Concept explainers

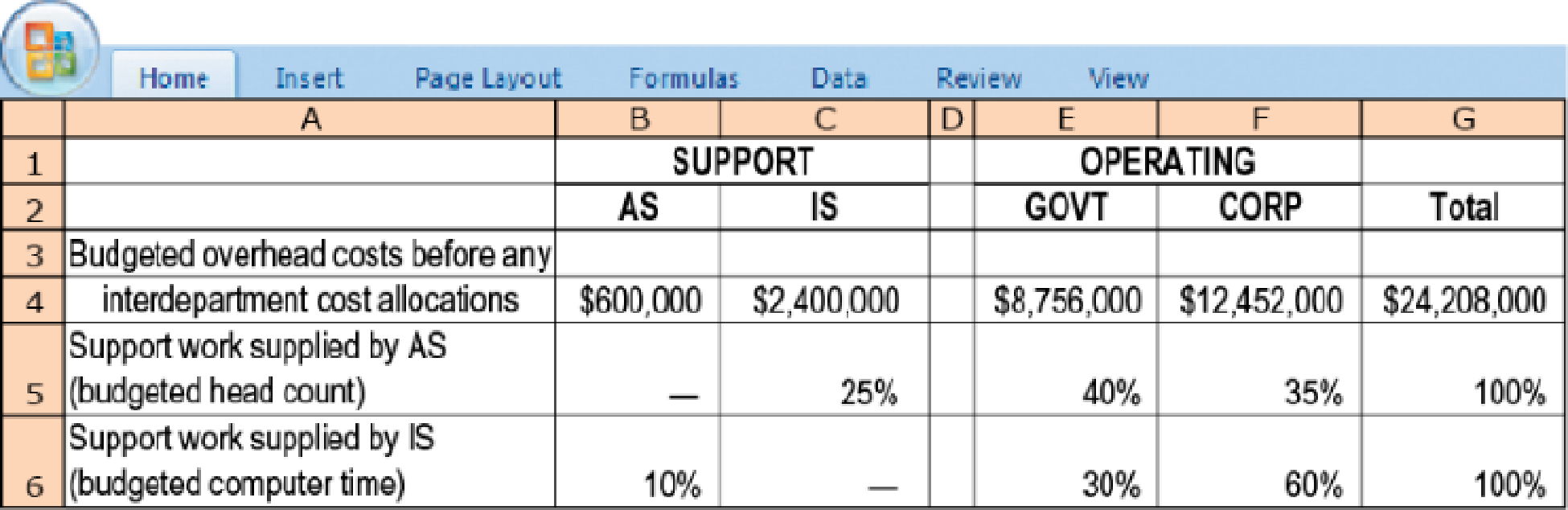

Support-department cost allocation; direct and step-down methods. Phoenix Partners provides management consulting services to government and corporate clients. Phoenix has two support departments—administrative services (AS) and information systems (IS)—and two operating departments—government consulting (GOVT) and corporate consulting (CORP). For the first quarter of 2017, Phoenix’s cost records indicate the following:

- 1. Allocate the two support departments’ costs to the two operating departments using the following methods:

Required

- a. Direct method

- b. Step-down method (allocate AS first)

- c. Step-down method (allocate IS first)

- 2. Compare and explain differences in the support-department costs allocated to each operating department.

- 3. What approaches might be used to decide the sequence in which to allocate support departments when using the step-down method?

Learn your wayIncludes step-by-step video

Chapter 15 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Additional Business Textbook Solutions

Foundations Of Finance

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

Operations Management

Fundamentals of Management (10th Edition)

Horngren's Accounting (12th Edition)

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

- Alderon Ltd. has 1,200 defective units of a product that cost $3.50 per unit in direct costs and $7.10 per unit in indirect costs when produced last year. The units can be sold as scrap for $4.80 per unit or reworked at an additional cost of $3.10 per unit and sold at the full price of $13.50. The incremental net income (loss) from the choice of reworking the units would be____.arrow_forwardMangesh Analytics, Inc. sells earnings forecasts for European securities. Its credit terms are 2/15, net 40. Based on experience, 60 percent of all customers will take the discount. What is the average collection period? Need answerarrow_forwardWhat would be the cost per equivalent unit ?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,