Block Foods, a retail grocery store, has agreed to purchase all of its merchandise from Square Wholesalers. In return. Block receives a special discount on purchases. Over recent months, Square noticed that purchases by Block had been falling off. At first, Square simply thought that business might be down for Block and was hopeful that their purchases would pick up. When business with Block did not return to a normal level, Square requested financial statements from Block. Squares records indicate that Block purchased $300,000 worth of merchandise during 20-1, the most recent year.

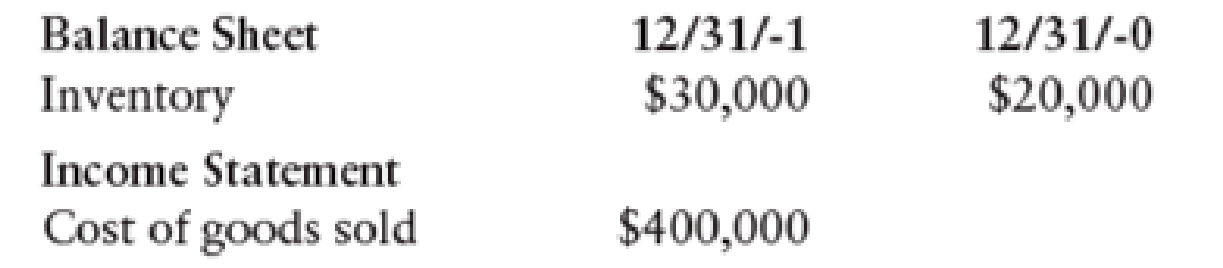

Selected information taken from Block's financial statements is as follows:

REQUIRED

Compute net purchases made by Block during 20-1. Does it appear that Block violated the agreement?

Trending nowThis is a popular solution!

Chapter 14 Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT