College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN: 9781305666160

Author: James A. Heintz, Robert W. Parry

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 14, Problem 10SPA

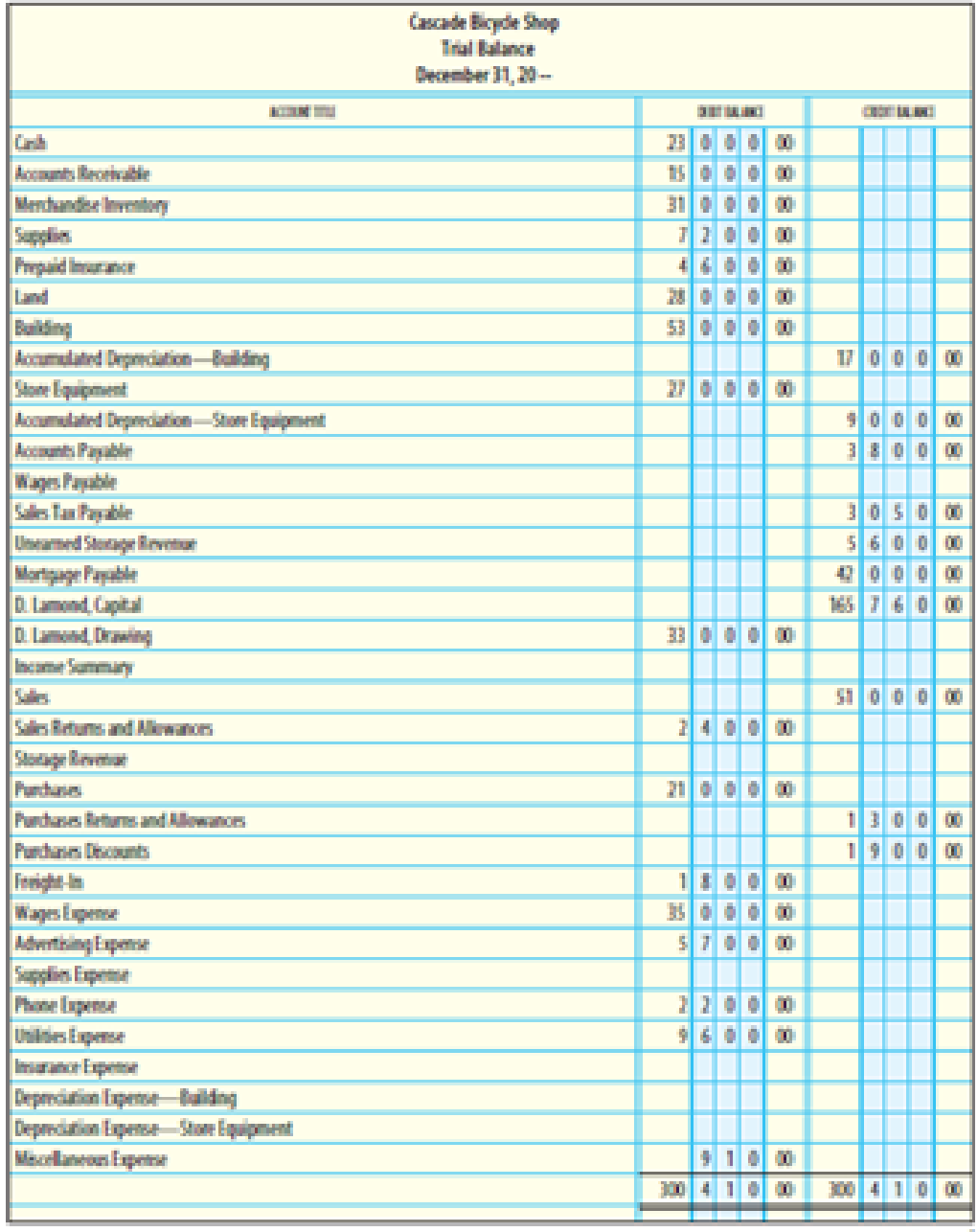

COMPLETION OF A WORK SHEET SHOWING A NET LOSS The

(a and b) Merchandise inventory costing $22,000 is on hand as of December 31, 20--. (The periodic inventory system is used.)

(c) Supplies remaining at the end of the year, $2,400.

(d) Unexpired insurance on December 31, $1,750.

(e)

(f) Depreciation expense on the store equipment for 20--, $3,600.

(g) Unearned storage revenue as of December 31, $1,950.

(h) Wages earned but not paid as of December 31, $750.

REQUIRED

- 1. Complete the Adjustments columns, identifying each adjustment with its corresponding letter.

- 2. Complete the work sheet.

- 3. Enter the adjustments in the general journal.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Answer please

Need correct answer general accounting

Olds Inc

Chapter 14 Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

Ch. 14 - Under the periodic inventory system, the beginning...Ch. 14 - Under the periodic inventory system, the ending...Ch. 14 - The cash received in advance before delivering a...Ch. 14 - Unearned revenue is adjusted into an expense...Ch. 14 - Sales Returns and Allowances is classified as a...Ch. 14 - Prob. 1MCCh. 14 - Prob. 2MCCh. 14 - Prob. 3MCCh. 14 - Prob. 4MCCh. 14 - Prob. 5MC

Ch. 14 - Prepare the cost of goods sold section for Josephs...Ch. 14 - The Venice Theatre sold and collected cash of...Ch. 14 - Prob. 3CECh. 14 - Using the partial work sheet provided below,...Ch. 14 - Prob. 5CECh. 14 - A firm is preparing to make adjusting entries at...Ch. 14 - Prob. 2RQCh. 14 - Prob. 3RQCh. 14 - What is an unearned revenue?Ch. 14 - Give three examples of unearned revenue.Ch. 14 - Prob. 6RQCh. 14 - Prob. 7RQCh. 14 - A firm is preparing to make adjusting entries at...Ch. 14 - ADJUSTMENT FOR MERCHANDISE INVENTORY USING T...Ch. 14 - CALCULATION OF COST OF GOODS SOLD: PERIODIC...Ch. 14 - ADJUSTMENT FOR UNEARNED REVENUES USING T ACCOUNTS...Ch. 14 - WORK SHEET EXTENSIONS FOR MERCHANDISE INVENTORY...Ch. 14 - DETERMINING THE BEGINNING AND ENDING INVENTORY...Ch. 14 - JOURNALIZE ADJUSTING ENTRIES FOR A MERCHANDISING...Ch. 14 - JOURNAL ENTRIES UNDER THE PERPETUAL INVENTORY...Ch. 14 - Prob. 8SEACh. 14 - COMPLETION OF A WORK SHEET SHOWING A NET INCOME...Ch. 14 - COMPLETION OF A WORK SHEET SHOWING A NET LOSS The...Ch. 14 - WORKING BACKWARD FROM ADJUSTED TRIAL BALANCE TO...Ch. 14 - Prob. 12SPACh. 14 - ADJUSTMENT FOR MERCHANDISE INVENTORY USING T...Ch. 14 - CALCULATION OF COST OF GOODS SOLD: PERIODIC...Ch. 14 - ADJUSTMENT FOR UNEARNED REVENUES USING T ACCOUNTS...Ch. 14 - WORK SHEET EXTENSIONS FOR MERCHANDISE INVENTORY...Ch. 14 - Prob. 5SEBCh. 14 - Prob. 6SEBCh. 14 - JOURNAL ENTRIES UNDER THE PERPETUAL INVENTORY...Ch. 14 - JOURNALIZE ADJUSTING ENTRY FOR A MERCHANDISING...Ch. 14 - COMPLETION OF A WORK SHEET SHOWING A NET INCOME A...Ch. 14 - Prob. 10SPBCh. 14 - WORKING BACKWARD FROM ADJUSTED TRIAL BALANCE TO...Ch. 14 - WORKING BACKWARD FROM THE INCOME STATEMENT AND...Ch. 14 - A friend of yours recently opened Abracadabra, a...Ch. 14 - Jason Tierro, an inventory clerk at Lexmar...Ch. 14 - John Neff owns and operates Waikiki Surf Shop. A...Ch. 14 - Block Foods, a retail grocery store, has agreed to...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The standard cost of Wonder Walkers includes 3 units of direct materials at $9.00 per unit. During July, the company buys 40,000 units of direct materials at $8.25 and uses those materials to produce 15,000 units. Compute the total, price, and quantity variances for materials.arrow_forwardBranson paid $465,000 cash for all of the outstanding common stock of Wolfpack, Incorporated, on January 1, 2023. On that date, the subsidiary had a book value of $340,000 (common stock of $200,000 and retained earnings of $140,000), although various unrecorded royalty agreements (10-year remaining life) were assessed at a $100,000 fair value. Any remaining excess fair value was considered goodwill. In negotiating the acquisition price, Branson also promised to pay Wolfpack's former owners an additional $50,000 if Wolfpack's income exceeded $120,000 total over the first two years after the acquisition. At the acquisition date, Branson estimated the probability-adjusted present value of this contingent consideration at $35,000. On December 31, 2023, based on Wolfpack's earnings to date, Branson increased the value of the contingency to $40,000. During the subsequent two years, Wolfpack reported the following amounts for income and dividends: Dividends Declared Year Net Income $ 65,000…arrow_forwardAnswer? ? Financial accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

IAS 29 Financial Reporting in Hyperinflationary Economies: Summary 2021; Author: Silvia of CPDbox;https://www.youtube.com/watch?v=55luVuTYLY8;License: Standard Youtube License