Concept explainers

Fixed-cost allocation. Central University completed construction of its newest administrative building at the end of 2017. The University’s first employees moved into the building on January 1, 2018. The building consists of office space, common meeting rooms (including a conference center), a cafeteria, and even a workout room for its exercise enthusiasts. The total 2018 building space of 250,000 square feet was utilized as follows:

| Usage of Space | % of Total Building Space |

| Office space (occupied) | 52% |

| Vacant office space | 8% |

| Common area and meeting space | 17% |

| Workout room | 8% |

| Cafeteria | 15% |

The new building cost the university $40 million and was

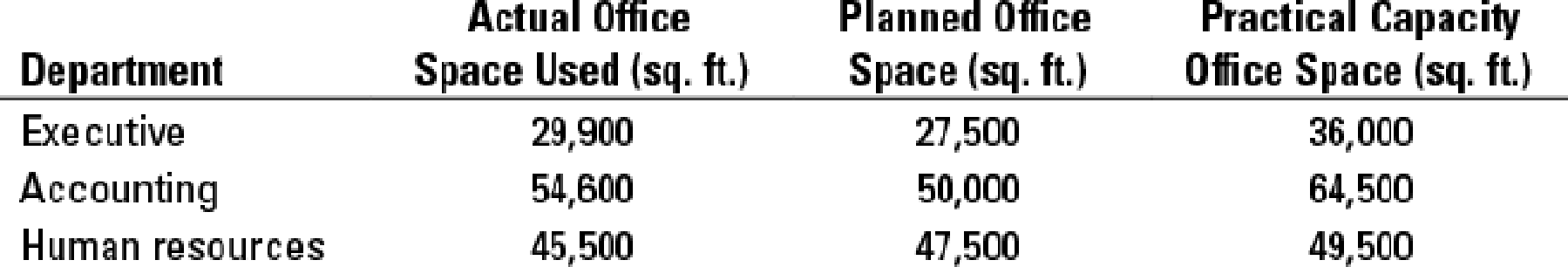

- 1. How much of the total annual building cost of $2,000,000 will be allocated in 2018 to each of the departments, if the cost is allocated to each department on the basis of the following?

- a. Actual usage of the three departments

- b. Planned office space of the three departments

- c. Practical capacity of the three departments

- 2. Assume that Central University allocates the total annual building cost of $2,000,000 in the following manner:

- a. All vacant office space is absorbed by the university and is not allocated to the departments.

- b. All occupied office space costs are allocated on the basis of actual square footage used by each department.

- c. All common area costs are allocated on the basis of a department’s practical capacity. Calculate the cost allocated to each department in 2018 under this plan. Do you think the allocation method used here is appropriate? Explain.

Want to see the full answer?

Check out a sample textbook solution

Chapter 15 Solutions

Horngren's Cost Accounting, Student Value Edition Plus MyLab Accounting with Pearson eText - Access Card Package (16th Edition)

- What will be the monthly payment on the loan for this general accounting question?arrow_forwardPettis needs to determine its year-end inventory. The warehouse contains 27,000 units, of which 3,700 were damaged by flood and cannot be sold. Another 2,700 units were purchased and shipped to FOB destination, and are in transit. The company also consigns goods and has 4,700 units at a consignee's location. How many units should Pettis include in its year-end inventory? A. 34,400 B. 25,300 C. 30,700 D. 38,100 E. 28,000arrow_forwardfinancial accounting questionarrow_forward

- The total cost that would be recorded on the job cost sheet for Job 593 would be:arrow_forwardSusan Mitchell Law Firm purchases $1,000 worth of office equipment on account. This causes: A. Cash and Mitchell, Capital to decrease by $1,000 B. Office Equipment and Accounts Payable to increase by $1,000 C. Office Equipment to decrease and Accounts Payable to increase by $1,000 D. Accounts Payable to increase and Mitchell, Capital to decrease by $1,000arrow_forwardgeneral account answer needarrow_forward

- Please need answer the general accounting questionarrow_forwardAnswer? ? Financial accounting questionarrow_forwardThe following data relate to direct materials costs for February: Materials cost per yard: standard, $1.98; actual, $2.04 Standard yards per unit: standard, 4.74 yards; actual, 5.14 yards Units of production: 9,300 Calculate the direct materials price variance. a. $558.00 unfavorable b. $2,644.92 favorable c. $2,868.12 favorable d. $2,868.12 unfavorablearrow_forward

- At October 1, Bonita company reported owners equity of $70,000. During October, the owner made additional investments of $4,300 and the company earned a net income of $13,900. If the owner's equity at October 31 totals $80,700, what amount of owner's drawings were made during the month?arrow_forwardGeneral Account - At October 1, Bonita company reported owners equity of $70,000. During October, the owner made additional investments of $4,300 and the company earned a net income of $13,900. If the owner's equity at October 31 totals $80,700, what amount of owner's drawings were made during the month?arrow_forwardWhat is the total amount of capital raised on these financial accounting question?arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning