Concept explainers

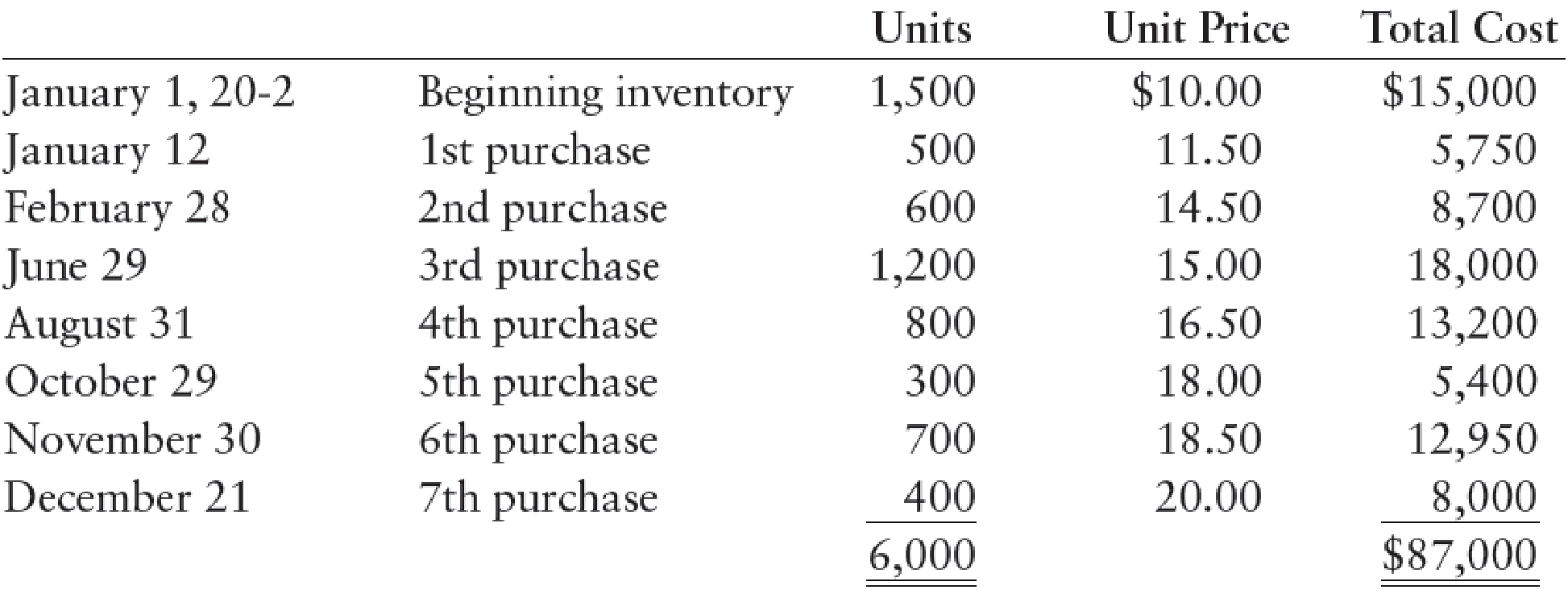

Hurst Company’s beginning inventory and purchases during the fiscal year ended December 31, 20-2, were as follows:

There are 1,200 units of inventory on hand on December 31, 20-2.

REQUIRED

- 1. Calculate the total amount to be assigned to the cost of goods sold for 20-2 and ending inventory on December 31 under each of the following periodic inventory methods:

- (a) FIFO

- (b) LIFO

- (c) Weighted-average (round calculations to two decimal places)

- 2. Assume that the market price per unit (cost to replace) of Hurst’s inventory on December 31 was $18. Calculate the total amount to be assigned to the ending inventory on December 31 under each of the following methods:

- (a) FIFO lower-of-cost-or-market

- (b) Weighted-average lower-of-cost-or-market

- 3. In addition to taking a physical inventory on December 31, Hurst decides to estimate the ending inventory and cost of goods sold. During the fiscal year ended December 31, 20-2, net sales of $100,000 were made at a normal gross profit rate of 35%. Use the gross profit method to estimate the cost of goods sold for the fiscal year ended December 31 and the inventory on December 31.

1.

(a)

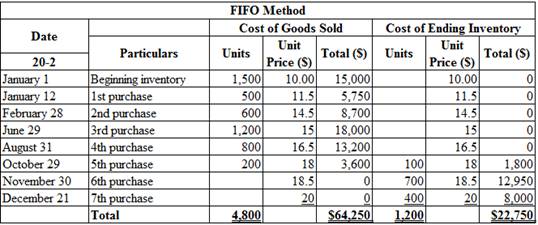

Calculate the total amount of cost of goods sold and cost of ending inventory on December 31, under FIFO method (Periodic inventory system).

Explanation of Solution

First-in-First-Out (FIFO): In First-in-First-Out method, the first purchased items are sold first. The value of the ending inventory consists of the recently purchased items.

Calculate the total amount of cost of goods sold and cost of ending inventory on December 31, under FIFO method (Periodic inventory system):

Table (1)

Therefore, the cost of sold and cost of ending inventory under FIFO (Periodic inventory system) is $64,250 and $22,750.

2.

(b)

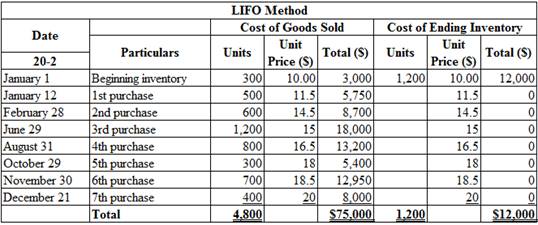

Calculate the total amount of cost of goods sold and cost of ending inventory on December 31, under LIFO method (Periodic inventory system).

Explanation of Solution

Last-in-First-Out (LIFO): In Last-in-First-Out method, the last purchased items are sold first. The value of the closing stock consists of the initially purchased items.

Calculate the total amount of cost of goods sold and cost of ending inventory on December 31, under LIFO method (Periodic inventory system):

Table (2)

Therefore, the cost of sold and cost of ending inventory under LIFO (Periodic inventory system) is $75,000 and $12,000.

3.

(c)

Calculate the total amount of cost of goods sold and cost of ending inventory on December 31, 20-2 under weighted average cost method.

Explanation of Solution

Weighted-average cost method: Under average cost method inventories are priced at the average of all available inventories. Average cost is the quotient of total cost of goods available for sale and total units available for sale.

Calculate the total amount of cost of goods sold and cost of ending inventory on December 31 under weighted average cost method:

Step 1: Calculate the weighted-average cost.

Step 2: Calculate the amount of ending inventory.

Step 3: Calculate the amount of cost of goods sold.

Therefore, the cost of sold and cost of ending inventory under weighted average cost method (Periodic inventory system) is $69,600 and $17,400.

2.

(a)

Calculate the cost of ending inventory on December 31 under FIFO method (Lower of cost or market).

Explanation of Solution

Lower-of-cost-or-market: The lower-of-cost-or-market (LCM) is a method which requires the reporting of the ending merchandise inventory in the financial statement of a company, at its current market value or at is historical cost price, whichever is less.

First-in-First-Out (FIFO): In First-in-First-Out method, the first purchased items are sold first. The value of the ending inventory consists of the recently purchased items.

Calculate the cost of ending inventory under FIFO (Lower of cost or market):

|

Particulars |

FIFO Cost (A) |

Market Cost (B) |

LCM Valuation (C = A or B ) Whichever is lesser |

| Ending inventory under FIFO | $22,750 | $21,600 | $21,600 |

Table (3)

Working note:

Calculate the market cost.

Therefore, the cost of ending inventory on December 31 under FIFO method (Lower of cost or market) is $21,600.

2.

(b)

Calculate the cost of ending inventory on December 31 under weighted average cost method (Lower of cost or market).

Explanation of Solution

Weighted-average cost method: Under average cost method inventories are priced at the average of all available inventories. Average cost is the quotient of total cost of goods available for sale and total units available for sale.

Calculate the cost of ending inventory under weighted average cost (Lower of cost or market):

|

Particulars |

Weighted Average Cost (A) |

Market Cost (B) |

LCM Valuation (C = A or B ) Whichever is lesser |

| Ending inventory under weighted average cost | $17,400 | $21,600 | $17,400 |

Table (4)

Working note:

Calculate the market cost.

Therefore, the cost of ending inventory on December 31 under weighted average cost method (Lower of cost or market) is $17,400.

3.

Estimate the cost of goods sold and ending inventory for the year December 31 uing the gross profit methods.

Explanation of Solution

Gross profit method:

- Gross profit method is used to determine the amount of estimated inventory lost or destroyed by theft, fire, or other hazards.

- The gross profit for the period is calculated from the preceding year, which is adjusted for any current period changes in the sales and cost price of the inventory.

- It estimates the value of inventory and cost of goods sold by avoiding the expenses occurred on physical count of inventory.

Estimate the cost of goods sold and ending inventory for the year December 31 uing the gross profit methods:

| Gross profit Method | ||

| Details | Amount ($) | Amount ($) |

| Beginning inventory, January 1, 20-2 | 15,000 | |

| Add: Net cost of purchases, January 1, 20-2 – December 31, 20-2 | 72,000 | |

| Cost of goods available for sale | 87,000 | |

| Less: Estimated cost of goods sold. | ||

| Net sales | 100,000 | |

| Less: Estimated gross profit of 35% | (35,000) | |

| Estimated cost of goods sold | (65,000) | |

| Estimated cost of inventory at December 31, 20-2 | $22,000 | |

Table (5)

Working note:

Calculate the estimated gross profit.

The estimated gross profit is 35% of the net sales.

Therefore, the estimated cost of goods sold and ending inventory for the year December 31 uing the gross profit methods is $65,000 and $22,000.

Want to see more full solutions like this?

Chapter 13 Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning