Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 13, Problem 13.6.1MBA

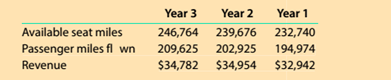

Utilization rate Delta Air Lines (DAL) reported the following data (in millions) for three recent years.

Delta refers to its utilization rates as passenger load factor.

Compute the passenger load factor (utilization rate) for each year.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Question

Zombie Corp. has a profit margin

of 7.6%, total asset turnover of

3.9, and ROE of 32.55%.

What is this firm's debt-equity

ratio?

Ans please

Chapter 13 Solutions

Survey of Accounting (Accounting I)

Ch. 13 - Static budgets are often used: A.By production...Ch. 13 - The total estimated sales for the coming year is...Ch. 13 - Dixon Company expects $650,000 of credit sales in...Ch. 13 - The actual and standard direct materials costs for...Ch. 13 - Bower Company produced 4,000 units of product. The...Ch. 13 - Prob. 1CDQCh. 13 - What is the manager’s role in a responsibility...Ch. 13 - Briefly describe the type of human behavior...Ch. 13 - Give an example of budgetary slack.Ch. 13 - What behavioral problems are associated with...

Ch. 13 - Prob. 6CDQCh. 13 - Prob. 7CDQCh. 13 - Under what circumstances would a static budget be...Ch. 13 - How do computerized budgeting systems aid firms in...Ch. 13 - What is the first step in preparing a master...Ch. 13 - Why should the production requirements set forth...Ch. 13 - Why should the timing of direct materials...Ch. 13 - Prob. 13CDQCh. 13 - Prob. 14CDQCh. 13 - Prob. 15CDQCh. 13 - Prob. 16CDQCh. 13 - Prob. 17CDQCh. 13 - Prob. 18CDQCh. 13 - What is meant by reporting by the "principle of...Ch. 13 - Prob. 20CDQCh. 13 - How are standards used in budgetary performance...Ch. 13 - a. What are the two variances between the actual...Ch. 13 - Prob. 23CDQCh. 13 - Prob. 24CDQCh. 13 - Prob. 25CDQCh. 13 - Prob. 26CDQCh. 13 - Flexible budget for selling and administrative...Ch. 13 - Static budget vs. flexible budget The production...Ch. 13 - Flexible budget for Fabrication Department...Ch. 13 - Sales and production budgets Ultimate Audio...Ch. 13 - Professional fees earned budget Day & Spieth,...Ch. 13 - Professional labor cost budget Based on the data...Ch. 13 - Direct materials purchases budget Zippy's Frozen...Ch. 13 - Prob. 13.8ECh. 13 - Prob. 13.9ECh. 13 - Production and direct labor cost budgets Levi...Ch. 13 - Factory overhead cost budget Nutty Candy Company...Ch. 13 - Cost of goods sold budget The controller of Pueblo...Ch. 13 - Prob. 13.13ECh. 13 - Schedule of cash collections of accounts...Ch. 13 - Schedule of cash payments Tadpole Learning Systems...Ch. 13 - Schedule of cash payments Organic Physical Therapy...Ch. 13 - Capital expenditures budget On August 1, 20Y4. the...Ch. 13 - Standard product cost Sorrento Furniture Company...Ch. 13 - Prob. 13.19ECh. 13 - Direct materials variances The following data...Ch. 13 - Standard direct materials cost per unit from...Ch. 13 - Standard product cost, direct materials variance...Ch. 13 - Direct labor variances The following data relate...Ch. 13 - Prob. 13.24ECh. 13 - Direct materials and direct labor variances At the...Ch. 13 - Prob. 13.26ECh. 13 - Factory overhead cost variances The following data...Ch. 13 - Prob. 13.28ECh. 13 - Factory overhead variance corrections The data...Ch. 13 - Prob. 13.30ECh. 13 - Sales, production, direct materials purchases, and...Ch. 13 - Sales, production, direct materials purchases, and...Ch. 13 - Sales, production, direct materials purchases, and...Ch. 13 - Sales, production, direct materials purchases, and...Ch. 13 - Budgeted income statement and supporting budgets...Ch. 13 - Budgeted income statement and supporting budgets...Ch. 13 - Budgeted income statement and supporting budgets...Ch. 13 - Budgeted income statement and supporting budgets...Ch. 13 - Budgeted income statement and supporting budgets...Ch. 13 - Budgeted income statement and supporting budgets...Ch. 13 - Prob. 13.2.7PCh. 13 - Budgeted income statement and supporting budgets...Ch. 13 - Cash budget The controller of Shoe Mart Inc. asks...Ch. 13 - Cash budget The controller of Shoe Mart Inc. asks...Ch. 13 - Direct materials and direct labor variance...Ch. 13 - Direct materials and direct labor, variance...Ch. 13 - Prob. 13.6.1PCh. 13 - Prob. 13.6.2PCh. 13 - Prob. 13.6.3PCh. 13 - Prob. 13.6.4PCh. 13 - Prob. 13.6.5PCh. 13 - Standards for nonmanufacturing expenses The...Ch. 13 - Prob. 13.7PCh. 13 - Prob. 13.1.1MBACh. 13 - Prob. 13.1.2MBACh. 13 - Prob. 13.1.3MBACh. 13 - Prob. 13.1.4MBACh. 13 - Prob. 13.1.5MBACh. 13 - Prob. 13.1.6MBACh. 13 - Prob. 13.2.1MBACh. 13 - Prob. 13.2.2MBACh. 13 - Prob. 13.2.3MBACh. 13 - Prob. 13.2.4MBACh. 13 - Process yield Hendrick Motorsports sponsors cars...Ch. 13 - Prob. 13.3.1MBACh. 13 - Prob. 13.3.2MBACh. 13 - Prob. 13.3.3MBACh. 13 - Prob. 13.3.4MBACh. 13 - Prob. 13.4.1MBACh. 13 - Prob. 13.4.2MBACh. 13 - Prob. 13.4.3MBACh. 13 - Prob. 13.4.4MBACh. 13 - Prob. 13.5.1MBACh. 13 - Prob. 13.5.2MBACh. 13 - Prob. 13.5.3MBACh. 13 - Prob. 13.5.4MBACh. 13 - Utilization rate Delta Air Lines (DAL) reported...Ch. 13 - Prob. 13.6.2MBACh. 13 - Prob. 13.6.3MBACh. 13 - Prob. 13.7.1MBACh. 13 - Prob. 13.7.2MBACh. 13 - Prob. 13.7.3MBACh. 13 - Ethics and professional conduct in business The...Ch. 13 - Prob. 13.2.1CCh. 13 - Prob. 13.2.2CCh. 13 - Prob. 13.3.1CCh. 13 - Prob. 13.3.2CCh. 13 - Objectives of the master budget Domino's Pizza LLC...Ch. 13 - Prob. 13.5.1CCh. 13 - Prob. 13.5.2CCh. 13 - Prob. 13.6CCh. 13 - Prob. 13.7C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Zombie Corparrow_forwardWhat is the gross profit? ? Financial accounting questionarrow_forwardAs part of your Portfolio Project due in Module 8, your job is to identify new opportunities for your company. Describe the company and the products and services created by this company. Part of your employment responsibility includes completing the following two reports to support your recommendation for an international expansion: Conduct a Market Intelligence Assessment: This is a broad overview of the target country. The overview should include information about its political, legal, cultural, economic, and technological characteristics. Provide supporting statistics and indicators for each component of the macroenvironment. Conduct a Business Environment Analysis: To do so, determine key national characteristics that will affect the marketing of the product. Comment on any potential ethical implications.arrow_forward

- To prepare to write your Portfolio Project, create an annotated bibliography by following these steps: 1. Find five credible external sources to support the ideas in your Module 2 Portfolio Milestone draft. A credible source is defined as: a scholarly or peer-reviewed journal article – searching for “intercultural communication theory” in the search box at the top of the CSU Global Library page will take you to a variety of sources that you can use; also, choose a specific theory from our textbook or interactive lectures and search for that term, as well. Some examples of theories you can research, along with research to help you get started, are Hofstede’s Model of Cultural DimensionsLinks to an external site. Face Negotiation TheoryLinks to an external site. Communication Accommodation TheoryLinks to an external site. Anxiety/Uncertainty Management TheoryLinks to an external site. Integrative Communication Theory of Cross-Cultural AdaptationLinks to an external site. Sapir-Whorf…arrow_forwardBuilding from the Module 2 Critical Thinking assignment about your company’s water purification product and target country market, research the components needed to build the product. Use the following questions to guide your decisions about production and components, respond to the following topics for this week’s critical thinking assignment. What does the target country produce and export? What does the target country import; what are the imports used for? To what degree does the target country have relevant and cost-effective component manufacturing capabilities? Does the target country have relevant and cost-effective manufacturing/assembly capabilities to create products of acceptable quality? If the target country does not have relevant component and manufacturing skills, where will the water purification components/devices be sourced from given the target country’s trade agreements? How do trade profiles and trade relationships enter into your decision about manufacturing…arrow_forwardThe actual cost of direct labor per hour is $17.20, and the standard cost of direct labor per hour is $16.80. The direct labor hours allowed per finished unit is 0.6 hour. During the current period, 6,200 units of finished goods were produced using 4,000 direct labor hours. How much is the direct labor efficiency variance? a. $4,320 favorable b. $4,320 unfavorable c. $4,800 favorable d. $4,800 unfavorable e. $4,704 unfavorable Answer thisarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY