Concept explainers

Direct materials and direct labor

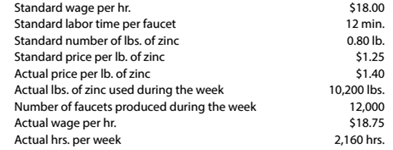

Faucet Industries Inc. manufactures faucets in a small manufacturing facility. The faucets are made from zinc. Faucet Industries has 60 employees. Each employee presently provides 36 hours of labor per week. Information about a production week is as follows:

Instructions

Determine (a) the

(a)

Concept Introduction:

Standard cost is an accounting system which is used by manufacturers to know the difference between actual cost and standard cost of product.

To Compute:

The standard cost per unit for direct material and direct labor.

Answer to Problem 13.4P

The standard cost per unit for direct material is

Explanation of Solution

Details of material and labour are given in following table:

| Materials and Labours | ||||||

| Particulars | Standard Quantity | Standard Price(per unit) | Standard Cost | Actual Quantity | Actual Price(Per unit) | Actual cost |

| Material (lbs) | | | | | | |

| Labour (hrs) | | | | | | |

Now, the calculation of standard cost per unit of direct material and direct labour:

| Particulars | Amount ($)( | Amount per Faucet |

| Material | | |

| Labour | | |

| | |

(b)

Concept Introduction:

Standard cost is an accounting system which is used by manufacturers to know the difference between actual cost and standard cost of product.

To Compute:

The price variance, quantity variance and cost variance direct material.

Answer to Problem 13.4P

The direct material price variance is

The direct material quantity variance is

The direct material cost variance is

Explanation of Solution

Computation of direct material price variance is as follows:

Direct material price variance is adverse as the actual price is more than standard price.

Computation of Direct material quantity variance is as follows:

Direct material quantity variance is adverse as the actual quantity is more than standard quantity.

Computation of Direct material cost variance is as follows:

The direct material cost variance is also adverse.

(c)

Concept Introduction:

Standard cost is an accounting system which is used by manufacturers to know the difference between actual cost and standard cost of product.

To Compute:

The rate variance, time variance and cost variance of direct labour.

Answer to Problem 13.4P

The direct labourrate variance is

The direct labour time variance is

The direct labour cost variance is

Explanation of Solution

Computation of direct labour rate variance is as follows:

Direct labour rate variance is adverse as the actual rate per hour is more than standard rate per hour.

Computation of Direct labor time variance is as follows:

Direct labour time variance is Favorable as the actual direct labour hours is less than standard direct labour hours.

Computation of Direct labour cost variance is as follows:

The direct labour cost variance is also Favorable.

Want to see more full solutions like this?

Chapter 13 Solutions

Survey of Accounting (Accounting I)

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning