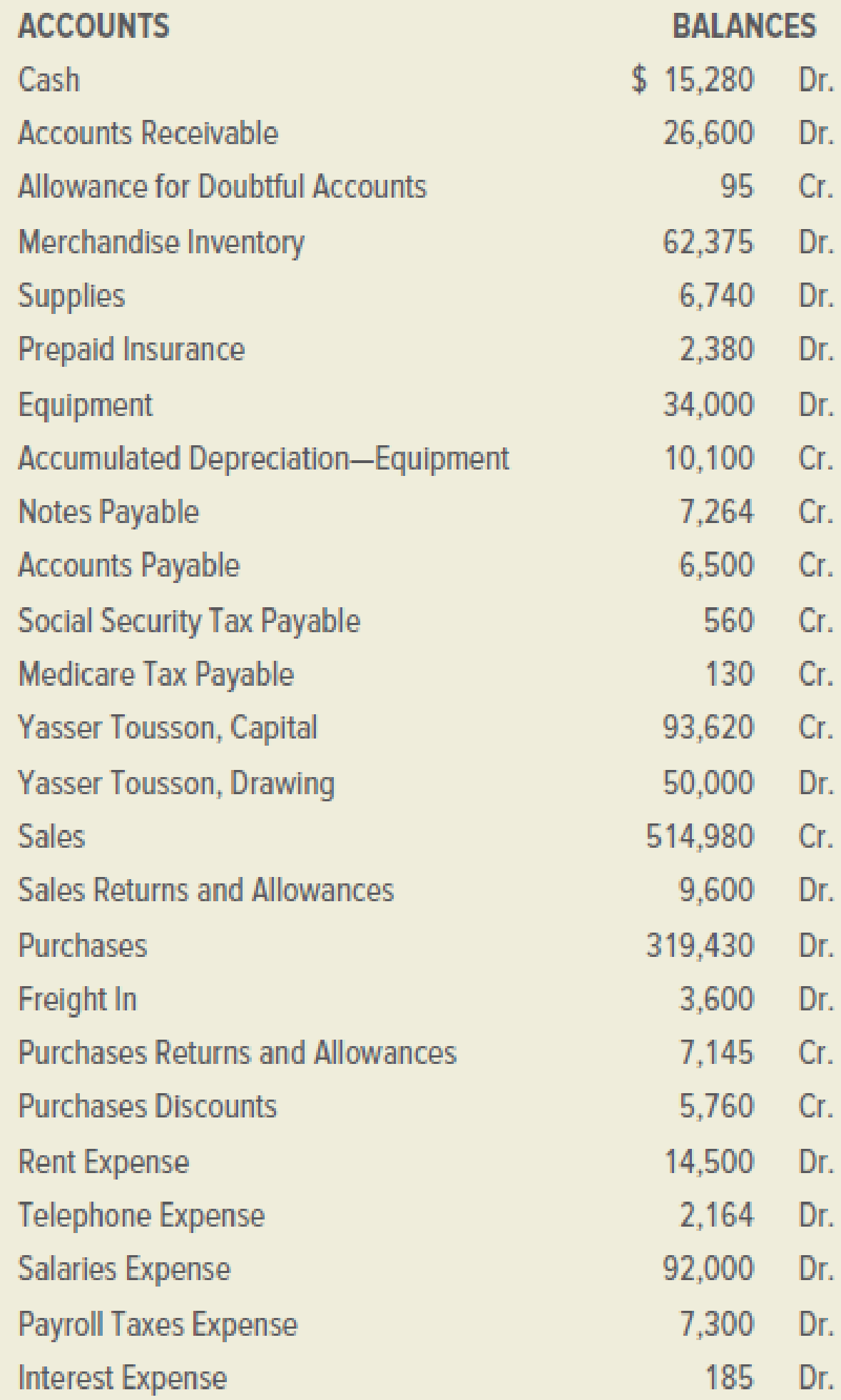

Programs Plus is a retail firm that sells computer programs for home and business use. On December 31, 2019, its general ledger contained the accounts and balances shown below:

The following accounts had zero balances:

The data needed for the adjustments on December 31 are as follows:

a.–b. Ending merchandise inventory, $67,850.

c. Uncollectible accounts, 0.5 percent of net credit sales of $245,000.

d. Supplies on hand December 31, $1,020.

e. Expired insurance, $1,190.

f.

g. Accrued interest expense on notes payable, $325.

h. Accrued salaries, $2,100.

i. Social Security Tax Payable (6.2 percent) and Medicare Tax Payable (1.45 percent) of accrued salaries.

INSTRUCTIONS

- 1. Prepare a worksheet for the year ended December 31, 2019.

- 2. Prepare a classified income statement. The firm does not divide its operating expenses into selling and administrative expenses.

- 3. Prepare a statement of owner’s equity. No additional investments were made during the period.

- 4. Prepare a classified

balance sheet . All notes payable are due within one year. - 5. Journalize the

adjusting entries . Use 25 as the first journal page number. - 6. Journalize the closing entries.

- 7. Journalize the reversing entries.

Analyze: By what percentage did the owner’s capital account change in the period from January 1, 2019, to December 31, 2019?

1.

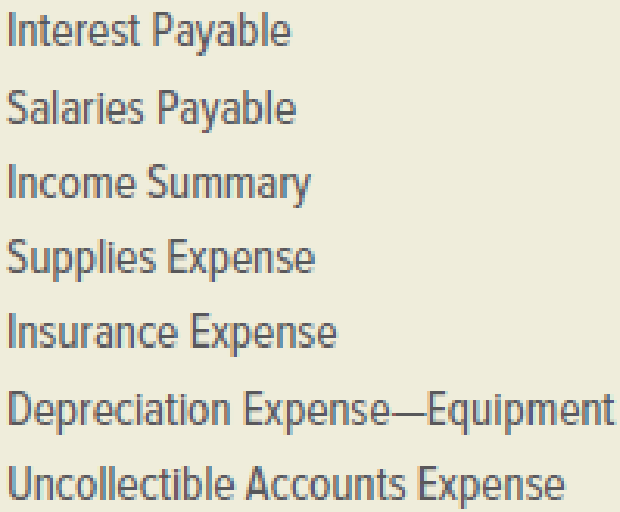

Prepare the worksheet and complete the sections of Trial balance, adjustments and compute the changes to the BW Capital that will be shown in the statement of owner's equity.

Explanation of Solution

Worksheet: A worksheet is the used in the preparation of the financial statement. It is a pre-defined form, having multiple columns, used in the adjustment process.

Prepare the worksheet for the year ended December 31, 2019.

Figure (1)

Figure (2)

2.

Show the Classified Income Statement.

Explanation of Solution

Classified Income statement: The classified income statement is a financial statement that shows the revenues, expenses with various classifications and sub-totals. The classified income statement is used for complex income statement as its more easily understandable.

Prepare the classified income statement:

| Company PP | ||||

| Income Statement | ||||

| Year Ended December 31, 2019 | ||||

| Particulars | Amount ($) | Amount ($) | Amount ($) | Amount ($) |

| Operating Revenue | ||||

| Sales | $514,980 | |||

| Less: Sales Returns and Allowances | $9,600 | |||

| Net Sales | $505,380 | |||

| Cost of Goods Sold | ||||

| Merchandise Inventory, January 1, 2019 | $62,375 | |||

| Purchases | $319,430 | |||

| Freight In | $3,600 | |||

| Delivered Cost of Purchases | $323,030 | |||

| Less: Sales Returns and Allowances | $7,145 | |||

| Purchases Discount | $5,760 | $12,905 | ||

| Net Delivered Cost of Purchases | $310,125 | |||

| Total Merchandise Available for sale | $372,500 | |||

| Less: Merchandise Inventory, closing | $67,850 | |||

| Cost of Goods Sold | $304,650 | |||

| Gross Profit on Sales | $200,730 | |||

| Operating Expenses | ||||

| Rent expense | $14,500 | |||

| Telephone Expense | $2,164 | |||

| Salaries Expense | $94,100 | |||

| Payroll Taxes Expense | $7,460.65 | |||

| Supplies Expense | $5,720 | |||

| Insurance Expense | $1,190 | |||

| Depreciation Expense - Equipment | $5,600 | |||

| Uncollectible Accounts Expense | $1,225 | |||

| Total Operating Expenses | $131,959.65 | |||

| Income from Operations | $68,770.35 | |||

| Other Expense | ||||

| Interest Expense | $510.00 | |||

| Net income for the year | $68,260.35 | |||

Table (1)

3.

Show the Statement of Owner's equity.

Explanation of Solution

Statement of owner's’ equity: This statement reports the beginning owner’s equity and all the changes which led to ending owner's’ equity.

Prepare the Statement of owner's’ equity:

| Company PP | ||

| Statement of Owner's Equity | ||

| Year Ended December 31, 2019 | ||

| Particulars | Amount ($) | Amount ($) |

| YT Capital, January 1, 2019 | $93,620 | |

| Net income for the year | $68,260.35 | |

| Deduct - Withdrawals | $50,000.00 | |

| Increase in Capital | $18,260.35 | |

| YT Capital, December 31, 2019 | $111,880.35 | |

Table (2)

4.

Show the Classified Balance Sheet and compute the percentage change in the owner’s capital in the accounting year 2019.

Explanation of Solution

Classified balance sheet: The main elements of balance sheet assets, liabilities, and stockholders’ equity are categorized or classified further into sections, and sub-sections in a classified balance sheet. Assets are further classified as current assets, long-term investments, property, plant, and equipment (PPE), and intangible assets. Liabilities are classified into two sections current and long-term. Stockholders’ equity comprises of common stock and retained earnings. Thus, the classified balance sheet includes all the elements under different sections.

Prepare the classified balance sheet:

| Company PP | |||

| Balance Sheet | |||

| December 31, 2019 | |||

| Particulars | Amount ($) | Amount ($) | Amount ($) |

| Assets | |||

| Current Assets | |||

| Cash | $15,280 | ||

| Accounts receivable | $26,600 | ||

| Less: Allowance for Doubtful Debts | $1,320 | $25,280 | |

| Merchandise Inventory | $67,850 | ||

| Prepaid expenses | |||

| Supplies | $1,020 | ||

| Prepaid insurance | $1,190 | $2,210 | |

| Total Current Assets | $110,620 | ||

| Plant and Equipment | |||

| Equipment | $34,000 | ||

| Less: Accumulated Depreciation | $15,700 | $18,300 | |

| Total Plant and Equipment | $18,300 | ||

| Total Assets | $128,920 | ||

| Liabilities and Owner's Equity | |||

| Current Liabilities | |||

| Notes Payable | $7,264 | ||

| Accounts payable | $6,500 | ||

| Interest Payable | $325 | ||

| Social Security Tax Payable | $690.20 | ||

| Medicare Tax Payable | $160.45 | ||

| Salaries Payable | $2,100 | ||

| Total Current Liabilities | $17,039.65 | ||

| Owner's Equity | |||

| YT Capital | $111,880.35 | ||

| Total Liabilities and Owner's Equity | $128,920 | ||

Table (3)

Compute the percentage increase in owner’s capital:

The percentage increase in the owner’s capital is 19.5%.

5.

Journalize the adjusting entries as on December 31, 2019.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and stockholders’ equity) to maintain the records according to accrual basis principle.

Pass the adjusting entry for the given transaction:

| General Journal | Page - 25 | |||

| Date | Description | Post Ref. | Debit | Credit |

| 2019 | ||||

| December 31 | Income Summary | $62,375 | ||

| Merchandise Inventory | $62,375 | |||

| (To record the beginning inventory) | ||||

| December 31 | Merchandise Inventory | $67,850 | ||

| Income Summary | $67,850 | |||

| (To record the closing inventory) | ||||

| December 31 | Uncollectible Accounts Expense | $1,225 | ||

| Allowance for Doubtful Accounts | $1,225 | |||

| (To record the estimated loss on the net credit sale) |

Table (4)

| General Journal | Page - 26 | |||

| Date | Description | Post Ref. | Debit | Credit |

| 2019 | ||||

| December 31 | Supplies Expense | $5,720 | ||

| Supplies | $5,720 | |||

| (To record the Supplies used) | ||||

| December 31 | Insurance expense | $1,190 | ||

| Prepaid Insurance | $1,190 | |||

| (To record the prepaid insurance) | ||||

| December 31 | Depreciation Expense - Equipment | $5,600 | ||

| Accumulated Depreciation - Equipment | $5,600 | |||

| (To record the depreciation on equipment) | ||||

| December 31 | Interest expense | $325 | ||

| Interest Payable | $325 | |||

| (To record the interest payable) | ||||

| December 31 | Salaries Expense | $2,100 | ||

| Salaries Payable | $2,100 | |||

| (To record the salaries payable) | ||||

| December 31 | Payroll Taxes Expense | $160.65 | ||

| Social Security Tax Payable | $130.20 | |||

| Medicare Tax Payable | $30.45 | |||

| (To record the taxes on accrued wages) |

Table (5)

6.

Journalize the closing entries as on December 31, 2019.

Explanation of Solution

Closing entries: The journal entries prepared to close the temporary accounts to Retained Earnings account are referred to as closing entries. The revenue, expense, and dividends accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Pass the closing entries:

| General Journal | Page - 27 | |||

| Date | Description | Post Ref | Debit | Credit |

| 2019 | ||||

| December 31 | Sales | $514,980 | ||

| Purchases Returns and allowances | $7,145 | |||

| Purchases Discounts | $5,760 | |||

| Income Summary | $527,885 | |||

| (To record the closing entry for the income) | ||||

| December 31 | Income Summary | $465,099.65 | ||

| Sales Returns and Allowances | $9,600 | |||

| Purchases | $319,430 | |||

| Freight In | $3,600 | |||

| Rent Expense | $14,500 | |||

| Telephone Expense | $2,164 | |||

| Salaries Expense | $94,100.00 | |||

| Payroll Taxes Expense | $7,460.65 | |||

| Supplies Expense | $5,720 | |||

| Insurance expense | $1,190 | |||

| Depreciation Expense - Warehouse Equipment | $5,600 | |||

| Uncollectible Accounts Expense | $1,225 | |||

| Interest Expense | $510 | |||

| (To record the closing entry for the expenses) |

Table (6)

| General Journal | Page - 28 | |||

| Date | Description | Post Ref | Debit | Credit |

| 2019 | ||||

| December 31 | Income Summary | $68,260.35 | ||

| YT Capital | $68,260.35 | |||

| (To record the closing entry for the capital) | ||||

| December 31 | YT Capital | $50,000 | ||

| YT Drawings | $50,000 | |||

| (To record the closing entry for the capital) |

Table (7)

7.

Journalize the reversing entries as on January 1, 2020.

Explanation of Solution

Reversing entries: Reversing entries are those entries which are recorded at the beginning of the year, to reverse or set right the adjusting entries made in the end of the previous accounting year, in order to maintain the records according to accrual basis principle.

Pass the reversing entries:

| General Journal | Page - 29 | |||

| Date | Description | Post Ref | Debit | Credit |

| 2020 | ||||

| January 1 | Interest Payable | $325 | ||

| Interest Expense | $325 | |||

| (To record the reversing entry for interest payable) | ||||

| January 1 | Salaries Payable | $2,100 | ||

| Salaries Expense - Office | $2,100 | |||

| (To record the reversing entry for salaries payable) | ||||

| January 1 | Social Security Tax Payable | $130.20 | ||

| Medicare Tax Payable | $30.45 | |||

| Payroll Taxes Expense | $160.65 | |||

| (To record the reversing entry for payroll taxes payable) |

Table (8)

Want to see more full solutions like this?

Chapter 13 Solutions

COLLEGE ACCOUNTING (LL)W/ACCESS>CUSTOM<

- Which feature distinguishes nominal accounts from real accounts in closing entries? Options: (i) Temporary nature requiring closure (ii) Balance sheet presentation (iii) Permanent balances carried forward (iv) Contra account status financial Accounting problemarrow_forwardProvide correct solution accountingarrow_forwardWhat is its degree of opereting leverage? General accountingarrow_forward

- General accountingarrow_forwardWhich feature distinguishes nominal accounts from real accounts in closing entries? Options: (i) Temporary nature requiring closure (ii) Balance sheet presentation (iii) Permanent balances carried forward (iv) Contra account statusarrow_forwardNeed help this questionarrow_forward

- Organization/Industry Rank Employer Survey Student Survey Career Service Director Survey Average Pay Deloitte & Touche/accounting 1 1 8 1 55 Ernst & Young/accounting 2 6 3 6 50 PricewaterhouseCoopers/accounting 3 22 5 2 50 KPMG/accounting 4 17 11 5 50 U.S. State Department/government 5 12 2 24 60 Goldman Sachs/investment banking 6 3 13 16 60 Teach for America/non-profit; government 7 24 6 7 35 Target/retail 8 19 18 3 45 JPMorgan/investment banking 9 13 12 17 60 IBM/technology 10 11 17 13 60 Accenture/consulting 11 5 38 15 60 General Mills/consumer products 12 3 33 28 60 Abbott Laboratories/health 13 2 44 36 55 Walt Disney/hospitality 14 60 1 8 40 Enterprise Rent-A-Car/transportation 15 28 51 4 35 General Electric/manufacturing 16 19 16 9 55 Phillip Morris/consumer products 17 8 50 19 55 Microsoft/technology 18 28 9 34 75 Prudential/insurance 19 9 55 37 50 Intel/technology 20 14 23 63 60 Aflac/insurance 21 9 55 62 50 Verizon…arrow_forwardProvide correct solution accountingarrow_forwardWhat is the gross marginarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning