Concept explainers

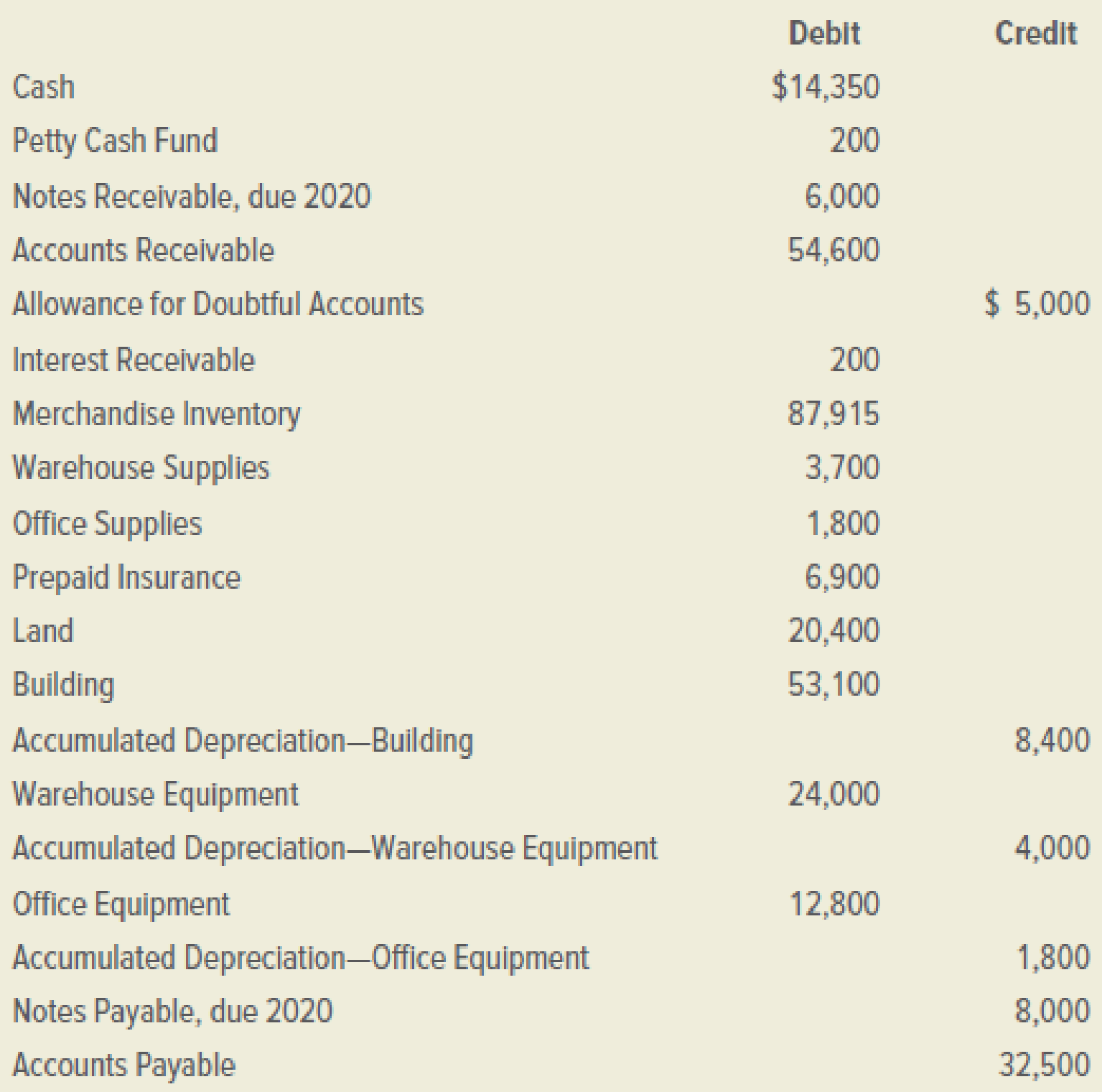

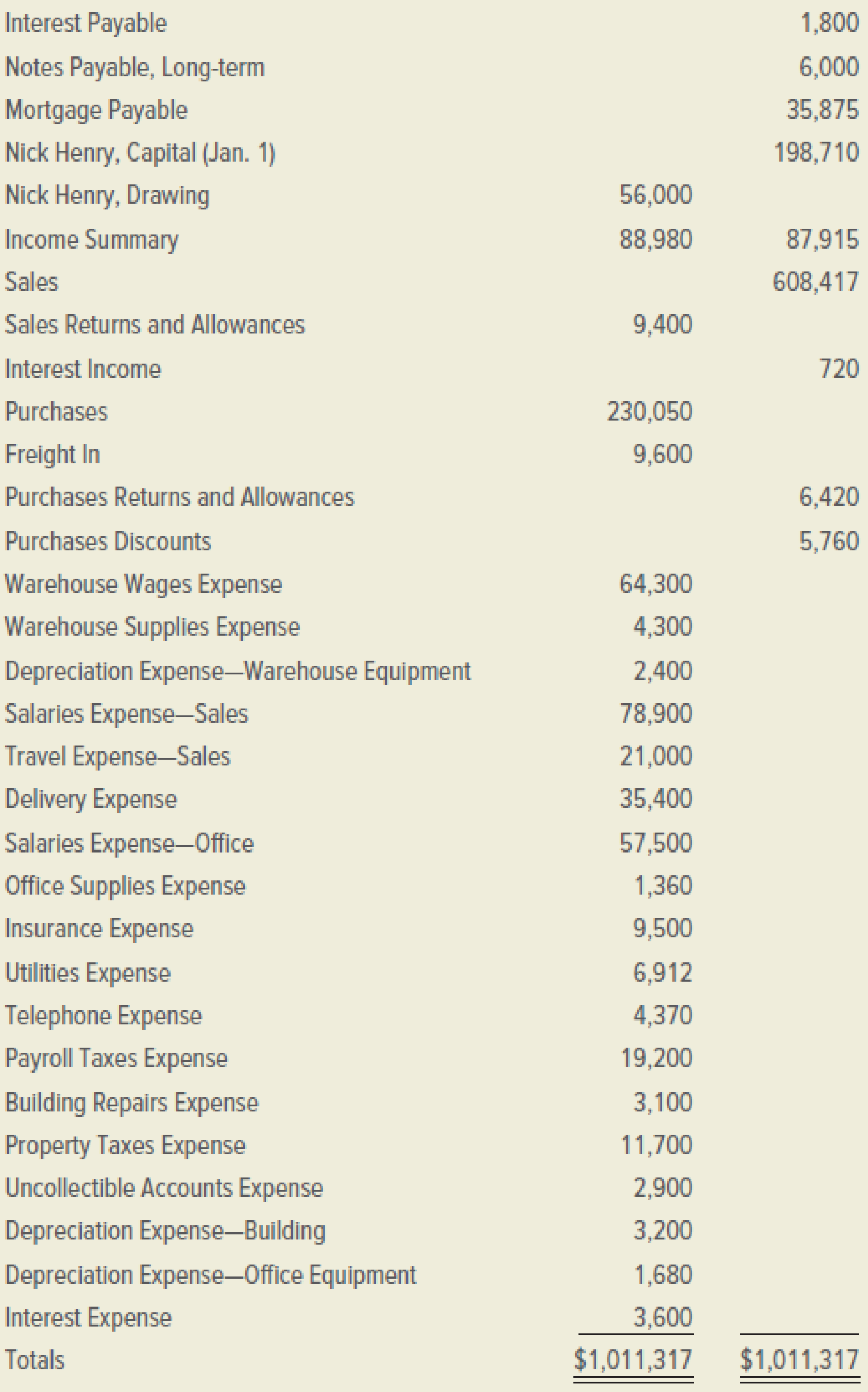

Hog Wild is a retail firm that sells motorcycles, parts, and accessories. The adjusted

INSTRUCTIONS

- 1. Prepare a classified income statement for the year ended December 31, 2019. The expense accounts represent warehouse expenses, selling expenses, and general and administrative expenses.

- 2. Prepare a statement of owner’s equity for the year ended December 31, 2019. No additional investments were made during the period.

- 3. Prepare a classified

balance sheet as of December 31, 2019. The mortgage payable extends for more than one year.

ACCOUNTS

Analyze: What is the inventory turnover for Hog Wild?

1.

Show the Classified Income Statement.

Explanation of Solution

Classified Income statement: The classified income statement is a financial statement that shows the revenues, expenses with various classifications and sub-totals. The classified income statement is used for complex income statement as its more easily understandable.

Prepare the classified income statement:

| Company HW | ||||

| Income Statement | ||||

| Year Ended December 31, 2019 | ||||

| Particulars | Amount ($) | Amount ($) | Amount ($) | Amount ($) |

| Operating Revenue | ||||

| Sales | $608,417 | |||

| Less: Sales Returns and Allowances | $9,400 | |||

| Net Sales | $599,017 | |||

| Cost of Goods Sold | ||||

| Merchandise Inventory, January 1, 2019 | $88,980 | |||

| Purchases | $230,050 | |||

| Freight In | $9,600 | |||

| Delivered Cost of Purchases | $239,650 | |||

| Less: Sales Returns and Allowances | $6,420 | |||

| Purchases Discount | $5,760 | $12,180 | ||

| Net Delivered Cost of Purchases | $227,470 | |||

| Total Merchandise Available for sale | $316,450 | |||

| Less: Merchandise Inventory, closing | $87,915 | |||

| Cost of Goods Sold | $228,535 | |||

| Gross Profit on Sales | $370,482 | |||

| Operating Expenses | ||||

| Warehouse Expenses | ||||

| Warehouse Wages Expense | $64,300 | |||

| Warehouse Supplies Expense | $4,300 | |||

| Depreciation Expense — Warehouse Equipment | $2,400 | |||

| Total Warehouse Expense | $71,000 | |||

| Selling Expenses | ||||

| Salaries Expense—Sales | $78,900 | |||

| Travel Expense | $21,000 | |||

| Delivery Expense | $35,400 | |||

| Total Selling Expense | $135,300 | |||

| General and Administrative Expenses | ||||

| Salaries Expense—Office | $57,500 | |||

| Office Supplies Expense | $1,360 | |||

| Insurance Expense | $9,500 | |||

| Utilities Expense | $6,912 | |||

| Telephone Expense | $4,370 | |||

| Payroll Taxes Expense | $19,200 | |||

| Building Repair Expense | $11,700 | |||

| Property Taxes Expense | $3,100 | |||

| Uncollectible Accounts Expense | $2,900 | |||

| Depreciation Expense - Building | $3,200 | |||

| Depreciation Expense - Office Equipment | $1,680 | |||

| Total General and Admin. Expenses | $121,422 | |||

| Total Operating Expenses | $327,722 | |||

| Income from Operations | $42,760 | |||

| Other Income | ||||

| Interest Income | $720 | |||

| Other Expense | ||||

| Interest Expense | $3,600 | |||

| Net Non-operating expenses | $2,880 | |||

| Net income for the year | $39,880 | |||

Table (1)

2.

Show the Statement of Owner's equity.

Explanation of Solution

Statement of owner's’ equity: This statement reports the beginning owner’s equity and all the changes which led to ending owner's’ equity.

Prepare the Statement of owner's’ equity:

| Company HW | ||

| Statement of Owner's Equity | ||

| Year Ended December 31, 2019 | ||

| Particulars | Amount ($) | Amount ($) |

| NH Capital, January 1, 2019 | $198,710 | |

| Net income for the year | $39,880 | |

| Deduct - Withdrawals | $56,000 | |

| Decrease in Capital | ($16,120) | |

| NH Capital, December 31, 2019 | $182,590 | |

Table (2)

3.

Show the Classified Balance Sheet and compute the inventory turnover of Company AW.

Explanation of Solution

Classified balance sheet: The main elements of balance sheet assets, liabilities, and stockholders’ equity are categorized or classified further into sections, and sub-sections in a classified balance sheet. Assets are further classified as current assets, long-term investments, property, plant, and equipment (PPE), and intangible assets. Liabilities are classified into two sections current and long-term. Stockholders’ equity comprises of common stock and retained earnings. Thus, the classified balance sheet includes all the elements under different sections.

Prepare the classified balance sheet:

| Company HW | |||

| Balance Sheet | |||

| December 31, 2019 | |||

| Particulars | Amount ($) | Amount ($) | Amount ($) |

| Assets | |||

| Current Assets | |||

| Cash | $14,350 | ||

| Petty Cash Fund | $200 | ||

| Notes receivable | $6,000 | ||

| Accounts receivable | $54,600 | ||

| Less: Allowance for Doubtful Debts | $5,000 | $49,600 | |

| Merchandise Inventory | $87,915 | ||

| Interest Receivable | $200 | ||

| Prepaid expenses | |||

| Warehouse Supplies | $3,700 | ||

| Office Supplies | $1,800 | ||

| Prepaid insurance | $6,900 | $12,400 | |

| Total Current Assets | $170,665 | ||

| Plant and Equipment | |||

| Land | $20,400 | ||

| Building | $53,100 | ||

| Less: Accumulated Depreciation | $8,400 | $44,700 | |

| Warehouse Equipment | $24,000 | ||

| Less: Accumulated Depreciation | $4,000 | $20,000 | |

| Office Equipment | $12,800 | ||

| Less: Accumulated Depreciation | $1,800 | $11,000 | |

| Total Plant and Equipment | $96,100 | ||

| Total Assets | $266,765 | ||

| Liabilities and Owner's Equity | |||

| Current Liabilities | |||

| Notes Payable | $8,000 | ||

| Accounts payable | $32,500 | ||

| Interest Payable | $1,800 | ||

| Total Current Liabilities | $42,300 | ||

| Long Term Liabilities | |||

| Mortgage payable | $35,875 | ||

| Notes Payable - Long Term | $6,000 | ||

| Total Long-Term Liabilities | $41,875 | ||

| Total Liabilities | $84,175 | ||

| Owner's Equity | |||

| CR Capital | $182,590 | ||

| Total Liabilities and Owner's Equity | $266,765 | ||

Table (3)

Inventory turnover ratio: Inventory turnover ratio is used to determine the number of times inventory used or sold during the particular accounting period. Inventory turnover ratio is calculated by using the formula:

Compute the inventory turnover ratio:

Compute the average inventory:

The inventory turnover is 2.58 times.

Want to see more full solutions like this?

Chapter 13 Solutions

COLLEGE ACCOUNTING (LL)W/ACCESS>CUSTOM<

- Critically discuss the advantages and disadvantages of the Accounting Rate of Return (ARR). with a minimum of 5 referencesarrow_forward5 PTSarrow_forwardIn 2011, It cost Parley Corp. $9 per unit to produce part T5. In 2012, it has increased to $12 per unit. In 2012, Southside Company has offered to provide Part T5 for $7 per unit to Westa. As it pertains to the make-or-buy decision, which statement is true?arrow_forward

- What is its ROEarrow_forwardKendall Corporation uses the weighted-average method in its process costing system. The ending work in process inventory consists of 10,000 units. The ending work in process inventory is 100% complete with respect to materials and 60% complete with respect to labor and overhead. If the cost per equivalent unit for the period is $4.00 for materials and $1.50 for labor and overhead, what is the balance of the ending work in process inventory account?arrow_forwardA manufacturer sells a product for $45 to a wholesaler, and the wholesaler sells it to a retailer. The wholesaler's normal markup (based on selling price) is 25%. The retailer prices the item to consumers to include a 33% markup (also based on selling price). What is the selling price to the consumer?arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College