Concept explainers

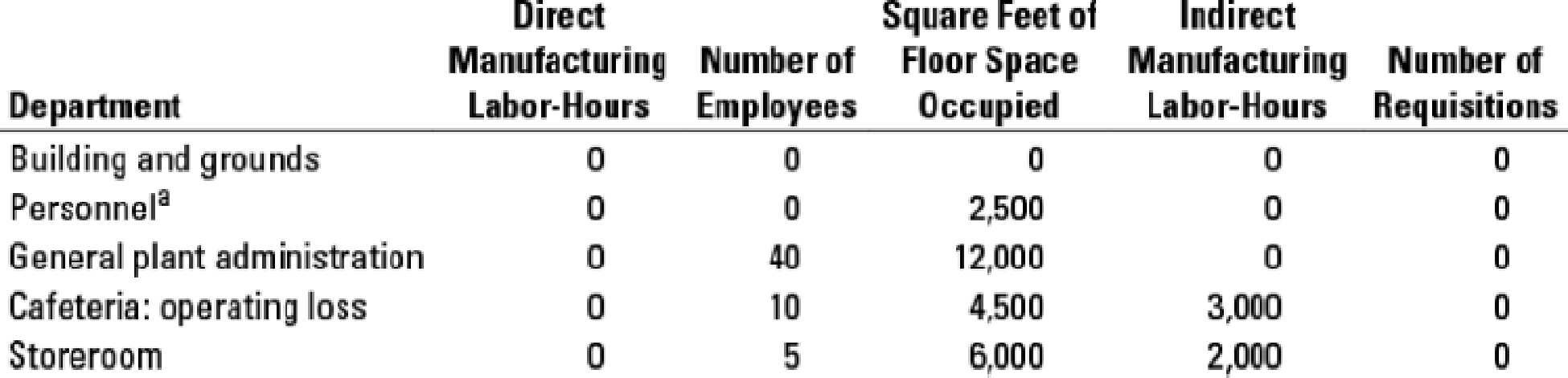

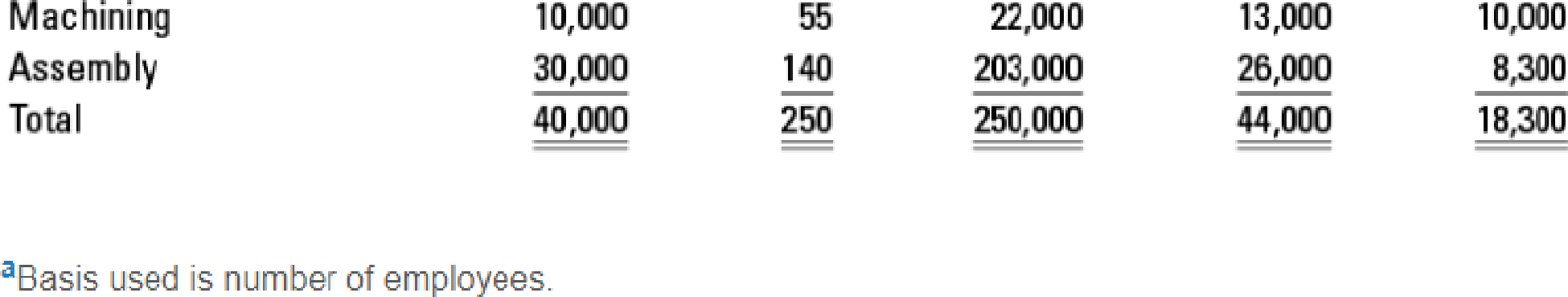

Allocating costs of support departments; step-down and direct methods. The Eastern Summit Company has prepared department

| Support departments: | ||

| Building and grounds | $45,000 | |

| Personnel | 7,800 | |

| General plant administration | 36,120 | |

| Cafeteria: operating loss | 20,670 | |

| Storeroom | 18,300 | $127,890 |

| Operating departments: | ||

| Machining | 536,000 | |

| Assembly | 60,000 | 96,000 |

| Total for support and operating departments | $223,890 |

Management has decided that the most appropriate inventory costs are achieved by using individual-department overhead rates. These rates are developed after support-department costs are allocated to operating departments.

Bases for allocation are to be selected from the following:

- 1. Using the step-down method, allocate support-department costs. Develop overhead rates per direct manufacturing labor-hour for machining and assembly. Allocate the costs of the support departments in the order given in this problem. Use the allocation base for each support department you think is most appropriate.

- 2. Using the direct method, rework requirement 1.

- 3. Based on the following information about two jobs, determine the total overhead costs for each job by using rates developed in (a) requirement 1 and (b) requirement 2.

| Direct Manufacturing Labor-Hours | ||

| Machining | Assembly | |

| Job 88 | 18 | 8 |

| Job 89 | 10 | 20 |

- 4. The company evaluates the performance of the operating department managers on the basis of how well they managed their total costs, including allocated costs. As the manager of the Machining Department, which allocation method would you prefer from the results obtained in requirements 1 and 2? Explain.

Learn your wayIncludes step-by-step video

Chapter 15 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Additional Business Textbook Solutions

Management (14th Edition)

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Engineering Economy (17th Edition)

Foundations of Financial Management

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Hii expert please provide correct answer general Accountingarrow_forwardchoose best answerarrow_forwardConsider the following information for a particular company and calculate the gross profit percentage. Sales Cost of goods sold Beginning inventory Ending inventory Beginning accounts receivable $29,100,120 $21,225,000 55,612 53,644 2,279,112 Beginning allowance for bad debts (125,560) Ending accounts receivable 2,345,591 Ending allowance for bad debts (113,824)arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning