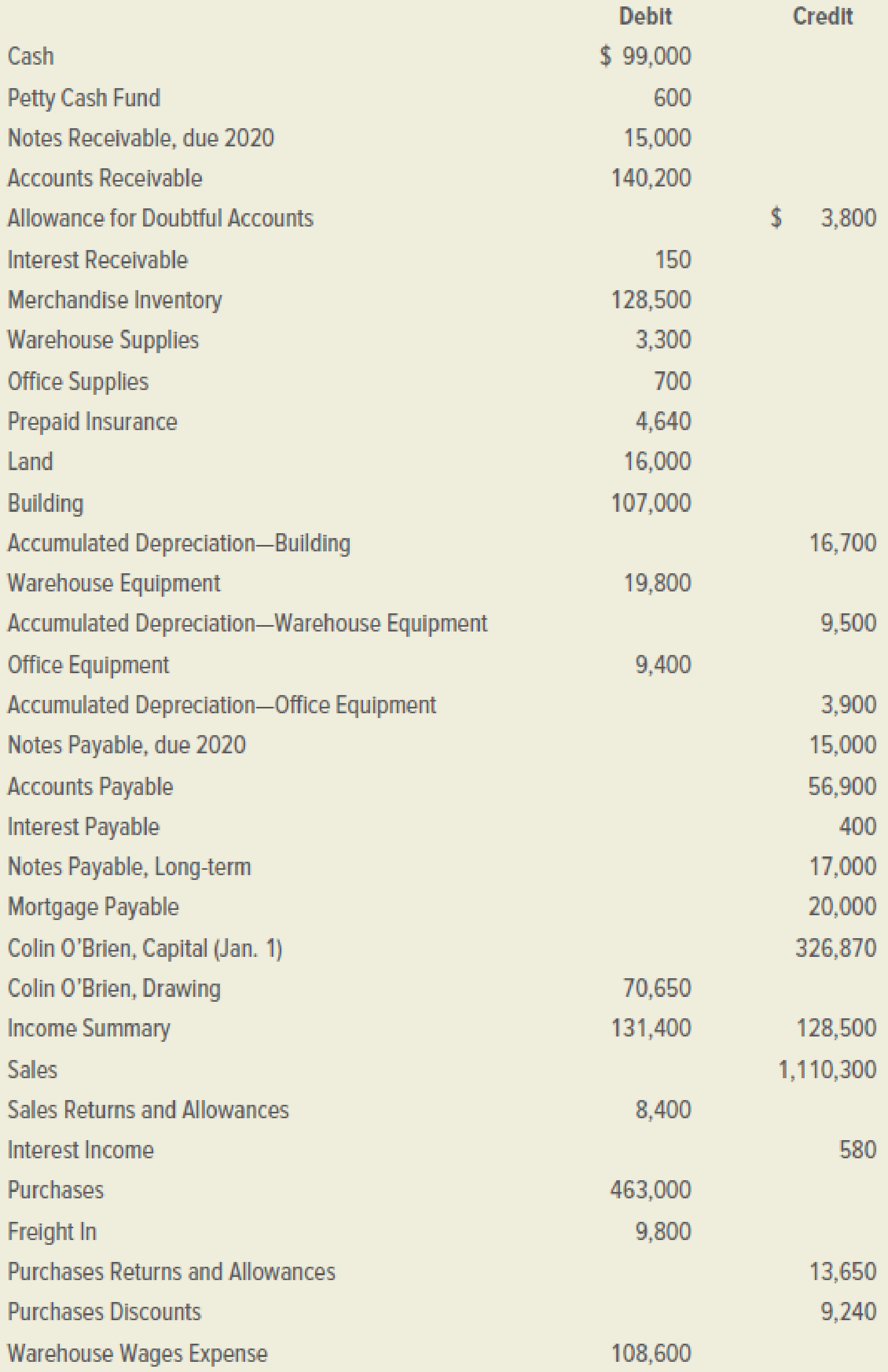

Good to Go Auto Products distributes automobile parts to service stations and repair shops. The adjusted

INSTRUCTIONS

- 1. Prepare a classified income statement for the year ended December 31, 2019. The expense accounts represent warehouse expenses, selling expenses, and general and administrative expenses.

- 2. Prepare a statement of owner’s equity for the year ended December 31, 2019. No additional investments were made during the period.

- 3. Prepare a classified

balance sheet as of December 31, 2019. The mortgage payable extends for more than one year.

ACCOUNTS

Analyze: What percentage of total operating expenses is attributable to warehouse expenses?

1.

Show the Classified Income Statement.

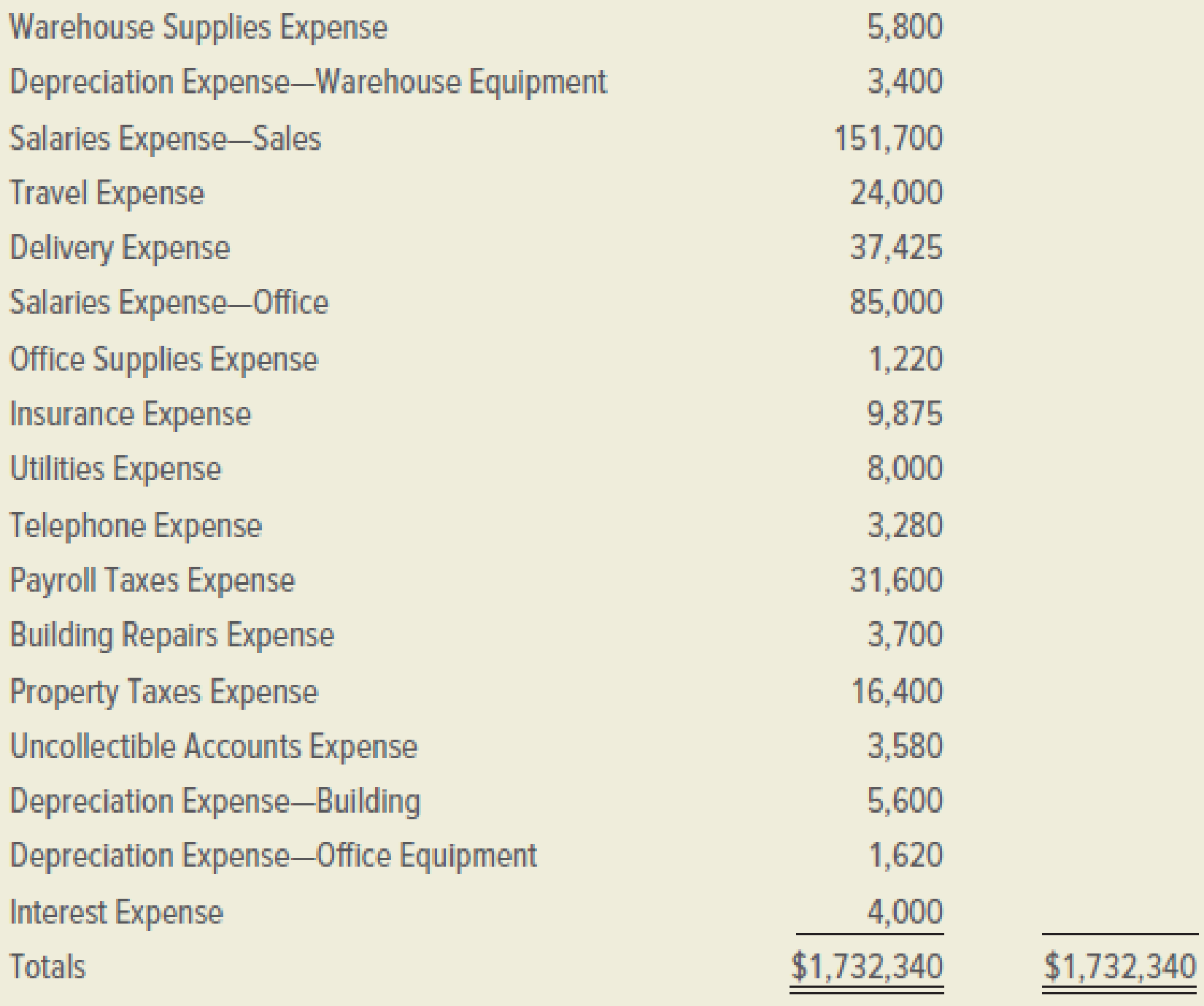

Explanation of Solution

Classified Income statement: The classified income statement is a financial statement that shows the revenues, expenses with various classifications and sub-totals. The classified income statement is used for complex income statement as its more easily understandable.

Prepare the classified income statement:

| Company GGAP | ||||

| Income Statement | ||||

| Year Ended December 31, 2019 | ||||

| Particulars | Amount ($) | Amount ($) | Amount ($) | Amount ($) |

| Operating Revenue | ||||

| Sales | $1,110,300 | |||

| Less: Sales Returns and Allowances | $8,400 | |||

| Net Sales | $1,101,900 | |||

| Cost of Goods Sold | ||||

| Merchandise Inventory, January 1, 2019 | $131,400 | |||

| Purchases | $463,000 | |||

| Freight In | $9,800 | |||

| Delivered Cost of Purchases | $472,800 | |||

| Less: Sales Returns and Allowances | $13,650 | |||

| Purchases Discount | $9,240 | $22,890 | ||

| Net Delivered Cost of Purchases | $449,910 | |||

| Total Merchandise Available for sale | $581,310 | |||

| Less: Merchandise Inventory, closing | $128,500 | |||

| Cost of Goods Sold | $452,810 | |||

| Gross Profit on Sales | $649,090 | |||

| Operating Expenses | ||||

| Warehouse Expenses | ||||

| Warehouse Wages Expense | $108,600 | |||

| Warehouse Supplies Expense | $5,800 | |||

| Depreciation Expense — Warehouse Equipment | $3,400 | |||

| Total Warehouse Expense | $117,800 | |||

| Selling Expenses | ||||

| Salaries Expense—Sales | $151,700 | |||

| Travel Expense | $24,000 | |||

| Delivery Expense | $37,425 | |||

| Total Selling Expense | $213,125 | |||

| General and Administrative Expenses | ||||

| Salaries Expense—Office | $85,000 | |||

| Office Supplies Expense | $1,220 | |||

| Insurance Expense | $9,875 | |||

| Utilities Expense | $8,000 | |||

| Telephone Expense | $3,280 | |||

| Payroll Taxes Expense | $31,600 | |||

| Building Repair Expense | $3,700 | |||

| Property Taxes Expense | $16,400 | |||

| Uncollectible Accounts Expense | $3,580 | |||

| Depreciation Expense - Building | $5,600 | |||

| Depreciation Expense - Office Equipment | $1,620 | |||

| Total General and Admin. Expenses | $169,875 | |||

| Total Operating Expenses | $500,800 | |||

| Income from Operations | $148,290 | |||

| Other Income | ||||

| Interest Income | $580 | |||

| Other Expense | ||||

| Interest Expense | $4,000 | |||

| Net Non-operating expenses | $3,420 | |||

| Net income for the year | $144,870 | |||

Table (1)

2.

Show the Statement of Owner's equity.

Explanation of Solution

Statement of owner's’ equity: This statement reports the beginning owner’s equity and all the changes which led to ending owner's’ equity.

Prepare the Statement of owner's’ equity:

| Company GGAP | ||

| Statement of Owner's Equity | ||

| Year Ended December 31, 2019 | ||

| Particulars | Amount ($) | Amount ($) |

| CB Capital, January 1, 2019 | $326,870 | |

| Net income for the year | $144,870 | |

| Deduct - Withdrawals | $70,650 | |

| Increase in Capital | $74,220 | |

| CB Capital, December 31, 2019 | $401,090 | |

Table (2)

3.

Show the Classified Balance Sheet and compute the total operating expenses percentage related to the warehouse expenses.

Explanation of Solution

Classified balance sheet: The main elements of balance sheet assets, liabilities, and stockholders’ equity are categorized or classified further into sections, and sub-sections in a classified balance sheet. Assets are further classified as current assets, long-term investments, property, plant, and equipment (PPE), and intangible assets. Liabilities are classified into two sections current and long-term. Stockholders’ equity comprises of common stock and retained earnings. Thus, the classified balance sheet includes all the elements under different sections.

Prepare the classified balance sheet:

| Company GGAP | |||

| Balance Sheet | |||

| December 31, 2019 | |||

| Particulars | Amount ($) | Amount ($) | Amount ($) |

| Assets | |||

| Current Assets | |||

| Cash | $99,000 | ||

| Petty Cash Fund | $600 | ||

| Notes receivable | $15,000 | ||

| Accounts receivable | $140,200 | ||

| Less: Allowance for Doubtful Debts | $3,800 | $136,400 | |

| Merchandise Inventory | $128,500 | ||

| Interest Receivable | $150 | ||

| Prepaid expenses | |||

| Warehouse Supplies | $3,300 | ||

| Store Supplies | $700 | ||

| Prepaid insurance | $4,640 | $8,640 | |

| Total Current Assets | $388,290 | ||

| Plant and Equipment | |||

| Land | $16,000 | ||

| Building | $107,000 | ||

| Less: Accumulated Depreciation | $16,700 | $90,300 | |

| Warehouse Equipment | $19,800 | ||

| Less: Accumulated Depreciation | $9,500 | $10,300 | |

| Office Equipment | $9,400 | ||

| Less: Accumulated Depreciation | $3,900 | $5,500 | |

| Total Plant and Equipment | $122,100 | ||

| Total Assets | $510,390 | ||

| Liabilities and Owner's Equity | |||

| Current Liabilities | |||

| Notes Payable | $15,000 | ||

| Accounts payable | $56,900 | ||

| Interest Payable | $400 | ||

| Total Current Liabilities | $72,300 | ||

| Long Term Liabilities | |||

| Mortgage payable | $20,000 | ||

| Loans Payable | $17,000 | ||

| Total Long-Term Liabilities | $37,000 | ||

| Total Liabilities | $109,300 | ||

| Owner's Equity | |||

| CR Capital | $401,090 | ||

| Total Liabilities and Owner's Equity | $510,390 | ||

Table (3)

Operating expenses: The expenses which are incurred in day-to-day business activities but not directly allied with the production of goods and service are called operating expenses. They are classified under three big categories: “administrative expenses, selling expenses, and general expenses”. The operating expenses exclude the financing expenses.

Compute the Operating expenses percentage:

The total operating expenses percentage related to the warehouse expenses is 23.52%.

Want to see more full solutions like this?

Chapter 13 Solutions

COLLEGE ACCOUNTING (LL)W/ACCESS>CUSTOM<

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning