Concept explainers

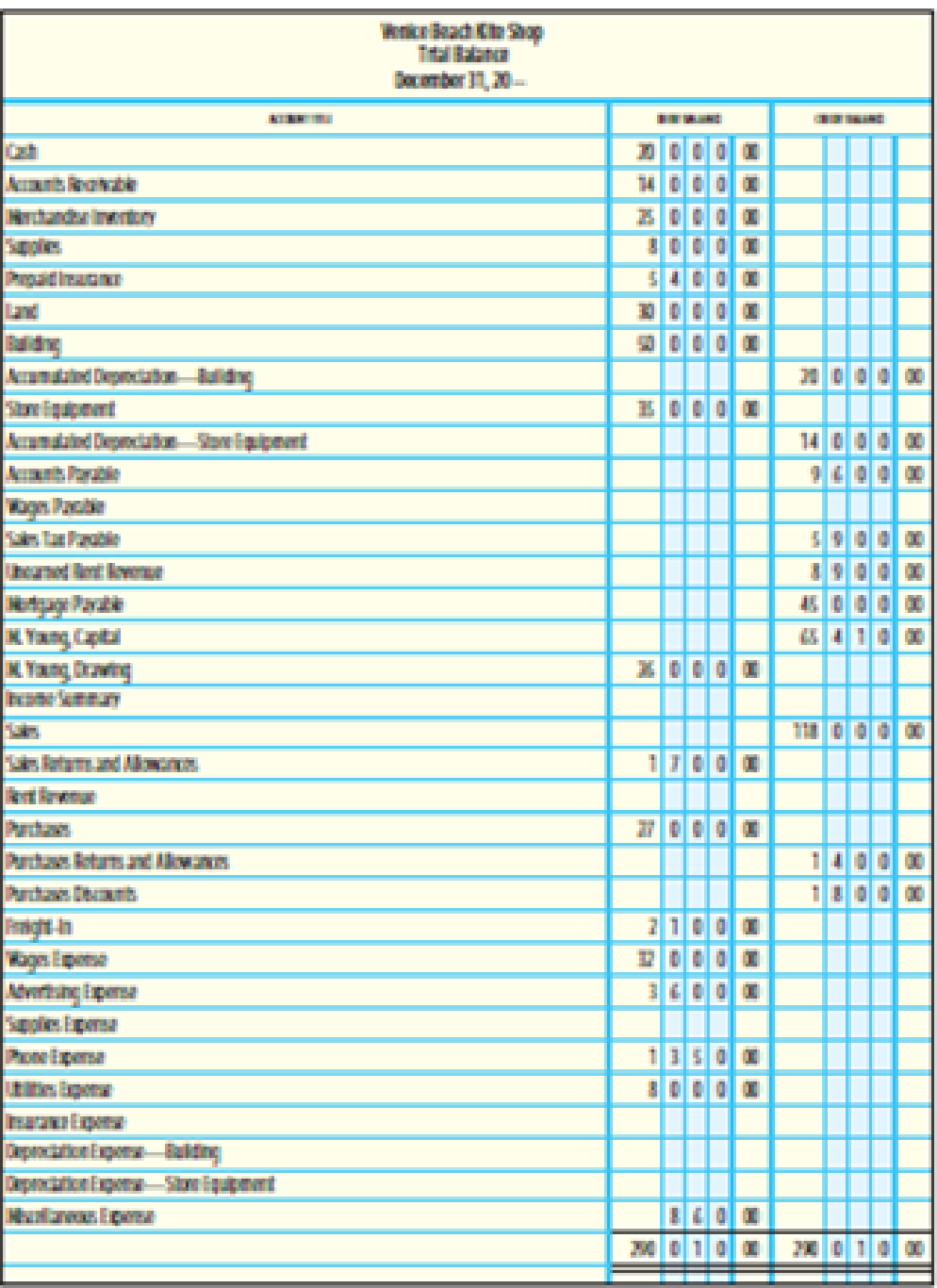

COMPLETION OF A WORK SHEET SHOWING A NET INCOME The

(a and b) Merchandise inventory costing $35,000 is on hand as of December .31, 20--. (The periodic inventory system is used.)

(c) Supplies remaining at the end of the year, $3,300.

(d) Unexpired insurance on December 31, S3,800.

(e)

(f) Depreciation expense on the store equipment for 20--, $3,500.

(g) Unearned rent revenue as of December 31, $4,00.

(h) Wages earned but not paid as of December 31, $800.

- 1. Complete the Adjustments columns, identifying each adjustment with its corresponding letter.

- 2. Complete the work sheet.

- 3. Enter the adjustments m a general journal.

Trending nowThis is a popular solution!

Chapter 14 Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

- correct answer pleasearrow_forwardThe following data were selected from the records of Fluwars Company for the year ended December 31, current year: Balances at January 1, current year: Accounts receivable (various customers) $ 111,500 Allowance for doubtful accounts 11,200 The company sold merchandise for cash and on open account with credit terms 1/10, n/30, without a right of return. The following transactions occurred during the current year: Sold merchandise for cash, $252,000. Sold merchandise to Abbey Corp; invoice amount, $36,000. Sold merchandise to Brown Company; invoice amount, $47,600. Abbey paid the invoice in (b) within the discount period. Sold merchandise to Cavendish Inc.; invoice amount, $50,000. Collected $113,100 cash from customers for credit sales made during the year, all within the discount periods. Brown paid its account in full within the discount period. Sold merchandise to Decca Corporation; invoice amount, $42,400. Cavendish paid its account in full after the…arrow_forwardcan you please solve thisarrow_forward

- The following data were selected from the records of Fluwars Company for the year ended December 31, current year: Balances at January 1, current year: Accounts receivable (various customers) $ 111,500 Allowance for doubtful accounts 11,200 The company sold merchandise for cash and on open account with credit terms 1/10, n/30, without a right of return. The following transactions occurred during the current year: Sold merchandise for cash, $252,000. Sold merchandise to Abbey Corp; invoice amount, $36,000. Sold merchandise to Brown Company; invoice amount, $47,600. Abbey paid the invoice in (b) within the discount period. Sold merchandise to Cavendish Inc.; invoice amount, $50,000. Collected $113,100 cash from customers for credit sales made during the year, all within the discount periods. Brown paid its account in full within the discount period. Sold merchandise to Decca Corporation; invoice amount, $42,400. Cavendish paid its account in full after the…arrow_forwardNeed help this question solutionarrow_forwardhelp me to solve this questions financial accountingarrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:CengagePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning