Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

16th Edition

ISBN: 9780134475585

Author: Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 15.25E

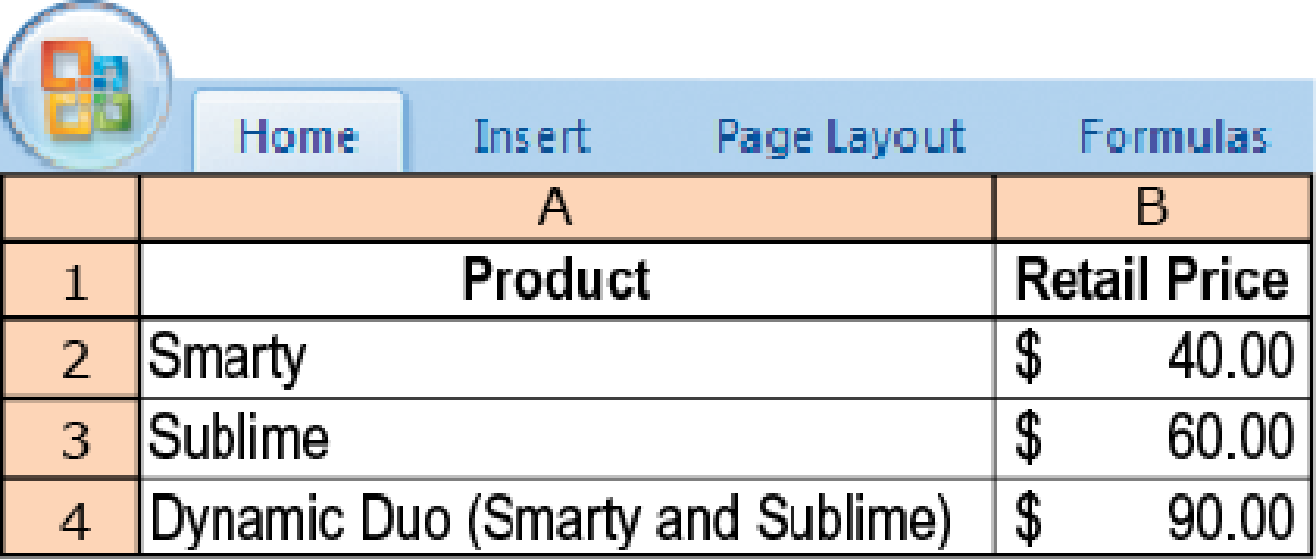

Revenue allocation, bundled products. Couture Corp sells Samsung 7 cases. It has a Men’s Division and a Women’s Division. Couture is now considering the sale of a bundled product called Dynamic Duo consisting of Smarty, a men’s case, and Sublime, a women’s case. For the most recent year, Couture sold equal quantities of Smarty and Sublime and reported the following:

- 1. Allocate revenue from the sale of each unit of Dynamic Duo to Smarty and Sublime using the following: Required

- a. The stand-alone revenue-allocation method based on selling price of each product

- b. The incremental revenue-allocation method, with Smarty ranked as the primary product

- c. The incremental revenue-allocation method, with Sublime ranked as the primary product

- d. The Shapley value method

- 2. Of the four methods in requirement 1, which one would you recommend for allocating Couture’s revenues to Smarty and Sublime? Explain.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

General accounting

Helen is a sole trader who runs a small bakery. She wants to prepare a cash budget for the first quarter

of the year (January to March) to manage her cash flows. You are provided with the following details:

1. Budgeted sales:

November

£10,000

December

£12,000

January

£15,000

February

£16,000

March

£18,000

40% of sales are cash sales, and the remaining 60% are credit sales. Credit customers pay 50% of

their balance in the month following the sale and the remaining 50% two months after the sale.

2. Purchases each month are 60% of sales for that month. Helen purchases on credit and pays her

suppliers 50% in the month following the purchase, and the remaining 50% two months later.

3. Helen plans to purchase new equipment worth £5,000 in February, payable in March.

4. Helen will make drawings of £500 per month starting in January.

5. The budgeted expenses figures for the three months as follows:

Rent

Salaries

Utilities

Other expenses

January

£2,000

£1,500

£500

£1,250

February

March

£2,000…

?!

Chapter 15 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Ch. 15 - Prob. 15.1QCh. 15 - Describe how the dual-rate method is useful to...Ch. 15 - How do budgeted cost rates motivate the...Ch. 15 - Give examples of allocation bases used to allocate...Ch. 15 - Why might a manager prefer that budgeted rather...Ch. 15 - To ensure unbiased cost allocations, fixed costs...Ch. 15 - Prob. 15.7QCh. 15 - What is conceptually the most defensible method...Ch. 15 - Distinguish between two methods of allocating...Ch. 15 - What are the challenges of using the incremental...

Ch. 15 - Prob. 15.11QCh. 15 - What is one key way to reduce cost-allocation...Ch. 15 - Describe how companies are increasingly facing...Ch. 15 - Distinguish between the stand-alone and the...Ch. 15 - Identify and discuss arguments that individual...Ch. 15 - Single-rate versus dual-rate methods, support...Ch. 15 - Single-rate method, budgeted versus actual costs...Ch. 15 - Dual-rate method, budgeted versus actual costs and...Ch. 15 - Support-department cost allocation; direct and...Ch. 15 - Support-department cost allocation, reciprocal...Ch. 15 - Direct and step-down allocation. E-books, an...Ch. 15 - Reciprocal cost allocation (continuation of...Ch. 15 - Allocation of common costs. Evan and Brett are...Ch. 15 - Allocation of common costs. Gordon Grimes, a...Ch. 15 - Revenue allocation, bundled products. Couture Corp...Ch. 15 - Allocation of common costs. Jim Dandy Auto Sales...Ch. 15 - Single-rate, dual-rate, and practical capacity...Ch. 15 - Prob. 15.28PCh. 15 - Fixed-cost allocation. Central University...Ch. 15 - Allocating costs of support departments; step-down...Ch. 15 - Support-department cost allocations;...Ch. 15 - Common costs. Tate Inc. and Booth Inc. are two...Ch. 15 - Prob. 15.33PCh. 15 - Support-department cost allocations;...Ch. 15 - Revenue allocation, bundled products. Boca Resorts...Ch. 15 - Support-department cost allocations; direct,...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Upton Ltd is a manufacturing company that plans to make 300 chairs and 100 tables with the following estimated costs: Direct labour Direct materials Fixed overheads Required: Chairs Tables £ £ 12,000 10,000 22,500 16,000 75,000 75,000 a) If the chairs are sold for £500 each, and tables are sold for £300 each, how many chairs and tables does Upton Ltd need to sell to break-even? b) What profit/loss is made if the planned sales level of chairs and tables is achieved?arrow_forwardShockglass Company had a beginning inventory of $16,000. During the year, the company recorded inventory purchases of $55,000 and a cost of goods sold of $52,000. The ending inventory is: A. $28,000 B. $27,000 C. $19,000 D. $26,000arrow_forwardDuring its first month of operation, Peter's Auto Supply Corporation, which specializes the sale of auto equipment and supplies, completed the following transactions. July Transactions July 1 Issued Common Stock in exchange for $100,000 cash. July 1 Paid $4,000 rent for the months of July and August July 2 Paid the insurance company $2,400 for a one year insurance policy, beginning July 1. July 5 Purchased inventory on account for $35,000 (Assume that the perpetual inventory system is used.) July 6 Borrowed $36,500 from a local bank and signed a note. The interest rate is 10%, and principal and interest is due to be repaid in six months. July 8 Sold inventory on account for $17,000. The cost of the inventory is $7,000. July 15 Paid employees $6,000 salaries for the first half of the month. July 18 Sold inventory for $15,000 cash. The cost of the inventory was $6,000. July 20 Paid $15,000 to suppliers for the inventory purchased on January 5. July 26…arrow_forward

- ??arrow_forwardGeneral accountingarrow_forwardUse the Following Data: Assets Liabilities Beginning of Year $25,000 $ 17,000 End of Year $ 62,000 $27,000 1. What is the equity at the beginning of the year? 2. What is the equity at the end of the year? 3. If the owner contributes $9,600 and the owner withdraws $40,200, how much is net income (loss)? 4. If net income is $2,600 and owner withdrawals are $7,600, how much did the owner contribute (owner, capital)?arrow_forward

- Purrfect Pets uses the perpetual inventory system. At the beginning of the quarter, Purrfect Pets has $35,000 in inventory. During the quarter, the company purchased, $8,650 of new inventory from a vendor, returned $1,200 of inventory to the vendor, and took advantage of discounts from the vendor of $250. At the end of the quarter, the balance in inventory is $29,000 What is the cost of goods sold? A. $6,000 B. $14,650 C. $14,650 D. $13,200 E. $15,150arrow_forwardHow much must Johnson include in her gross income??arrow_forwardwanted general account answer. help me to find.arrow_forward

- Prepare Helen’s cash budget for the months of January to March.arrow_forwardPeabody Enterprises Peabody Enterprises prepared the following sales budget: Month Budgeted Sales March $ 5,890 April $ 13,152 May $ 12,045 June $14,279 The expected gross profit rate is 40% and the inventory at the end of February was $10,000. Desired inventory levels at the end of the month are 20% of the next month's cost of goods sold. What is the budgeted ending inventory for May in dollars?arrow_forwardSub: Accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Profitability index; Author: The Finance Storyteller;https://www.youtube.com/watch?v=Md5ocNqKHq8;License: Standard Youtube License