1.

Prepare quality cost report and pie chart.

1.

Explanation of Solution

Quality Cost:

Organizations are required to bear costs due to non-conformity of goods or services with the general specifications. These costs are termed as quality costs. Quality costs can be categorized into preventive costs, detective costs, internal failure costs and external failure costs.

Preparation of quality cost report:

| Particulars | Year 1 ($) | Year 2 ($) |

| Prevention costs: | ||

| Quality circles | 6,000 | 60,000 |

| Design reviews | 3,000 | 30,000 |

| Quality improvement projects | 3,000 | 150,000 |

| Total prevention costs (A) | 12,000 | 240,000 |

| Percentage (E) | 0.39% | 7.81% |

| Detection costs: | ||

| Packaging inspection | 480,000 | 450,000 |

| Product acceptance | 60,000 | 42,000 |

| Total detection costs (B) | 540,000 | 492,000 |

| Percentage (F) | 17.58% | 16.02% |

| Internal failure costs: | ||

| Scrap | 420,000 | 360,000 |

| Rework | 540,000 | 480,000 |

| Yield losses | 240,000 | 150,000 |

| Retesting | 300,000 | 240,000 |

| Total internal failure costs (C) | 1,500,000 | 1,230,000 |

| Percentage (G) | 48.83% | 40.04% |

| External failure costs: | ||

| Returned materials | 240,000 | 240,000 |

| Allowances | 180,000 | 210,000 |

| Warranty | 600,000 | 660,000 |

| Total external failure costs (D) | 1,020,000 | 1,110,000 |

| Percentage (H) | 33.20% | 36.13% |

| Total quality costs | 3,072,000 | 3,072,000 |

| Total percentage | 100% | 100% |

Table (1)

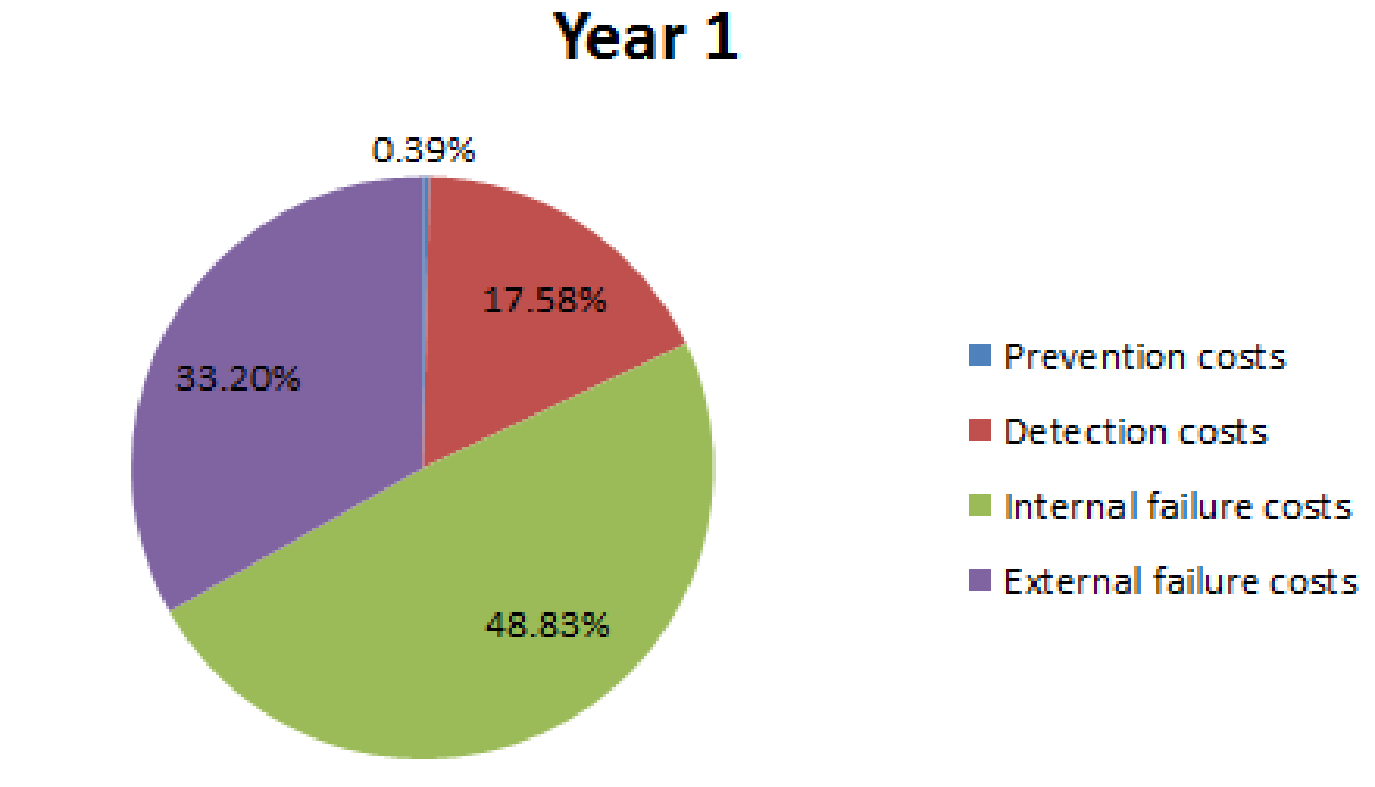

Pie chart for year 1:

Fig (1)

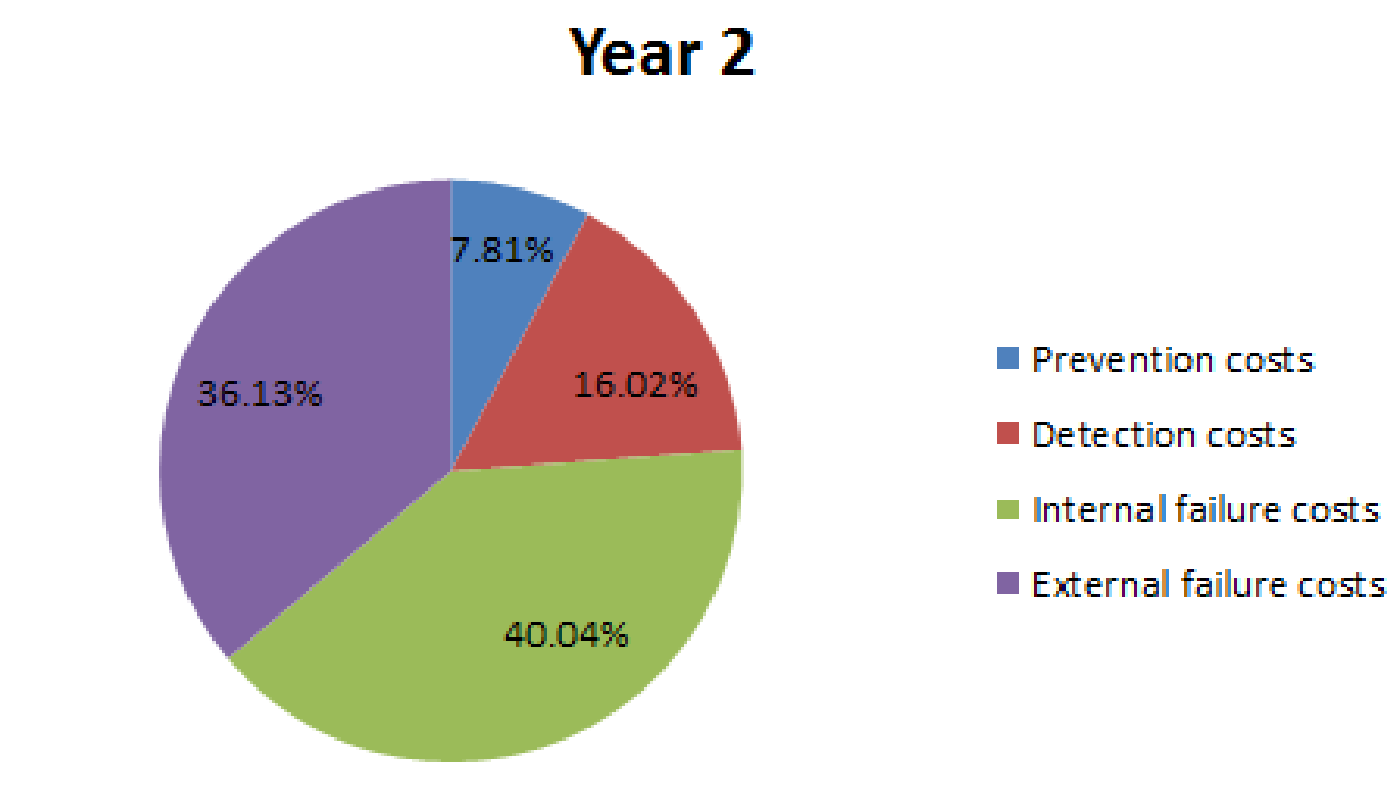

Pie chart for year 2:

Fig (2)

Analysis of pie charts:

- The distribution pattern shown in the chart in year 1 is not appropriate.

- External failure costs and internal failure costs are much higher than their required levels.

- In comparison with year 1, year 2 is moving towards a right balance; since failure costs are reducing and prevention costs are increasing.

2.

Present a performance report for year 2 by comparing budgeted and actual figures of year 2. Also, compute the profits that have been increased due to quality improvements.

2.

Answer to Problem 55P

Increase in profit due to quality improvements is $768,000.

Explanation of Solution

Preparation of quality cost report:

| Particulars |

Year 1 ($) |

Year 2 Budgeted ($) (E) |

Year 2 Actual ($) (F) |

Variance ($) |

| Prevention costs: | ||||

| Quality circles | 6,000 | 7,500 | 60,000 | |

| Design reviews | 3,000 | 3,750 | 30,000 | |

| Quality improvement projects | 3,000 | 3,750 | 150,000 | |

| Total prevention costs (A) | 12,000 | 15,000 | 240,000 | |

| Detection costs: | ||||

| Packaging inspection | 480,000 | 600,000 | 450,000 | 150,000 |

| Product acceptance | 60,000 | 75,000 | 42,000 | 33,000 |

| Total detection costs (B) | 540,000 | 675,000 | 492,000 | 183,000 |

| Internal failure costs: | ||||

| Scrap | 420,000 | 525,000 | 360,000 | 165,000 |

| Rework | 540,000 | 675,000 | 480,000 | 195,000 |

| Yield losses | 240,000 | 300,000 | 150,000 | 150,000 |

| Retesting | 300,000 | 375,000 | 240,000 | 135,000 |

| Total internal failure costs (C) | 1,500,000 | 1,875,000 | 1,230,000 | 645,000 |

| External failure costs: | ||||

| Returned materials | 240,000 | 300,000 | 240,000 | 60,000 |

| Allowances | 180,000 | 225,000 | 210,000 | 15,000 |

| Warranty | 600,000 | 750,000 | 660,000 | 90,000 |

| Total external failure costs (D) | 1,020,000 | 1,275,000 | 1,110,000 | 165,000 |

|

Total quality costs | 3,072,000 | 3,840,000 | 3,072,000 | 768,000 |

Table (2)

Year 2 budgeted figures are computed by dividing the costs of year 1 by sales of year 1 $12,000,000 and multiplying by sales of year 2, $15,000,000.

Increase in profit due to quality improvements is $768,000.

3.

Compute increase in profits in case quality costs are reduced to 3% of sales revenue.

3.

Explanation of Solution

Computation of increase in profit:

| Particulars | Amount ($) |

| Existing total quality costs (A) | 3,072,000 |

| Sales | 15,000,000 |

|

Revised total quality costs (B) | 450,000 |

| Increase in profit | 2,622,000 |

Table (3)

Want to see more full solutions like this?

Chapter 13 Solutions

Bundle: Managerial Accounting: The Cornerstone of Business Decision-Making, Loose-Leaf Version, 7th + CengageNOWv2, 1 term (6 months) Printed Access Card

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning