Teagan Fitzgerald is the owner of Newport Jewelry, a store specializing in gold, platinum, and special stones. During the past year, in response to increased demand, Teagan doubled her selling space by expanding into the vacant building space next door to her store. This expansion has been expensive because of the need to increase inventory and to purchase new store fixtures and equipment, including carpeting and state-of-the-art built-in fixtures. Teagan notes that the company’s cash position has gone down and she is worried about future demands on cash to finance the growth.

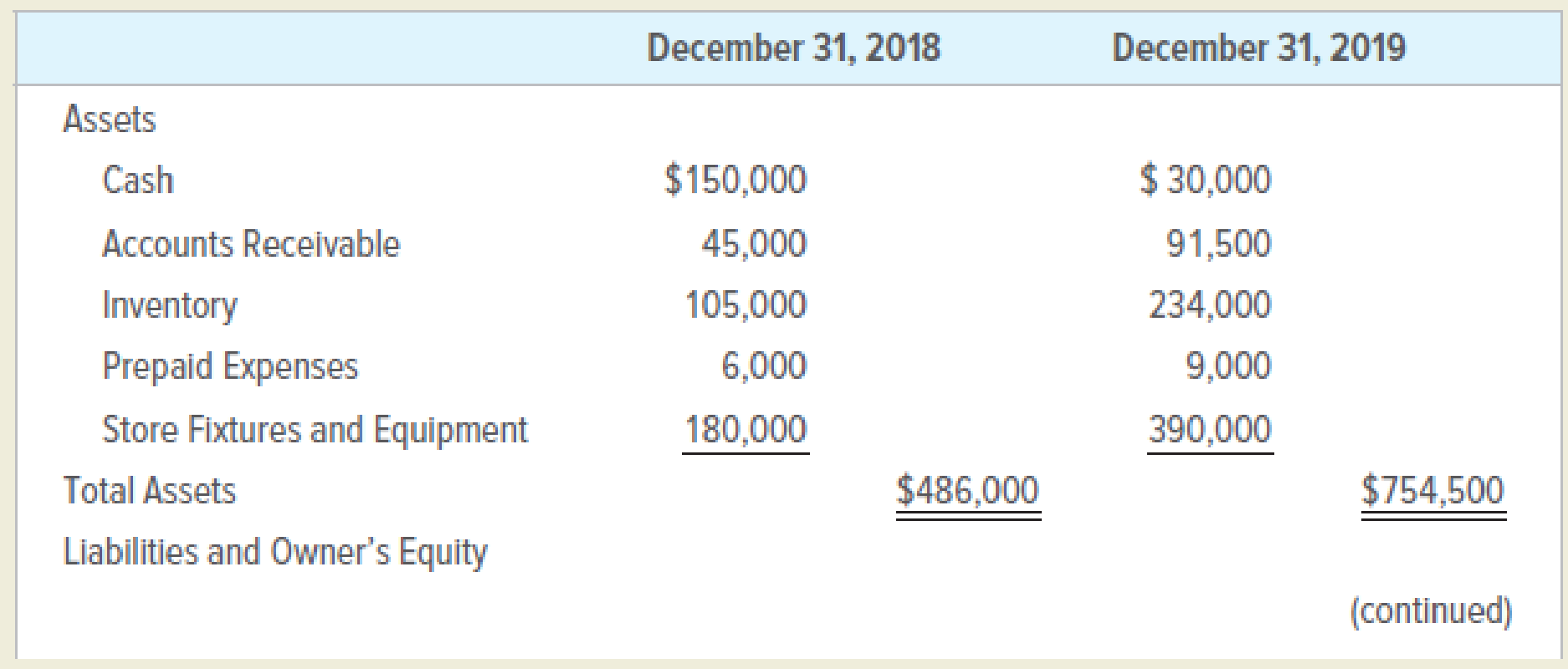

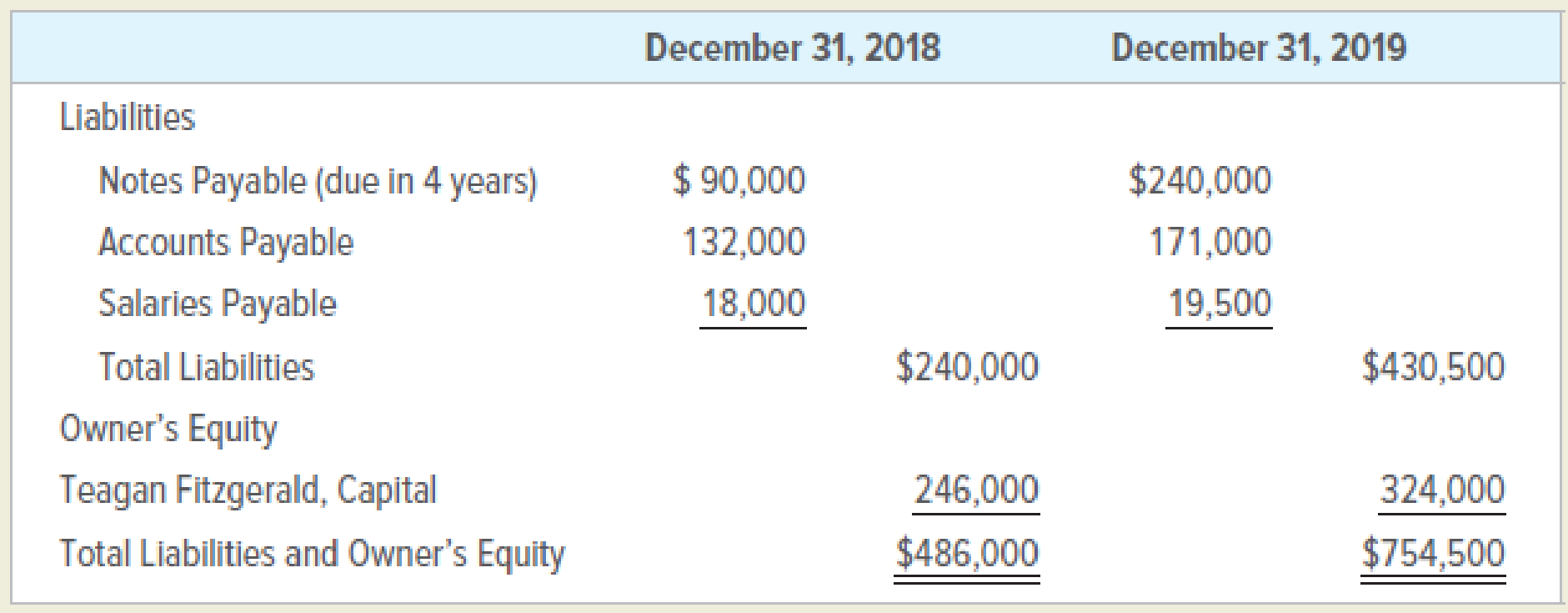

Teagan presents you with a statement showing the assets, liabilities, and her equity for year-end 2018 and 2019, and asks your opinion on the company’s ability to pay for the recent expansion. She did not have income and expense data available at the time. She commented that she had not made any new investment in the business in the past two years and was not financially able to do so presently. The information presented is shown below:

INSTRUCTIONS

- 1. Prepare classified balance sheets for Newport Jewelry for December 31, 2018, and December 31, 2019. (Ignore depreciation.)

- 2. Based on the information presented in the classified balance sheets, what is your opinion of Newport Jewelry’s ability to pay its current bills in a timely manner?

- 3. What is the advantage of a classified

balance sheet over a balance sheet that is not classified?

Want to see the full answer?

Check out a sample textbook solution

Chapter 13 Solutions

COLLEGE ACCOUNTING (LL)W/ACCESS>CUSTOM<

- Financial Accounting Question Solution with Correct Methodarrow_forwardComputing Return on Assets and Applying the Accounting Equation Nordstrom Inc. reports net income of $564 million for a recent fiscal year. At the beginning of that fiscal year, Nordstrom had $8,115 million in total assets. By fiscal year end, total assets had decreased to $7,886 million. What is Nordstrom’s ROA? Note: Enter answer as a percentage rounded to the nearest 2 decimal places (ex: 24.58%). ROA Answer 1arrow_forwardGive Answer of this Questionarrow_forward

- Val Sims is a self-employed CPA and is the sole practitioner in her tax practice. She has had several situations arise this year involving client representation, client records, and client fee arrangements. Val is concerned that her actions may be in violation of the Circular 230 regulations governing practice before the Internal Revenue Service (IRS). Indicate whether Val is in violation of the regulations for each of the actions described. 1. Howard Corporation's prior-year income tax return was prepared and filed by the company's controller. The return was audited and Howard Corporation paid the additional income taxes assessed by the IRS, including penalties and interest. Although Howard Corporation agreed with income tax assessment, it did not agree with the penalties and interest determined by the IRS. Howard Corporation engaged Val to file a refund claim in connection with the penalties and interest assessed. Val charged the client a fee based on 30 percent of the amount by…arrow_forwardHello I'm Waiting For This General Accounting Question Solutionarrow_forwardPlease I want Answer of this Financial Accounting Questionarrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College