College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN: 9781305666160

Author: James A. Heintz, Robert W. Parry

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 13, Problem 1CP

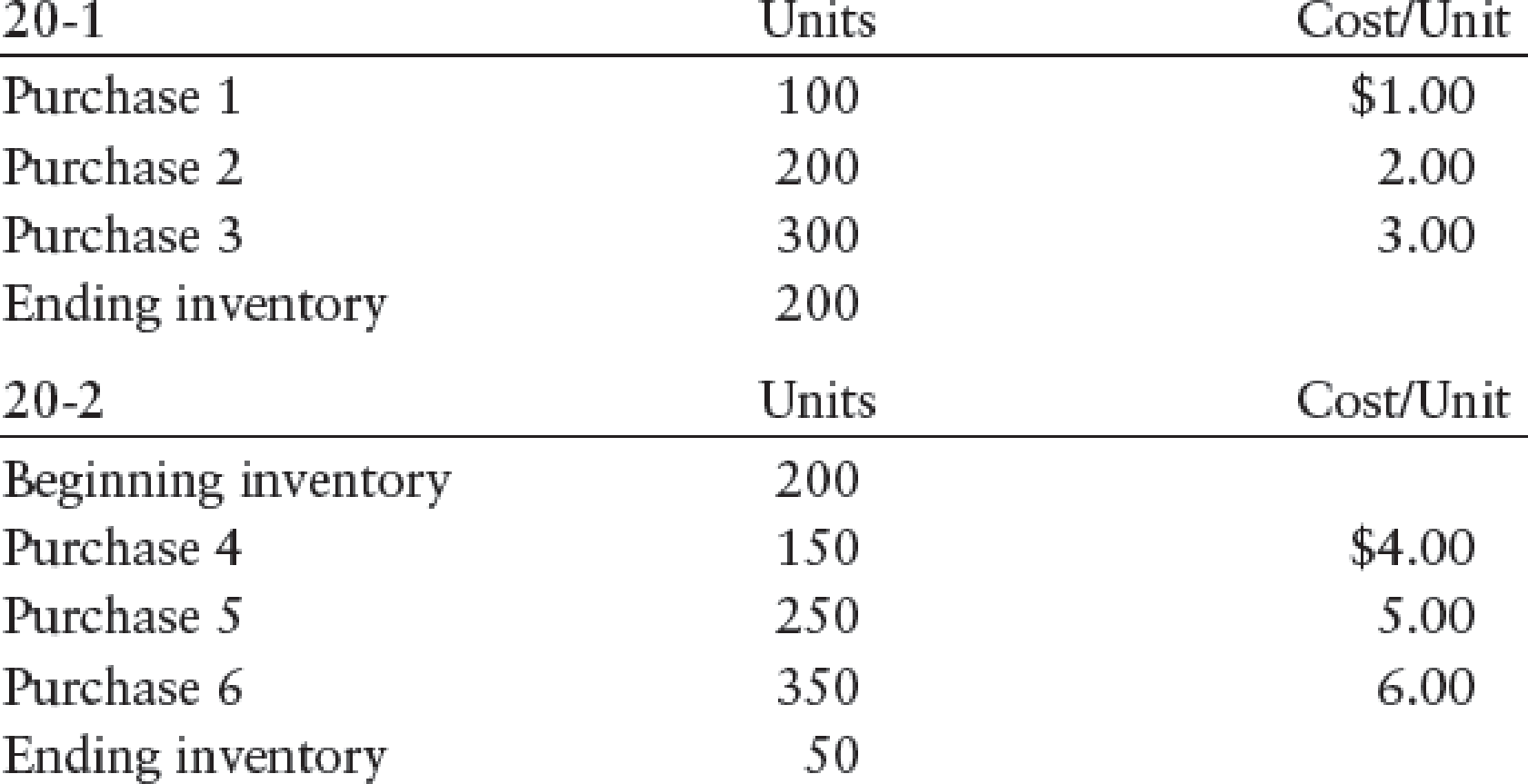

Bhushan Company has been using LIFO for inventory purposes because it would prefer to keep gross profits low for tax purposes. In its second year of operation (20-2), the controller pointed out that this strategy did not appear to work and suggested that FIFO cost of goods sold would have been higher than LIFO cost of goods sold for 20-2. Is this possible?

REQUIRED

Using the information provided, compute the cost of goods sold for 20-1 and 20-2 comparing the LIFO and FIFO methods.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

hello teacher please solve questions

hi expert please help me financial accounting

need help this questions

Chapter 13 Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

Ch. 13 - An overstatement of ending inventory in the year...Ch. 13 - An understatement of ending inventory in the year...Ch. 13 - LO2 Under the perpetual system of accounting for...Ch. 13 - LO3 A fiscal year that starts and ends at the time...Ch. 13 - LO3 If goods are shipped FOB shipping point, the...Ch. 13 - An understatement of ending inventory in the year...Ch. 13 - Prob. 2MCCh. 13 - In rimes of rising prices, the inventory cost...Ch. 13 - In rimes of rising prices, the inventory cost...Ch. 13 - In the application of lower-of-cost-or-market,...

Ch. 13 - LO1 If the ending inventory is overstated by...Ch. 13 - Using the following information, compute the...Ch. 13 - Use the following information to compute cost of...Ch. 13 - Kulsrud Company would like to estimate the current...Ch. 13 - What financial statements are affected by an error...Ch. 13 - What is the main difference between the periodic...Ch. 13 - Is a physical inventory necessary under the...Ch. 13 - Is a physical inventory necessary under the...Ch. 13 - In a period of rising prices, which inventory...Ch. 13 - What two factors are taken into account by the...Ch. 13 - Which inventory method always follows the actual...Ch. 13 - When lower-of-cost-or-market is assigned to the...Ch. 13 - List the three steps followed under the gross...Ch. 13 - List the five steps followed under the retail...Ch. 13 - INVENTORY ERRORS Assume that in year 1, the ending...Ch. 13 - JOURNAL ENTRIESPERIODIC INVENTORY Paul Nasipak...Ch. 13 - JOURNAL ENTRIESPERPETUAL INVENTORY Joan Ziemba...Ch. 13 - ENDING INVENTORY COSTS Sandy Chen owns a small...Ch. 13 - LOWER-OF-COST-OR-MARKET Stalberg Companys...Ch. 13 - SPECIFIC IDENTIFICATION, FIFO, LIFO, AND...Ch. 13 - COST ALLOCATION AND LOWER-OF-COST-OR-MARKET...Ch. 13 - Prob. 8SPACh. 13 - RETAIL INVENTORY METHOD The following information...Ch. 13 - INVENTORY ERRORS Assume that in year 1, the ending...Ch. 13 - JOURNAL ENTRIESPERIODIC INVENTORY Amy Douglas owns...Ch. 13 - JOURNAL ENTRIESPERPETUAL INVENTORY Doreen Woods...Ch. 13 - ENDING INVENTORY COSTS Danny Steele owns a small...Ch. 13 - LOWER-OF-COST-OR-MARKET Bouie Companys beginning...Ch. 13 - SPECIFIC IDENTIFICATION, FIFO, LIFO, AND...Ch. 13 - COST ALLOCATION AND LOWER-OF-COST-OR-MARKET Hall...Ch. 13 - GROSS PROFIT METHOD A flood completely destroyed...Ch. 13 - RETAIL INVENTORY METHOD The following information...Ch. 13 - Hurst Companys beginning inventory and purchases...Ch. 13 - Bhushan Company has been using LIFO for inventory...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Selected comparative financial statements of Korbin Company follow. Sales KORBIN COMPANY Comparative Income Statements For Years Ended December 31 2021 2020 $ 512,008 $ 392,240 2019 $ 272,200 Cost of goods sold 308,229 245,542 174,208 Gross profit 203,779 146,698 97,992 Selling expenses 72,705 54,129 35,930 Administrative expenses 46,081 34,517 22,593 Total expenses 118,786 88,646 58,523 Income before taxes .84,993 58,052 39,469 Income tax expense 15,809 11,901 8,012 Net income $ 69,184 $ 46,151 $ 31,457 KORBIN COMPANY Comparative Balance Sheets Assets Current assets Long-term investments Plant assets, net Total assets Liabilities and Equity Current liabilities Common stock Other paid-in capital Retained earnings December 31 2021 2020 2019 $ 54,370 0 $ 36,390 600 $ 48,645 3,870 99,436 90,776 53,339 Total liabilities and equity $ 153,806 $ 127,766 $ 105,854 $ 22,456 $ 19,037 $ 18,524 68,000 68,000 50,000 8,500 8,500 5,556 54,850 32,229 31,774 $ 153,806 $ 127,766 $ 105,854arrow_forwardprovide correct answer mearrow_forwardgeneral accountingarrow_forward

- E3-17 (Algo) Calculating Equivalent Units, Unit Costs, and Cost Assigned (Weighted-Average Method) [LO 3-2] Vista Vacuum Company has the following production Information for the month of March. All materials are added at the beginning of the manufacturing process. Units . • Beginning Inventory of 3,500 units that are 100 percent complete for materials and 28 percent complete for conversion. 14,600 units started during the period. Ending Inventory of 4,200 units that are 14 percent complete for conversion. Manufacturing Costs Beginning Inventory was $20,500 ($10,100 materials and $10,400 conversion costs). Costs added during the month were $28,400 for materials and $51,500 for conversion ($26.700 labor and $24,800 applied overhead). Assume the company uses Weighted-Average Method. Required: 1. Calculate the number of equivalent units of production for materials and conversion for March. 2. Calculate the cost per equivalent unit for materials and conversion for March. 3. Determine the…arrow_forwardNonearrow_forwardAccounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License