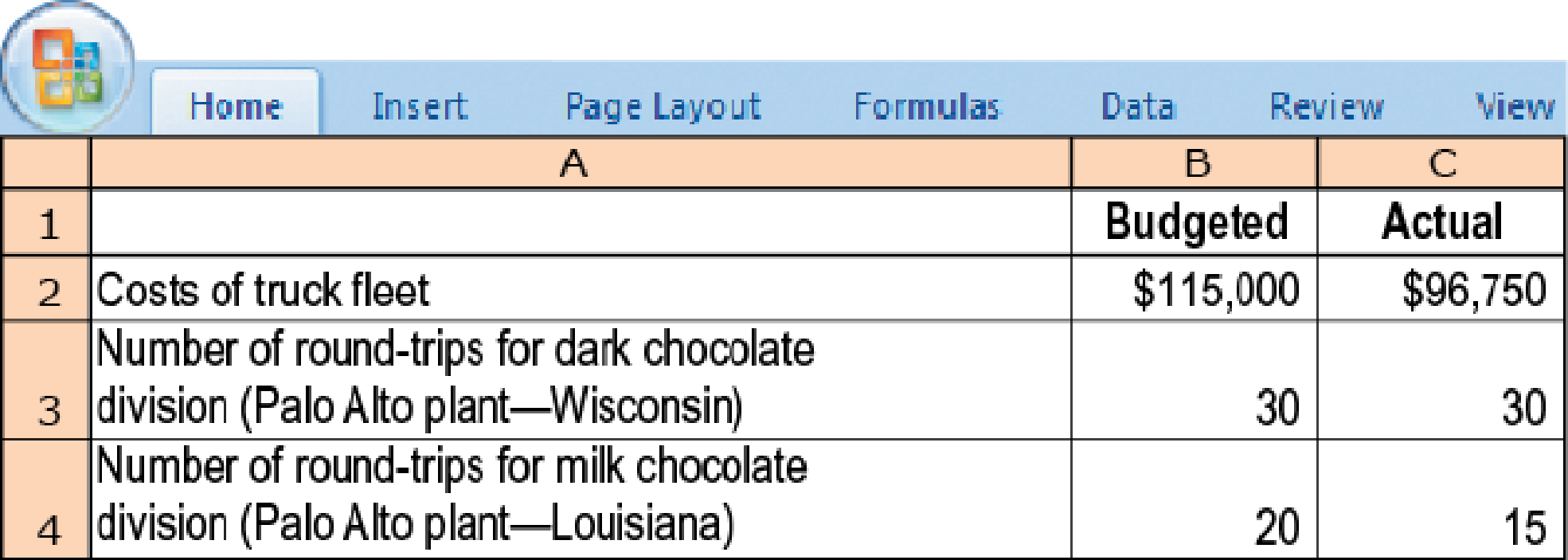

Single-rate method, budgeted versus actual costs and quantities. Chocolat Inc. is a producer of premium chocolate based in Palo Alto. The company has a separate division for each of its two products: dark chocolate and milk chocolate. Chocolat purchases ingredients from Wisconsin for its dark chocolate division and from Louisiana for its milk chocolate division. Both locations are the same distance from Chocolat’s Palo Alto plant.

Chocolat Inc. operates a fleet of trucks as a cost center that charges the divisions for variable costs (drivers and fuel) and fixed costs (vehicle

- 1. Using the single-rate method, allocate costs to the dark chocolate division and the milk chocolate division in these three ways.

- a. Calculate the budgeted rate per round-trip and allocate costs based on round-trips budgeted for each division.

- b. Calculate the budgeted rate per round-trip and allocate costs based on actual round-trips used by each division.

- c. Calculate the actual rate per round-trip and allocate costs based on actual round-trips used by each division.

- 2. Describe the advantages and disadvantages of using each of the three methods in requirement 1. Would you encourage Chocolat Inc. to use one of these methods? Explain and indicate any assumptions you made.

Want to see the full answer?

Check out a sample textbook solution

Chapter 15 Solutions

Horngren's Cost Accounting, Student Value Edition Plus MyLab Accounting with Pearson eText - Access Card Package (16th Edition)

- Cran Health Products is a cranberry cooperative that operates two divisions, a harvesting division and a processing division. Currently, all of harvesting’s output is converted into cranberry juice by the processing division, and the juice is sold to large beverage companies that produce cranberry juice blends. The processing division has a yield of 500 gallons of juice per 1,000 pounds of cranberries. Cost and market price data for the two divisions are as follows: Assume that Pat Borges, CEO of Cran Health, had mandated a transfer price equal to 225% of full cost. Now he decides to decentralize some management decisions and sends around a memo that states the following: “Effective immediately, each division of Cran Health is free to make its own decisions regarding the purchase of direct materials and the sale of finished products.” Q. Borges feels that a dual transfer-pricing policy will improve goal congruence. He suggests that transfers out of the harvesting division be made at…arrow_forwardThe Mandalorian Company has two divisions, Production and Marketing. Production manufactures Beskar Head Armour for Knights of the Old Republic, which it sells to both the Marketing Division and to other retailers (the latter under a different brand name). Marketing operates several small armour stores in shopping centers throughout Corruscant. Marketing sells both Beskar Head Armour and other brands. Relevant facts for Production are as follows: Sales Price to Outsiders.............................................................$28.50 per Pcs Variable Cost to Produce...........................................................$18.00 per Pcs Fixed Costs ................................................................................$100,000 per Month The following data pertain to the sale of Mandalorian Company Beskar Head Armour by Marketing: Marketing is operating far below its capacity. Sales…arrow_forwardThe Mandalorian Company has two divisions, Production and Marketing. Production manufactures Beskar Head Armour for Knights of the Old Republic, which it sells to both the Marketing Division and to other retailers (the latter under a different brand name). Marketing operates several small armour stores in shopping centers throughout Corruscant. Marketing sells both Beskar Head Armour and other brands. Relevant facts for Production are as follows: Sales Price to Outsiders.............................................................$28.50 per Pcs Variable Cost to Produce...........................................................$18.00 per Pcs Fixed Costs ................................................................................$100,000 per Month The following data pertain to the sale of Mandalorian Company Beskar Head Armour by Marketing: Marketing is operating far below its capacity. Sales…arrow_forward

- Cran Health Products is a cranberry cooperative that operates two divisions, a harvesting division and a processing division. Currently, all of harvesting’s output is converted into cranberry juice by the processing division, and the juice is sold to large beverage companies that produce cranberry juice blends. The processing division has a yield of 500 gallons of juice per 1,000 pounds of cranberries. Cost and market price data for the two divisions are as follows: Q.Compute Cran Health’s operating income from harvesting 480,000 pounds of cranberries during June 2017 and processing them into juice.arrow_forwardSignature Scents has two divisions: the Cologne Division and the Bottle Division. The Bottle Division produces containers that can be used by the Cologne Division. The Bottle Division's variable manufacturing cost is $2, shipping cost is $0.10, and the external sales price is $3. No shipping costs are incurred on sales to the Cologne Division, and the Cologne Division can purchase similar containers in the external market for $2.60.The Bottle Division has sufficient capacity to meet all external market demands in addition to meeting the demands of the Cologne Division. Using the general rule, the transfer price from the Bottle Division to the Cologne Division would be: Select one: a. $2.00. b. $2.10. c. $2.60. d. $2.90. e. $3.00.arrow_forwardSpringer Company produces and sells home-ground wheat flour. The flour mill division sells to the general public in its outlet store located at the mill. The mill division also is the supplier of flour for its bakery division located across the street from the flour mill. The following information has been collected by Springer’s controller: Production capacity 20,000 pounds Selling price $0.90 per pound Variable production cost $0.20 per pound Variable selling cost $0.08 per pound Number of pounds needed by the bakery 6,000 If the flour mill transfers flour to the baker, it can avoid $0.03 of the variable selling cost. Required: a. if the flour mill can only sell 12,000 pounds at its outlet store to outside customers, what is the lowest acceptable transfer price per pound that the flour mill division should accept? b. If the flour mill can sell all 20,000 pounds at its outlet store to outside customers, what is the lowest acceptable transfer price per pound the flour mill division…arrow_forward

- Coffee Bean Incorporated (CBI) processes and distributes high-quality coffee. CBI buys coffee beans from around the world and roasts, blends, and packages them for resale. Currently, the firm offers 2 coffees to gourmet shops in 1-pound bags. The major cost is direct materials; however, a substantial amount of factory overhead is incurred in the predominantly automated roasting and packing process. The company uses relatively little direct labor. CBI prices its coffee at full product cost, including allocated overhead, plus a markup of 30%. If its prices are significantly higher than the market, CBI lowers its prices. The company competes primarily on the quality of its products, but customers are price conscious as well. Data for the current budget include factory overhead of $3,238,000, which has been allocated on the basis of each product’s direct labor cost. The budgeted direct labor cost for the current year totals $600,000. The firm budgeted $6,000,000 for purchase and use of…arrow_forwardCoffee Bean Incorporated (CBI) processes and distributes high-quality coffee. CBI buys coffee beans from around the world and roasts, blends, and packages them for resale. Currently, the firm offers 2 coffees to gourmet shops in 1-pound bags. The major cost is direct materials; however, a substantial amount of factory overhead is incurred in the predominantly automated roasting and packing process. The company uses relatively little direct labor. CBI prices its coffee at full product cost, including allocated overhead, plus a markup of 30%. If its prices are significantly higher than the market, CBI lowers its prices. The company competes primarily on the quality of its products, but customers are price conscious as well. Data for the current budget include factory overhead of $3,140,000, which has been allocated on the basis of each product's direct labor cost. The budgeted direct labor cost for the current year totals $600,000. The firm budgeted $6,000,000 for purchase and use of…arrow_forwardCoffee Bean Incorporated (CBI) processes and distributes high-quality coffee. CBI buys coffee beans from around the world and roasts, blends, and packages them for resale. Currently, the firm offers 2 coffees to gourmet shops in 1-pound bags. The major cost is direct materials; however, a substantial amount of factory overhead is incurred in the predominantly automated roasting and packing process. The company uses relatively little direct labor. CBI prices its coffee at full product cost, including allocated overhead, plus a markup of 30%. If Its prices are significantly higher than the market, CBI lowers its prices. The company competes primarily on the quality of its products, but customers are price conscious as well. Data for the current budget Include factory overhead of $3,056,000, which has been allocated on the basis of each product's direct labor cost. The budgeted direct labor cost for the current year totals $600,000. The firm budgeted $6,000,000 for purchase and use of…arrow_forward

- Coffee Bean Incorporated (CBI) processes and distributes high-quality coffee. CBI buys coffee beans from around the world and roasts, blends, and packages them for resale. Currently, the firm offers 2 coffees to gourmet shops in 1-pound bags. The major cost is direct materials; however, a substantial amount of factory overhead is incurred in the predominantly automated roasting and packing process. The company uses relatively little direct labor. CBI prices its coffee at full product cost, including allocated overhead, plus a markup of 30%. If its prices are significantly higher than the market, CBI lowers its prices. The company competes primarily on the quality of its products, but customers are price conscious as well Data for the current budget include factory overhead of $3,028,000, which has been allocated on the basis of each product's direct labor cost. The budgeted direct labor cost for the current year totals $600,000. The firm budgeted $6,000,000 for purchase and use of…arrow_forwardCoffee Bean Incorporated (CBI) processes and distributes high-quality coffee. CBI buys coffee beans from around the world and roasts, blends, and packages them for resale. Currently, the firm offers 2 coffees to gourmet shops in 1-pound bags. The major cost is direct materials; however, a substantial amount of factory overhead is incurred in the predominantly automated roasting and packing process. The company uses relatively little direct labor. CBI prices its coffee at full product cost, including allocated overhead, plus a markup of 30%. If its prices are significantly higher than the market, CBI lowers its prices. The company competes primarily on the quality of its products, but customers are price conscious as well. Data for the current budget include factory overhead of $3,168,000, which has been allocated on the basis of each product's direct labor cost. The budgeted direct labor cost for the current year totals $600,000. The firm budgeted $6,000,000 for purchase and use of…arrow_forwardCoffee Bean Incorporated (CBI) processes and distributes high-quality coffee. CBI buys coffee beans from around the world and roasts, blends, and packages them for resale. Currently, the firm offers 2 coffees to gourmet shops in 1-pound bags. The major cost is direct materials; however, a substantial amount of factory overhead is incurred in the predominantly automated roasting and packing process. The company uses relatively little direct labor. CBI prices its coffee at full product cost, including allocated overhead, plus a markup of 30%. If its prices are significantly higher than the market, CBI lowers its prices. The company competes primarily on the quality of its products, but customers are price conscious as well. Data for the current budget include factory overhead of $3,126,000, which has been allocated on the basis of each product's direct labor cost. The budgeted direct labor cost for the current year totals $600,000. The firm budgeted $6,000,000 for purchase and use of…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning